Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Although the price of black gold moved higher after yesterday market’s open, happy moments of the buyers didn’t last too long. What happened? What can yesterday's price action do for oil bulls in the coming days?

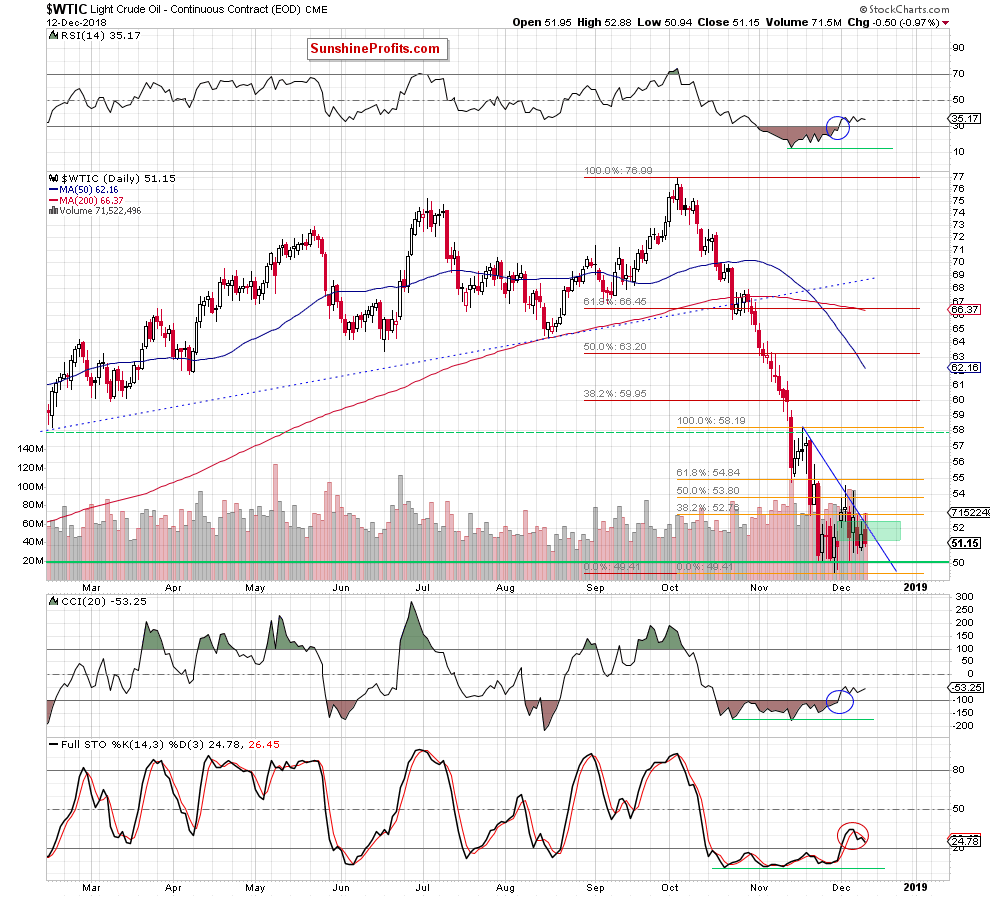

Let’s take a closer look at the daily chart below (charts courtesy of http://stockcharts.com).

Today’s alert is going to be very brief, because crude oil didn’t do anything that would change the outlook on Wednesday and the same applies to today’s session so far. The only thing that the commodity did during yesterday’s session is that it moved higher after the market’s open and re-tested the 38.2% Fibonacci retracement and the very short-term blue resistance line based on the previous highs once again.

Despite this “improvement” the price of black gold reversed in the following hours and cancelled all gains, finally closing the day 0.97% lower. Such daily reversal is a bearish sign, but the outlook was bearish anyway, so nothing really changed.

Consequently, the comments that we made on Tuesday remain up-to-date also today and if you haven’t had the chance to read that alert, we encourage you to do so today. We will provide you with a bigger update once we see more interesting developments on the crude oil market.

Taking all the above into account, we can summarize today's alert just as we did yesterday:

Summing up, the overall situation in the short term remains almost unchanged as crude oil is trading in a narrow range between the barrier of $50 and the blue declining resistance line, which continues to keep gains in check since the beginning of the month. Nevertheless, oil bulls’ weakness in combination with the sell signal generated by the Stochastic Oscillator suggests that one more downswing and a re-test of the nearest supports might be just around the corner.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts