Trading position (short-term; our opinion): Long positions (with the stop-loss order at $65.10 and the initial upside target at $70.37) are justified from the risk/reward perspective.

The first session of the week didn’t bring any spectacular victory to either bulls or bears. However, there is something that the buyers have done for the second time in a row. What are the implications?

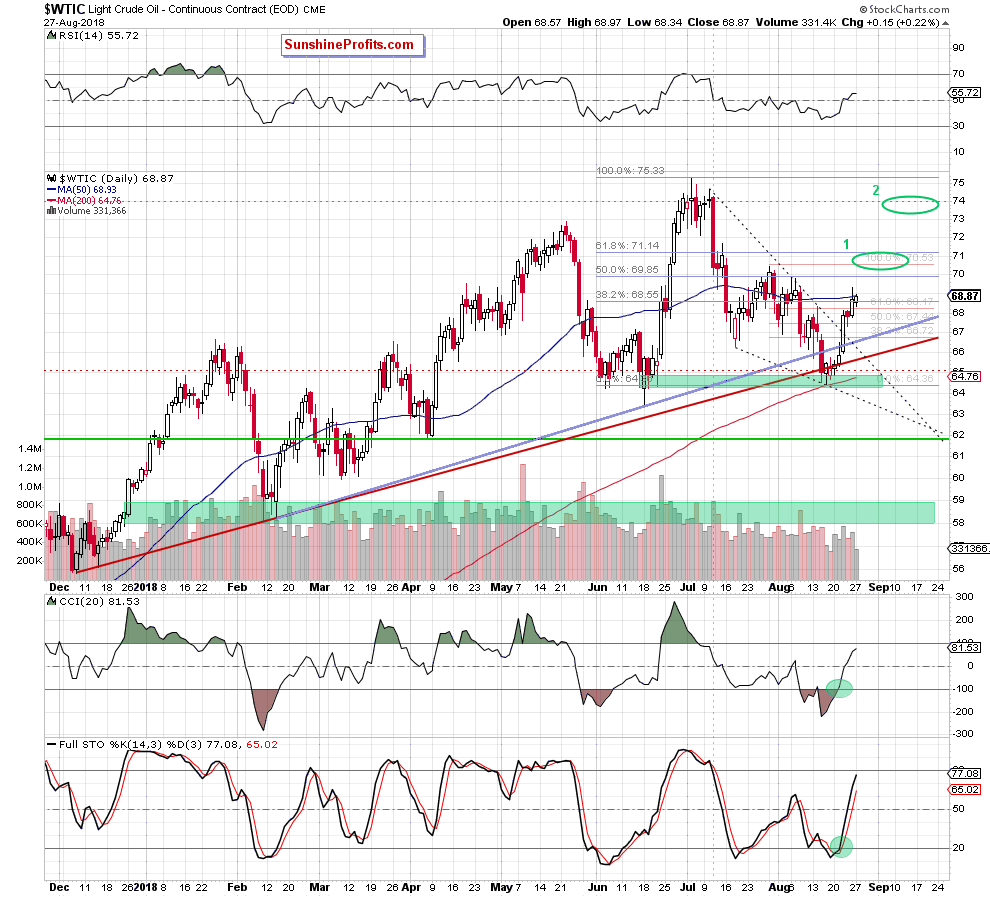

Let’s examine the chart below (charts courtesy of http://stockcharts.com).

Technical Picture of Crude Oil

Today’s Oil Trading Alert will be quite short, as basically nothing changed on the market since we commented on it yesterday and today’s entire alert could simply be a repeat of yesterday’s issue.

On Monday, crude oil extended gains above the 61.8% Fibonacci retracement (the second closure above this level in a row) and re-tested the 50-day moving average. Despite this move, the commodity finished the day below this resistance – similarly to what we saw on Friday. Nevertheless, the buy signals generated by the indicators continue to support oil bulls, suggesting another attempt to go higher in the coming days.

Therefore, if you haven’t had the chance to read yesterday’s alert, we encourage you to do so today - it’s up-to-date:

Will Crude Oil Soar at the end of August?

As always, we’ll keep you - our subscribers - informed should anything change.

Thank you.

Trading position (short-term; our opinion): Long positions (with the stop-loss order at $65.10 and the initial upside target at $70.37) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts