Trading position (short-term; our opinion): Long position in crude oil with target price at $54.48 and stop-loss at $49.87 is justified from the risk/reward perspective.

On Tuesday, crude oil moved lower and slipped to the previously-broken important levels. Nevertheless, in the following hour the price of the commodity rebounded and closed the day above the $53. What’s next?

Let’s take a closer look at the charts below (charts courtesy of http://stockcharts.com).

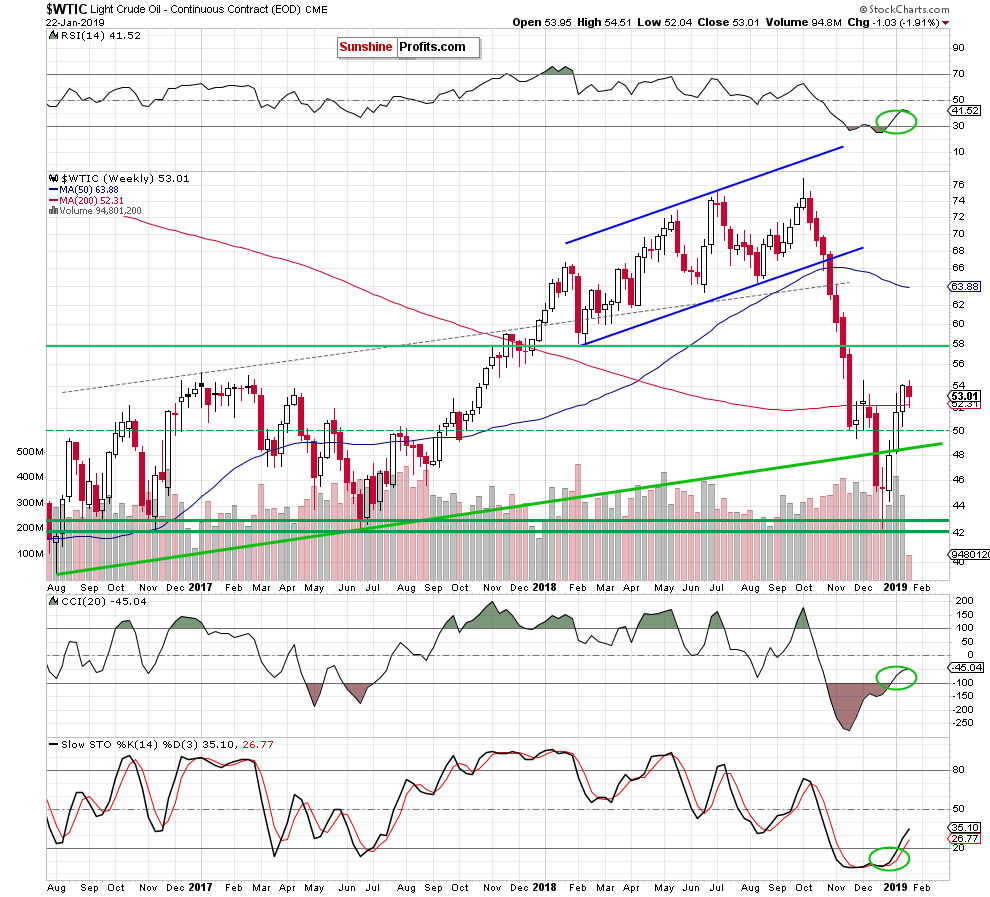

Looking at the medium-term chart, we see that although the commodity closed the previous week above the 200-week moving average for the first time since the beginning of December (and invalidated the earlier breakdown below it), the proximity to the early-December peak encouraged the sellers to act.

As a result, the commodity pulled back and tested the above-mentioned moving average, but then rebounded and closed Tuesday’s session above $53. How did this price action affect the very short-term chart? Let’s take a look at the daily chart below.

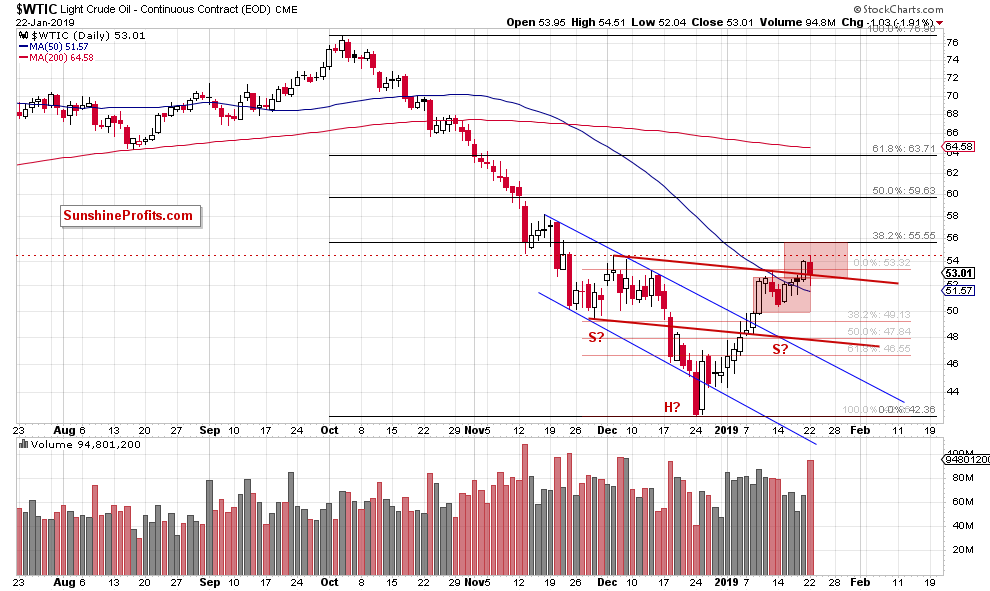

From this perspective, we see that crude oil slipped under the red declining resistance line and tested the previously-broken upper border of the red consolidation. Despite this deterioration, oil bulls managed to trigger a rebound before the session closure, which resulted in a comeback above the red line.

In this way, black gold invalidated the earlier tiny breakdown, which is a positive sign – especially when we factor in a verification of the breakout above the 200-week moving average. Nevertheless, as we wrote yesterday, if the buyers do not show strength later in the day and we see a daily closure below these levels, we’ll likely close our long position and consider opening short positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): Long position in crude oil with target price at $54.48 and stop-loss at $47.96 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager