Trading position (short-term; our opinion): Short positions (with the stop-loss order at $68.15 and the initial downside target at $56.57) are justified from the risk/reward perspective.

Friday's session brought further declines in crude oil, which pleased not only oil bears, but also our wallets. Thanks to that drop black gold slipped under the first important Fibonacci retracement, but then rebounded and invalidated this tiny breakdown. Do the bears have reasons to worry?

Let’s take a look at the charts below (charts courtesy of http://stockcharts.com).

In our Friday’s commentary, we wrote the following:

Although oil bulls managed to push black gold a bit higher after the market’s open, they didn’t take the commodity above this line, which resulted in a reversal. Such price action looked like a verification of the earlier breakdown under the above-mentioned line and encouraged their opponents to act.

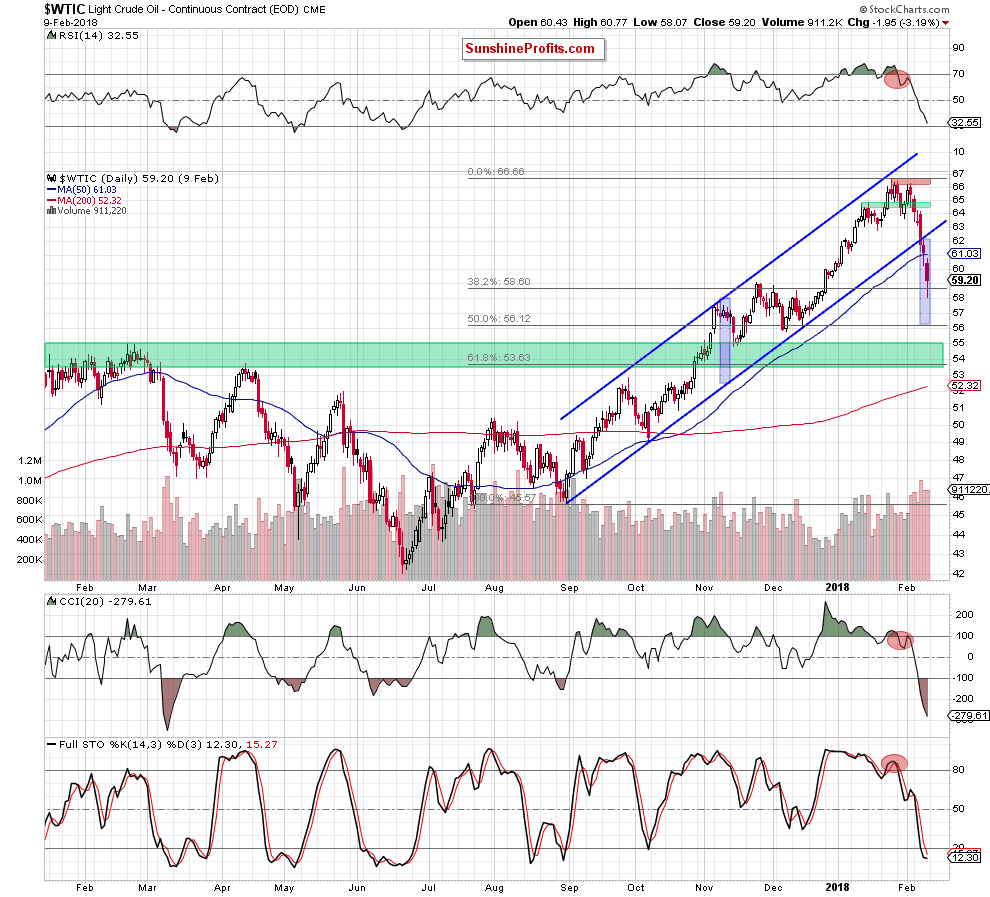

Thanks to yesterday’s drop, the price of light crude slipped temporary below $61 and the 50-day moving average, but then rebounded slightly and closed the day above them. Despite this “improvement” the sell signals generated by the daily (and also weekly) indicators suggest further deterioration in the coming day(s).

How low could the commodity go? In our opinion, the next downside target will be around $58.65-$59.05, where the 38.2% Fibonacci retracement (based on the August-January upward move) and the late November highs are.

From today’s point of view, we see that the situation developed in line with the above scenario and crude oil extended losses, making our short position more profitable. Thanks to Friday’s decline the commodity dropped to our first downside target, but then rebounded and invalidated the earlier breakdown under the 38.2% Fibonacci retracement (based on the August-January upward move).

Does it mean that the declines are over? In our opinion, there is only one answer - absolutely not. Why? Firstly, volume, which accompanied recent declines remains at a high level, confirming the strength of oil bears. Secondly, although daily indicators drop quite low, there are no buy signals, which could encourage oil bulls to act.

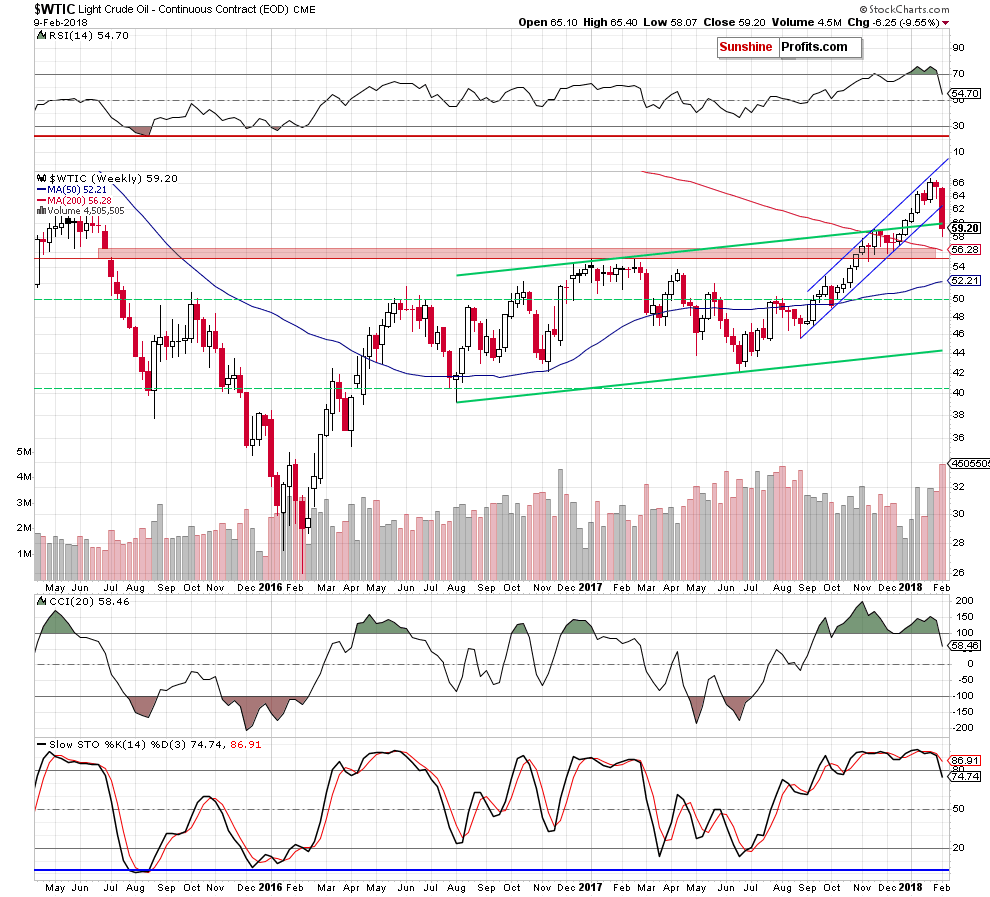

Third and the most important factor, which justifies the maintenance of short positions you can notice on the medium-chart below.

What do we mean? As you see on the weekly chart, the highlight of the previous week is an invalidation of the earlier breakout above the upper border of the green rising trend channel. What's even more important, the last week’s decline materialized on huge volume, increasing the probability of further deterioration.

Where could black gold head next? In our opinion, the first downside target will be around $55.82-$56.12, where the December lows and the 50% Fibonacci retracement are. Additionally, in this area the size of the downward move will correspond to the height of the blue rising trend channel, which increases the probability that oil bears will test this area, making our short positions even more profitable in the coming week.

As always, we’ll keep you - our subscribers - informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): Short positions (with the stop-loss order at $68.15 and the initial downside target at $56.57) are justified from the risk/reward perspective.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts