Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

At the beginning of the week oil bulls showed strength, which resulted in a climb to a fresh 2018 high, but will we see further improvement in the coming days?

Let’s take a look at the charts below (charts courtesy of http://stockcharts.com).

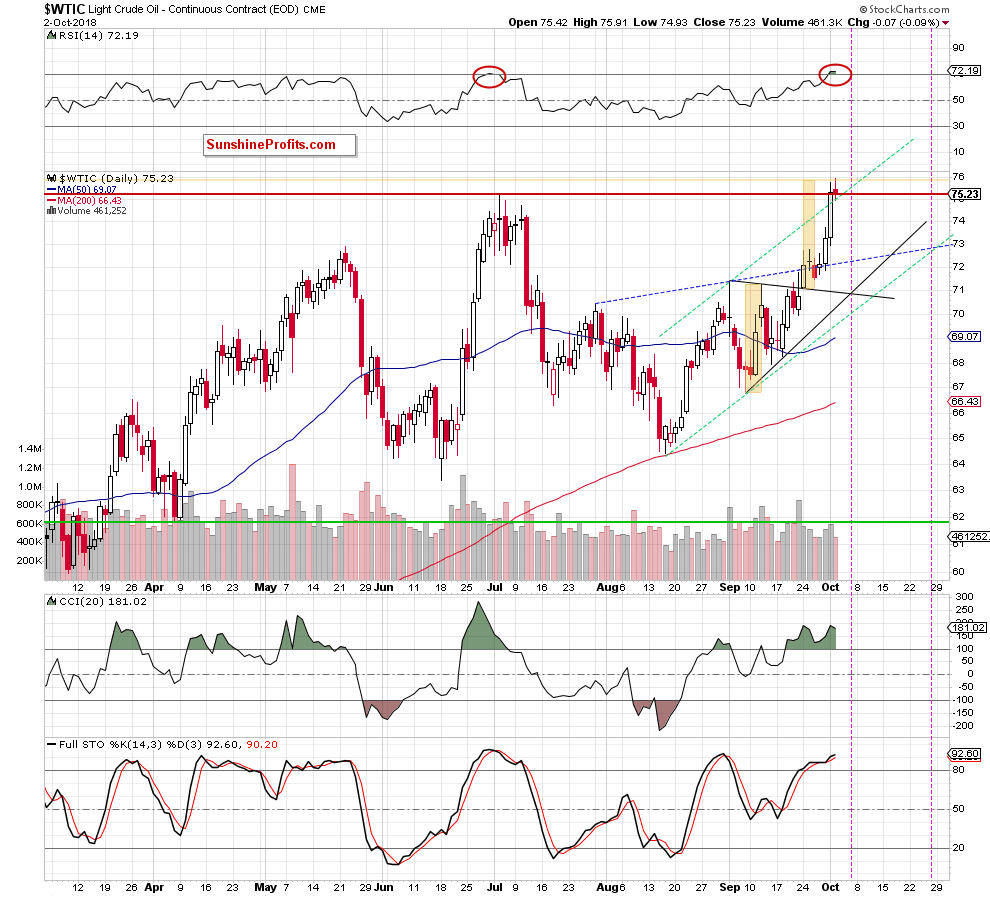

The first thing that catches the eye on the daily chart is a breakout above the early-July high. Although this is a bullish development, the buyers didn’t trigger further rally during yesterday’s session. Instead, their opponents took the price of black gold a bit below the above-mentioned July peak, invalidating the Monday’s breakout.

Additionally, thanks to the recent increases, the commodity climbed to the area, where the size of the upward move corresponded to the height of the black triangle, which could decrease the buying pressure.

On top of that, the RSI moved above the level of 70, increasing the probability of reversal in the very near future. At this point it is worth noting that even a bit lower reading of the indicator preceded declines at the beginning of July, which suggests that the history cloud repeat itself once again in the coming days – especially when we factor in the long-term picture into account. Let’s take a look at the monthly chart below.

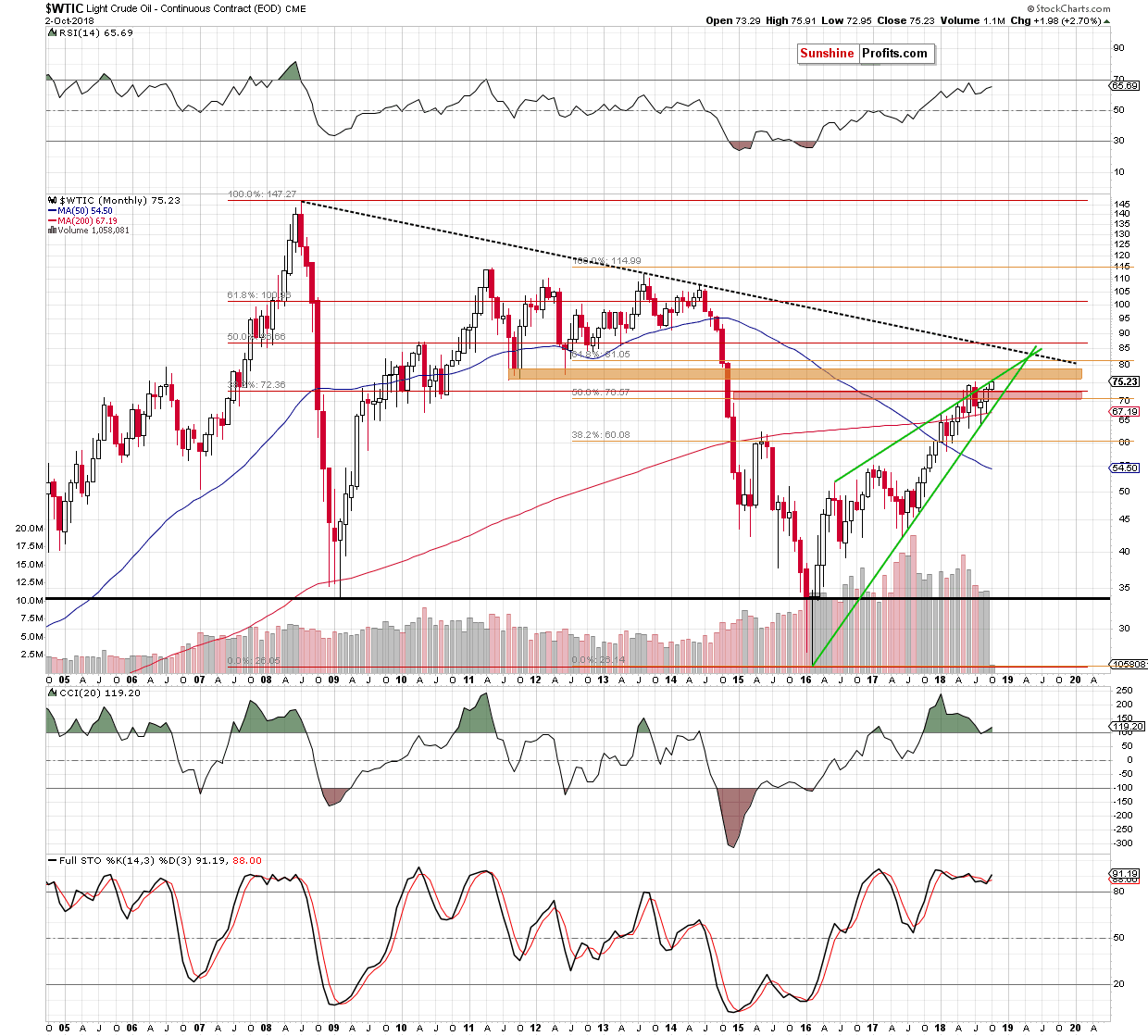

From this perspective, we see that crude oil reached the upper border of the green rising wedge and the orange resistance zone created by the August 2011, October 2011and June 2012 lows. As you see, the combination of these major resistances stopped the buyers earlier this year, which gives oil bears another reason to act in the very near future.

If this is the case, and light crude extends losses and closed today’s session (or one of the following days) under the previously-broken July peak and the upper border of the green dashed rising trend channel, we’ll consider opening short positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts