Trading position (short-term; our opinion): Short position with a stop-loss order at $58.37 and the initial (!) downside target at $50.38 in crude oil is justified from the risk/reward perspective.

Yesterday we witnessed a good attempt to move to the downside. The sellers were partially rebutted. How did the big picture stand the test of yesterday and what are we to do about it?

Let’s examine the charts below (charts courtesy of http://stockcharts.com).

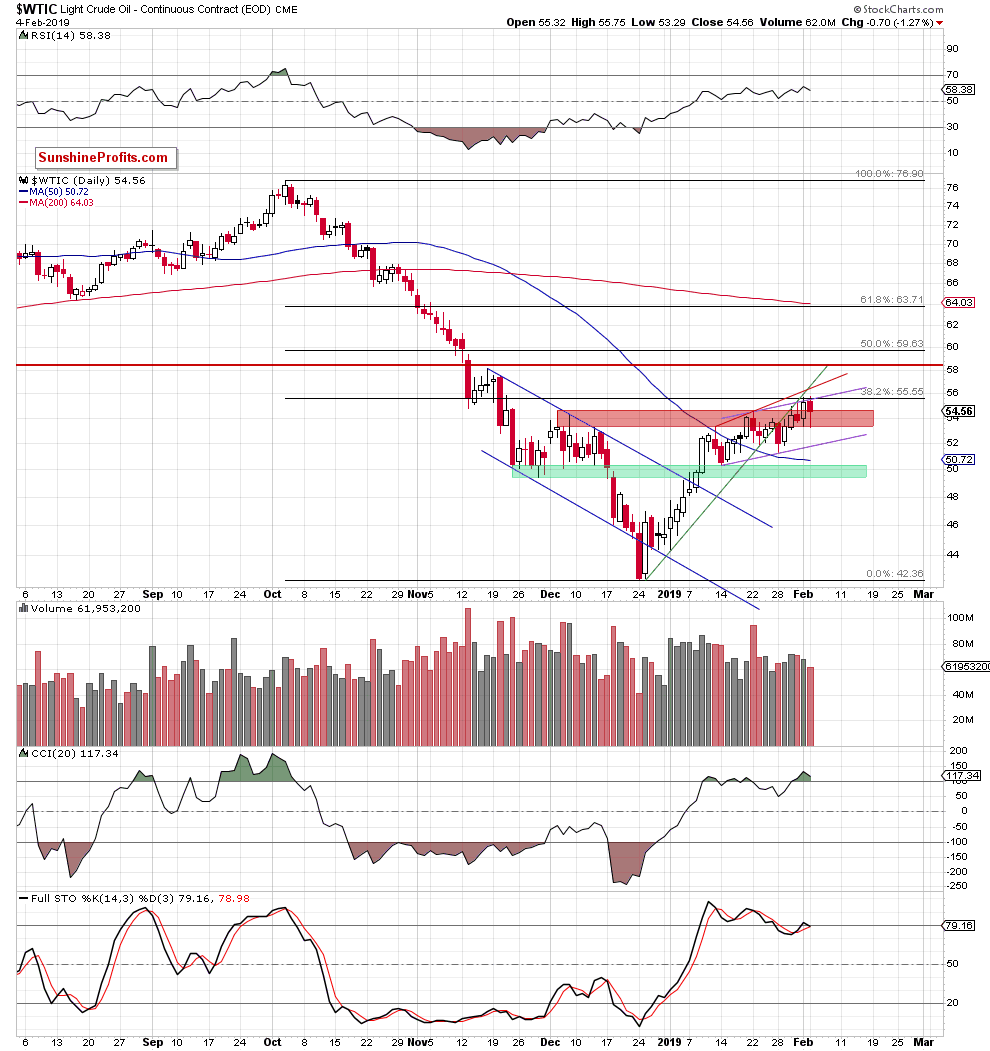

Yesterday, crude oil increased a bit after the market’s open and hit a fresh January high. On an intraday basis, that is. The combination of the 38.2% Fibonacci retracement and the upper line of the purple rising trend channel stopped the buyers for the third time in a row. The price reversed down and even if it ended the day way off the lows, it was still a clear down day. In the near future, we are likely to get more confirmation of the approaching move down in the form of higher accompanying volume than yesterday– that would represent more of a conviction of the sellers.

Black gold closed the day slightly below the upper border of the red consolidation based on the December peak. We can read this as invalidation of the earlier breakout, which is a bearish development. This is further underlined by the Stochastics Oscillator ready to flash its own sell signal.

Connecting the dots, what we wrote yesterday remains up-to-date also today.

Trading position (short-term; our opinion): Short position with a stop-loss order at $58.37 and the initial (!) downside target at $50.38 in crude oil is justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.