Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Although crude oil dived on Tuesday, the following days brought rebound and erased earlier losses. Will oil bulls’ lucky streak continue? What will they have to face next week?

Let's examine the charts below (charts courtesy of http://stockcharts.com).

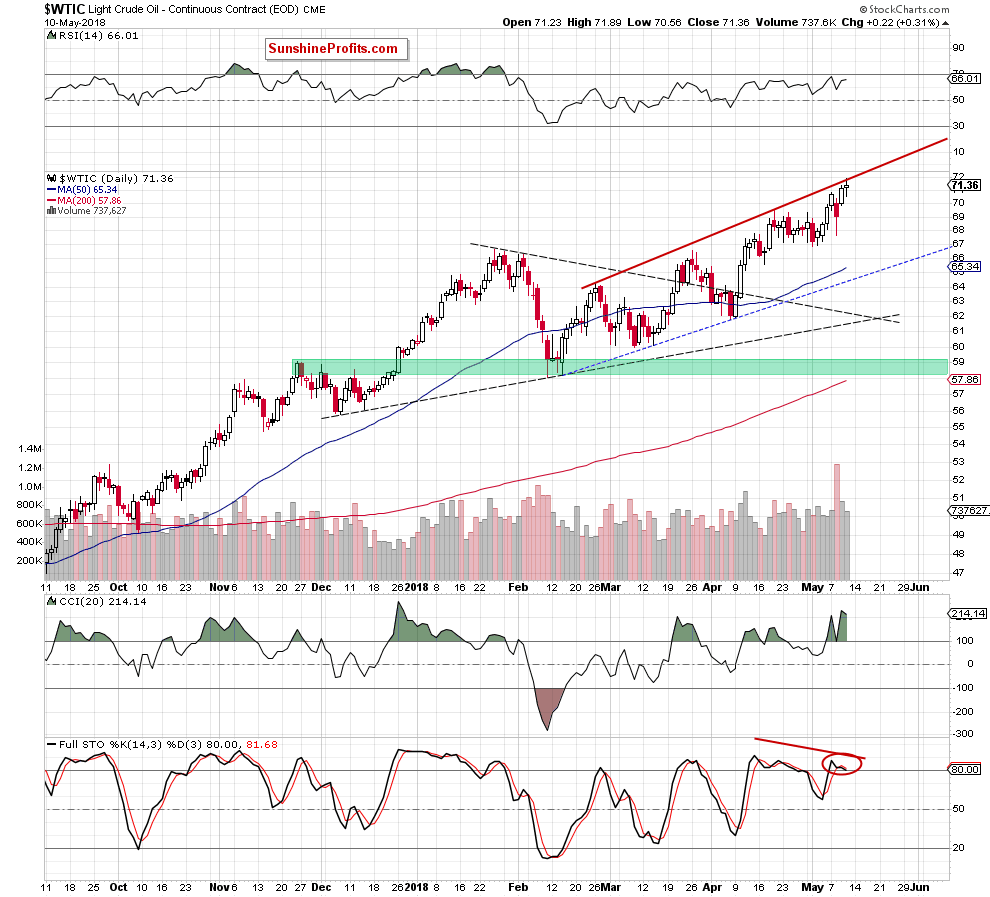

Looking at the daily chart, we see that crude oil rebounded in recent days, which resulted in a climb to the red rising resistance line based on the late February and mid-April peaks.

What’s interesting, during this increase size of volume decreased, which raises some doubts about further improvement – especially when we factor in bearish divergences between the Stochastic Oscillator (negative divergence we can also notice between the RSI and light crude) and the commodity and the sell signal generated by this indicator.

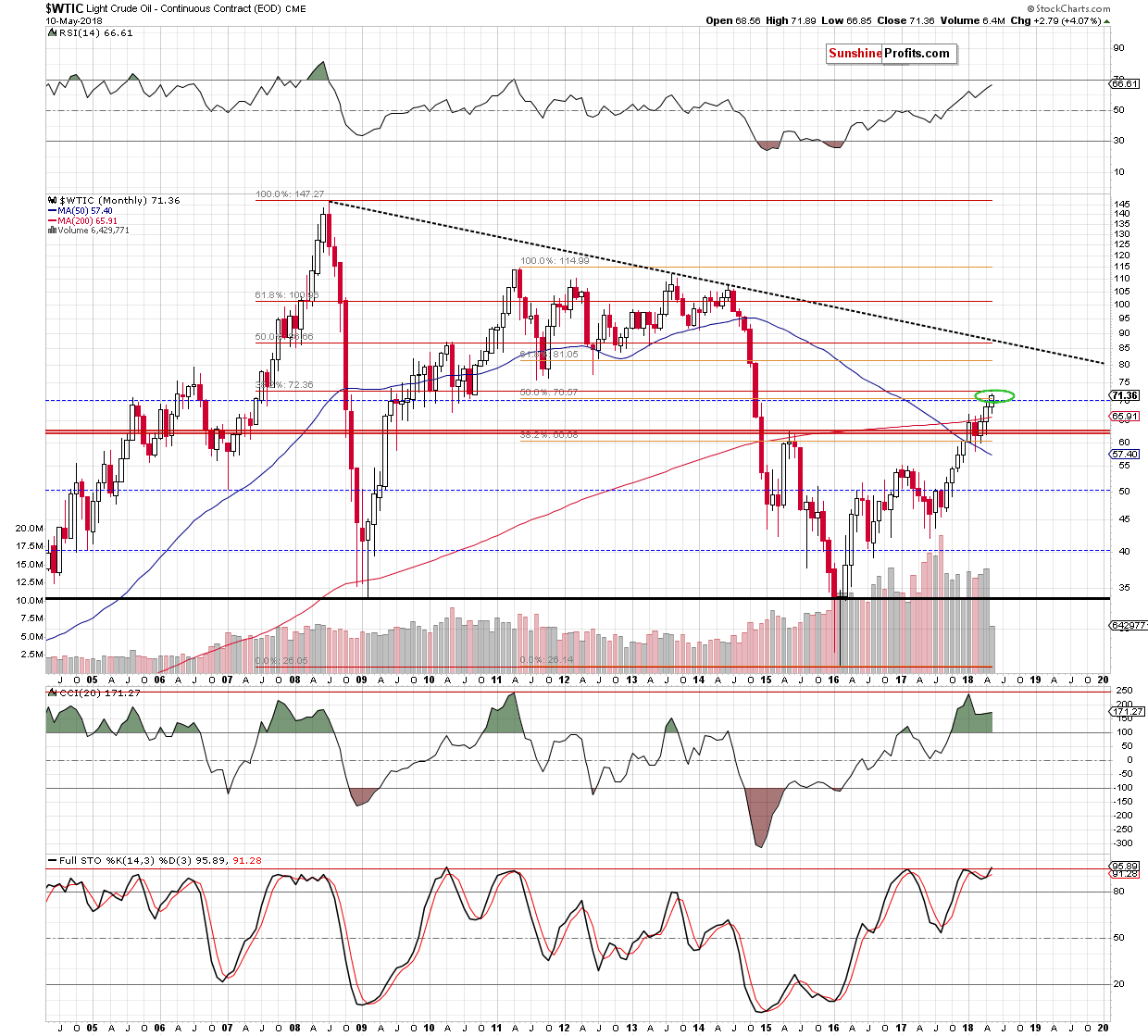

On top of that, the long-term picture also suggests that the space for gains may be limited. Let’s recall the quote from our Monday’s alert:

(…) how high oil bulls could push black gold if they manage to break above the barrier of $70? We think that the best answer to this question will be the long-term chart of light crude.

(…) if the barrier of $70 is broken, the next upside target will be around $70.57 (the 50% Fibonacci retracement based on the 2011-2016 downward move) or we could even see an increase to around $72.36, where the 38.2% Fibonacci retracement based on the entire 2008-2016 decline is.

Summing up, the overall situation in the very short term is too unclear to justify opening any positions now. Nevertheless, if we see successful breakout above all the above-mentioned resistances, we’ll consider going long. On the other hand, if oil bears show significant strength reinforced by the volume, we’ll consider opening short positions. Stay tuned.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts