Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Thursday, light crude moved a bit higher and closed the day above two very short-term resistances. Will this positive event be motivating enough for the buyers to break the major resistance line? How can the result of today's session affect the future of the commodity?

Let’s analyze the charts below (charts courtesy of http://stockcharts.com).

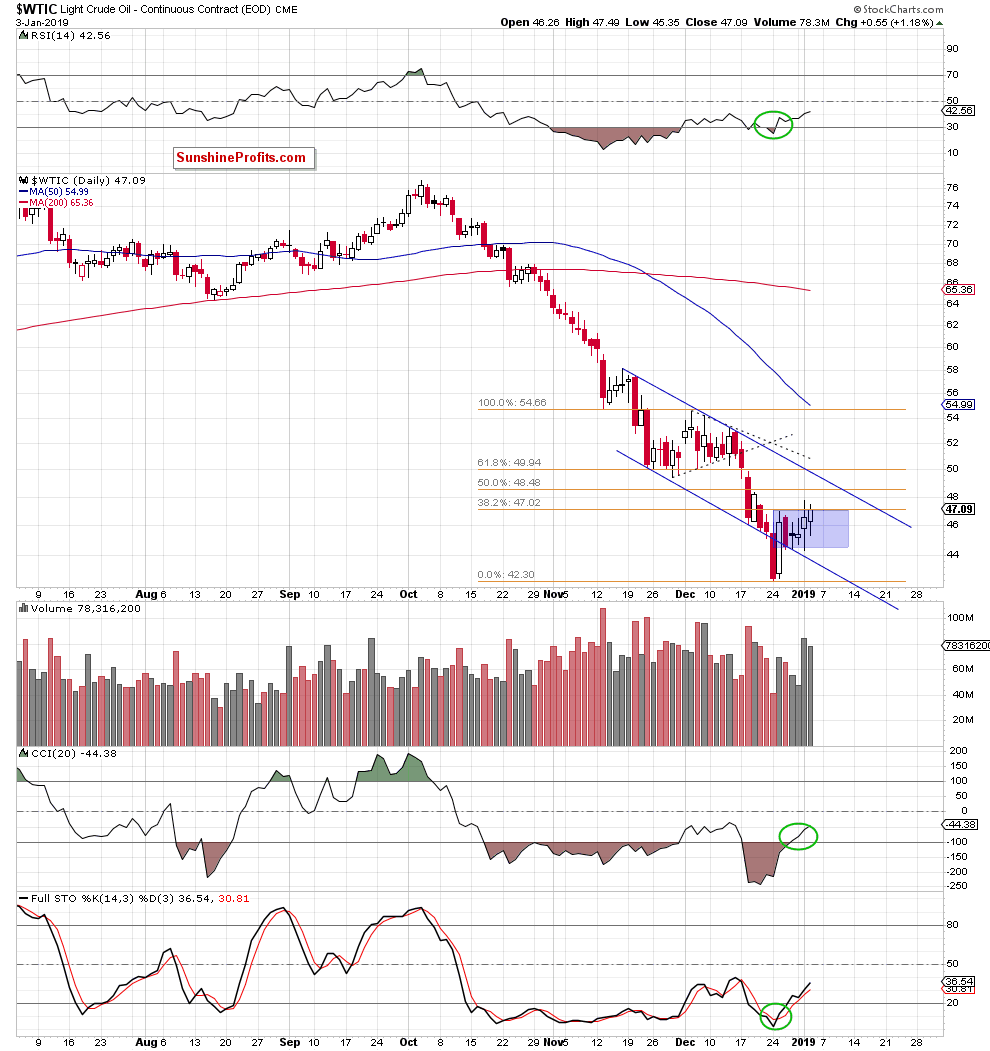

Looking at the daily chart, we see that although oil bears pushed black gold lower after yesterday’s market open, the buyers stopped them, triggering a rebound in the following hours.

Thanks to this action, light crude re-tested the Wednesday's high and the 38.2% Fibonacci retracement, but despite tiny pullback before the session closure the commodity finished the day above these resistances.

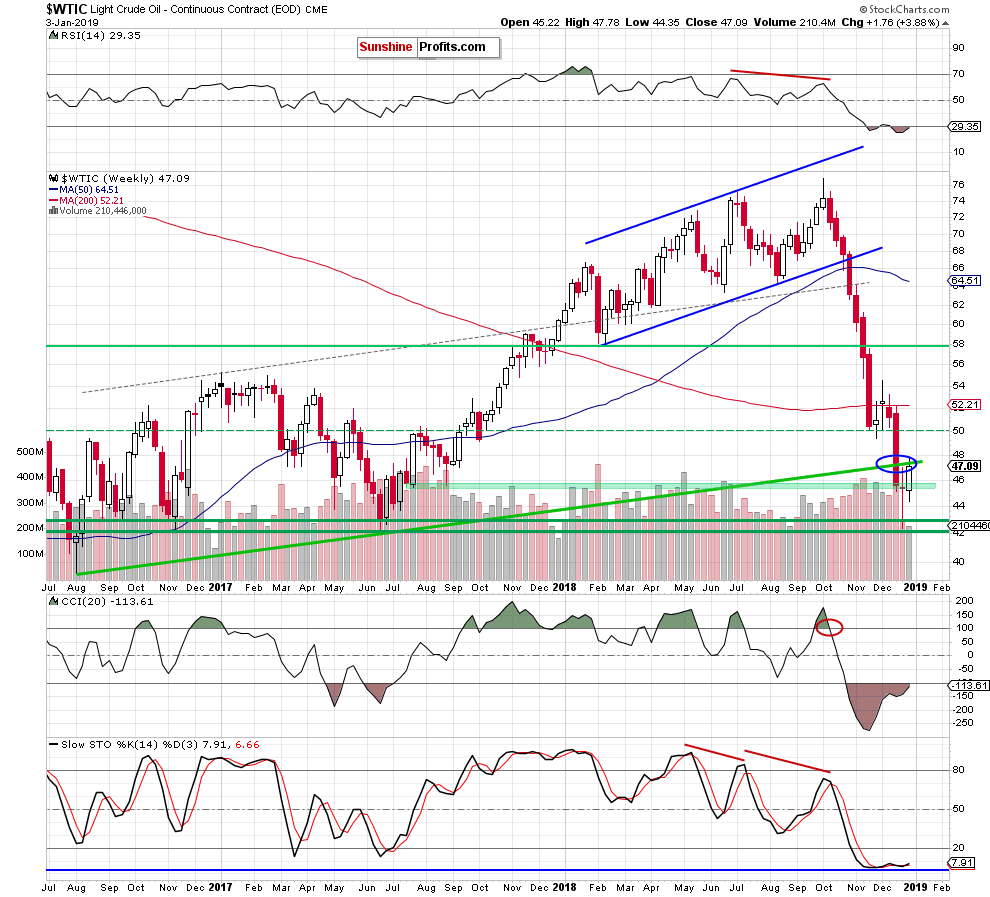

Taking this positive event into account and combining it with the buy signals generated by the indicators, it seems that oil bulls will try to push light crude higher and re-test the previously-broken long-term green line (seen on the weekly chart below) during today’s session.

Nevertheless, in our opinion, until we see a weekly closure above this important resistance line, the strength of the bulls is not yet credible enough for us to justify opening long positions. Therefore, we think that the result of the clash in this area will probably determine the next moves of black gold in a very short-term perspective.

What can happen if oil bulls mange to close today’s session above the green line? In our opinion, we’ll see an increase to the next retracements, the upper border of the blue trend channel or even to the barrier of $50 (marked on the daily chart).

However, on the other hand, if they fail and the sellers manage to maintain the price of black gold under the above-mentioned major resistance line, the probability of a test of the green support zone, this week lows (or even the December low) in the following days will increase significantly. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts