Trading position (short-term; our opinion): Long position in crude oil with target price at $54.48 and stop-loss at $49.87 is justified from the risk/reward perspective.

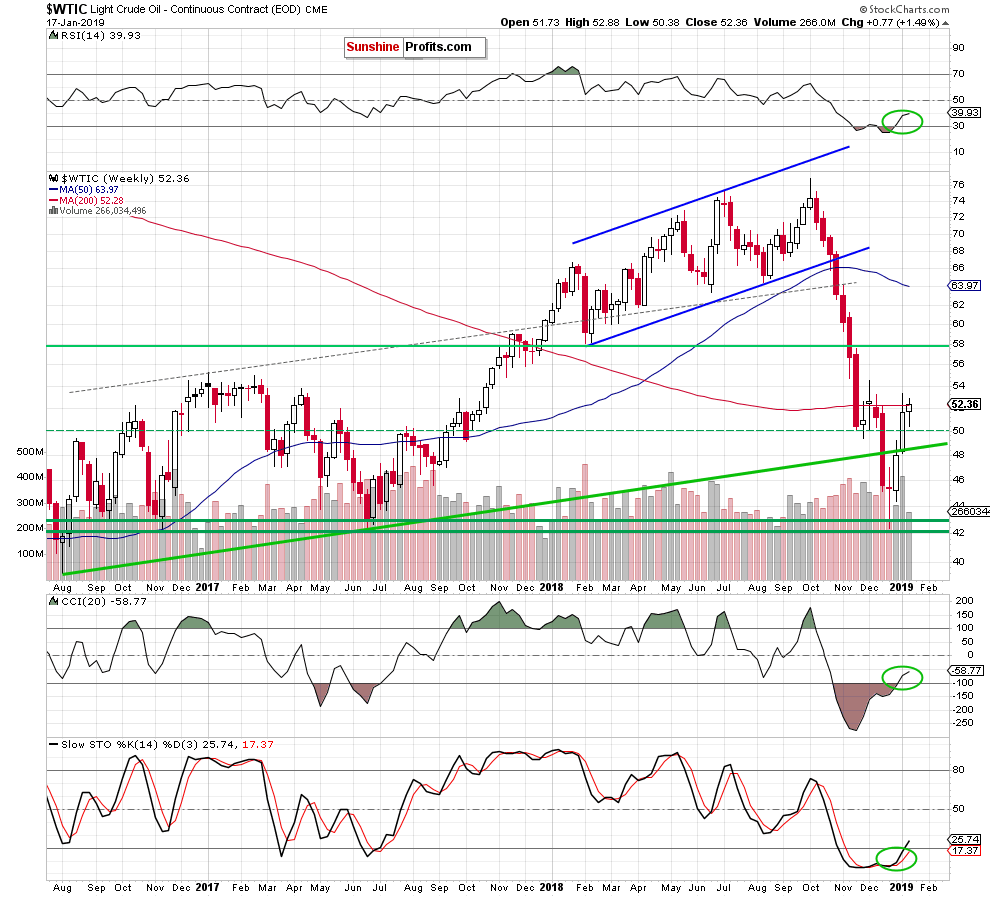

On Thursday, crude oil closed another day above the 200-week and 50-day moving averages, but did it change anything in the short-term picture of the commodity?

Let’s take a closer look at the charts below (charts courtesy of http://stockcharts.com).

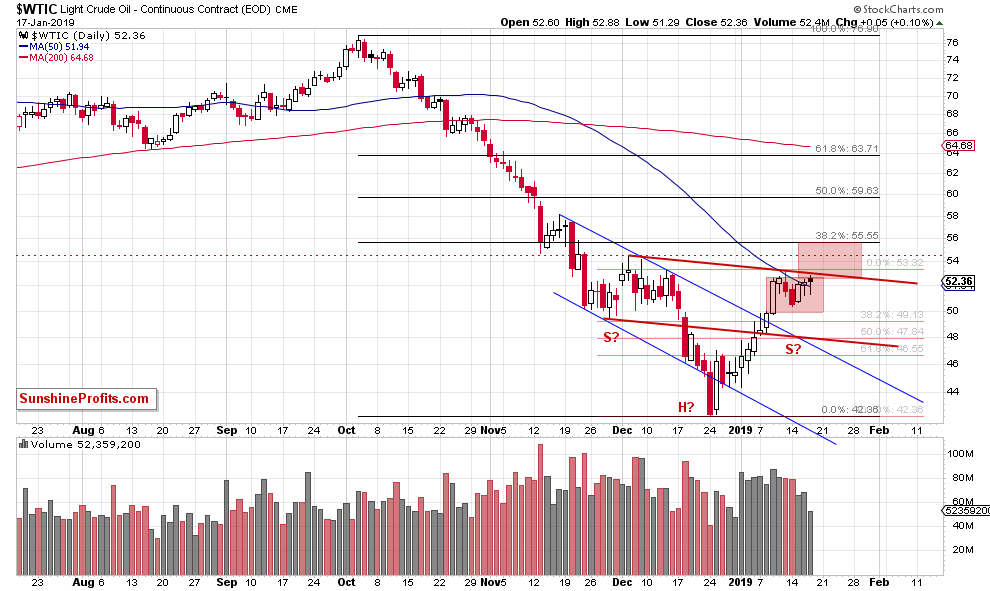

From today’s point of view, we see that crude oil moved a bit higher during Thursday session and closed another day above the 200-week and 50-day moving averages. Despite yesterday’s tiny upswing, the commodity is still trading in a narrow range under the red declining resistance line based on the early-December and January peaks, which means that the overall situation remains almost unchanged.

Therefore, we believe that our last commentary on light crude is up-to-date also today:

(…) black gold closed Wednesday session slightly above the 200-week and 50-day moving averages. Although these are positive events, we should keep in mind that the week is not over yet, which means that closing above the first average will be considered as a bullish signal only if light crude closes tomorrow's sessions above this average.

In the case of the second average (marked on the daily chart), the breakout will be considered as a more credible bullish signal when the price of black gold leaves the red consolidation (and preferably rises above the Friday's peak and the red resistance line).

Until this time, both yesterday improvements should be treated with moderate optimism - especially when we take into account the fact that the volume, which accompanied recent upswing was smaller than the one we saw when the last two black candles were shaping.

Connecting the dots, the overall situation in black gold hasn’t changed much as light crude still remains in the red consolidation slightly below the red resistance line (a potential neck line of the reverse head and shoulders formation. Therefore, we believe that everything that we wrote yesterday and on Monday remains up-to-date.

Trading position (short-term; our opinion): Long position in crude oil with target price at $54.48 and stop-loss at $47.96 is justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager