Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

In recent days, oil bulls have accustomed us to fresh peaks. However, when we look more closely at the volume, their actions lose some of the glow. When we add the picture, which emerges from the relationship between crude oil and precious metals, doubts about the strength of the rally are getting even bigger. Is it possible that this interesting link tell us more about the future of black gold?

Let’s take a closer look at the charts below (charts courtesy of http://stockcharts.com).

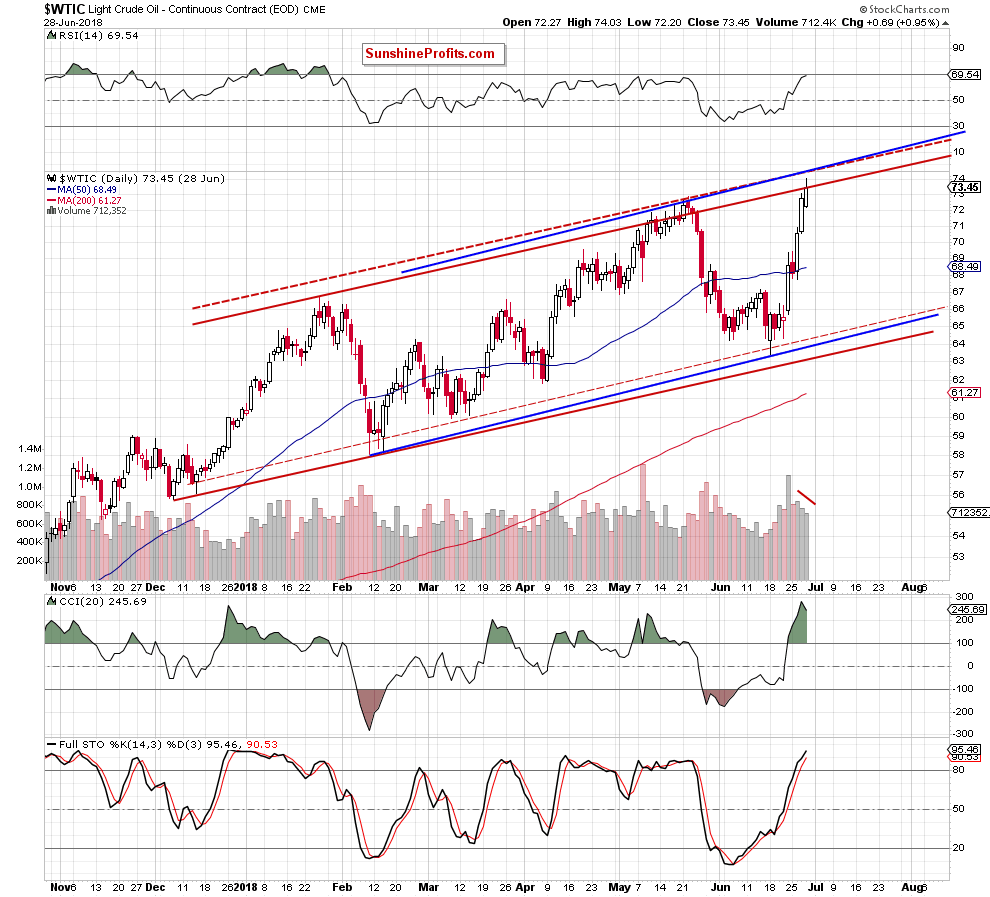

Technical Picture of Crude Oil

Looking at the daily chart, we see crude oil moved a bit higher during yesterday’s session, which resulted in a fresh peak. Although this is a positive event, we should keep in mind that black gold is still trading inside two rising trend channels: the blue one (based on the February and June lows and the May high) and the red one (created by the support line based on the December 2017 and February 2018 lows and the resistance line based on the January peak.

As you see, although black gold climbed above the upper border of the red rising trend channel in May, oil bulls didn’t manage to push the price higher, which resulted in a reversal and encouraged their opponent to act. Thanks to their action light crude approached the lower border of the channel.

Taking this fact into account and combining it with the current position of the daily indicators (they climbed to the highest levels since late May), it seems that even if light crude moves a bit higher from here, the upper border of the blue rising trend channel will be able to stop further rally in the coming day(s).

This scenario is also supported by the volume, which drops from sessions to sessions, raising more and more doubts about the strength of the bulls. On top of that, the picture, which emerges from the relationship between crude oil and precious metals also doesn’t bode well for further rally.

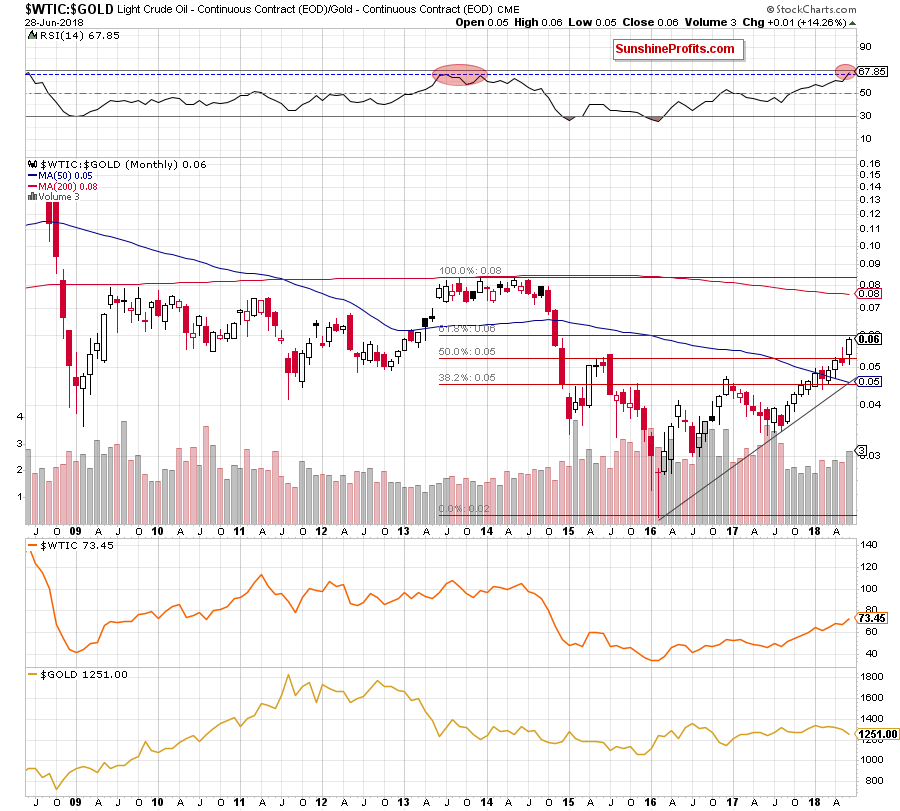

Crude Oil – Precious Metals Link

Let’s start this section with the long-term picture of the oil-to-gold ratio.

As you see on the above chart, the ratio approached the 61.8% Fibonacci retracement based on the entire 2013-2016 downward move, which suggests that even if the ratio moves slightly higher, the space for gains may be limited by this important resistance in the very near future.

Additionally, the RSI climbed to its highest level since 2013. Did anything important happen then? Looking at the above chart, we can see that such high reading of the indicator (we marked it with the red ellipse) preceded a multi-month consolidation and, in fact, a strong downward move that allowed our readers to increase their profits.

So, will the history repeat itself once again? At the first glance, this is a fairly credible scenario, but let's check other charts to have a fuller picture of the current situation.

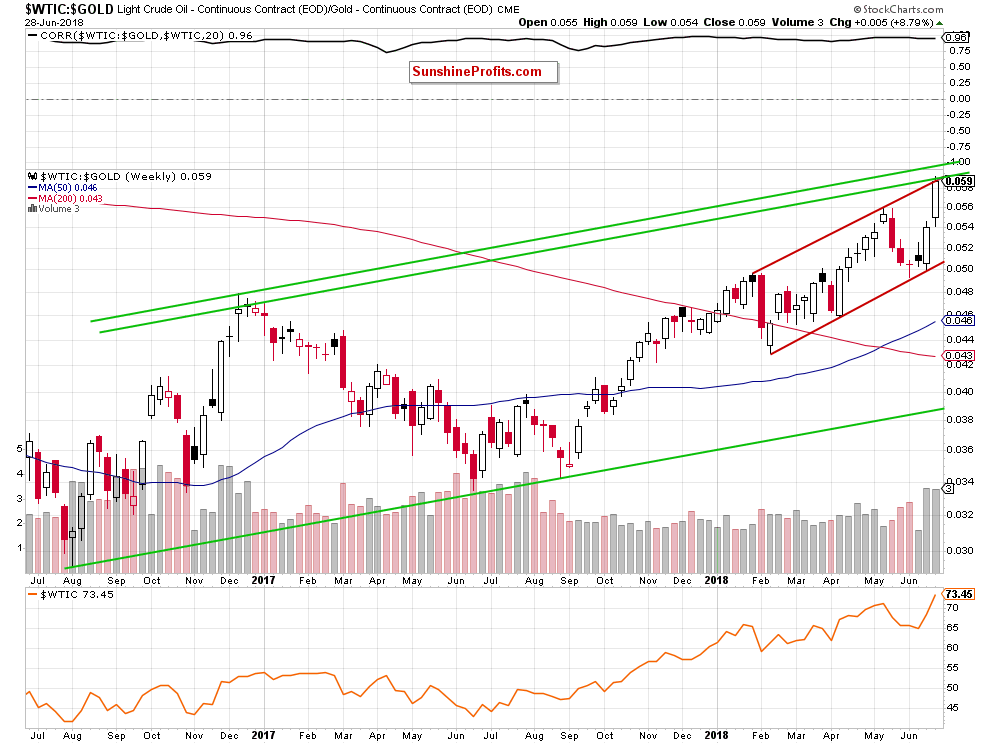

Considering the same ratio, but from the medium-term perspective, we see it climbed to the resistance area created by two important resistance lines: the upper line of the red rising trend channel and the upper border of the long-term green rising trend channel.

In the above case, the ratio also has some space for growth (to the upper green line, which is based on an intraweek high), but it seems very limited. At this point, you can ask: ok, but what does this have to do with the price of crude oil? As it turned out many times in the past, it has quite a lot in common. Why? As you can see on the above chart, the level of correlation between the price of light crude and the ratio is very high (0.96), which means that the potential reversal in the case of ratio can also translate into a reversal in the case of black gold – just like it has already happened many times in similar cases. Therefore, in our opinion, careful observation of this chart may give us an advantage and confirm the potential moment of opening the position.

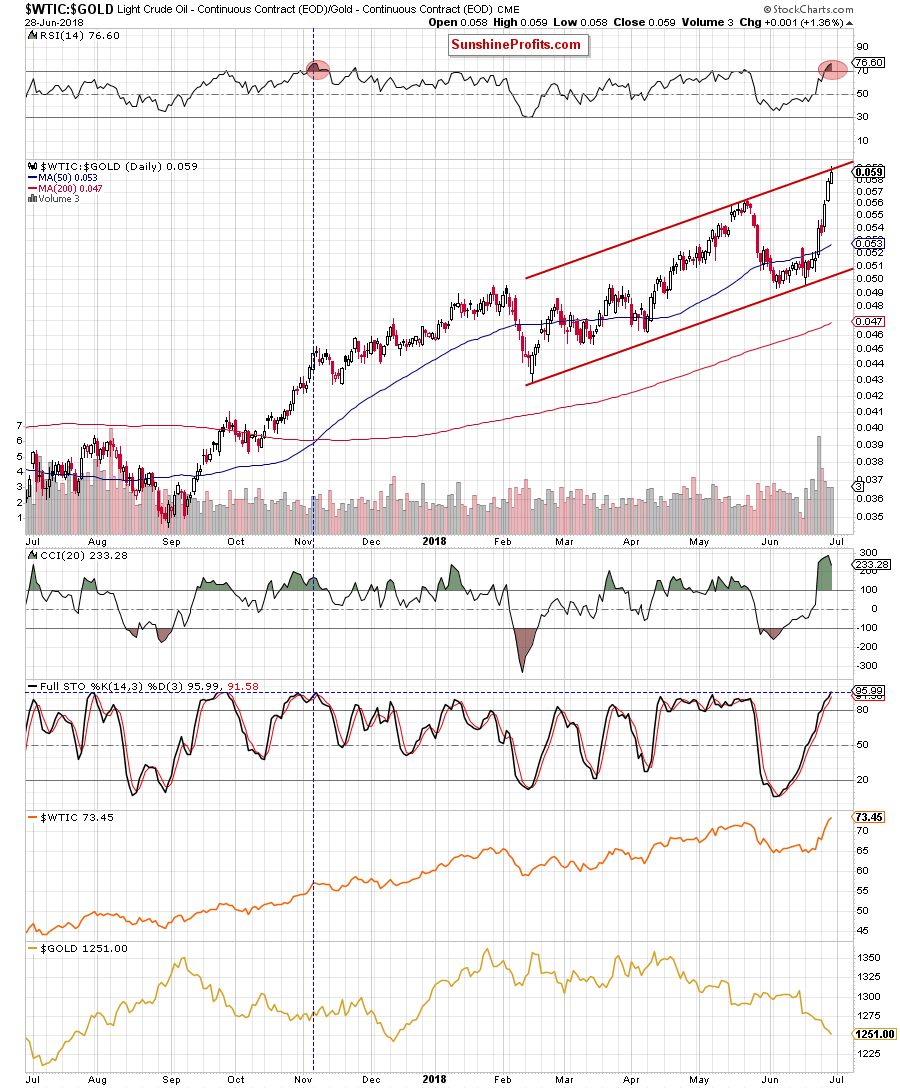

Can we infer something more from the daily chart?

From this point of view, you can see more clearly the red rising trend channel and the level of the RSI. Similar reading of the indicator we saw only once during the last year. Back then, it preceded a correction, which took place in the following days, which suggests that we may see something similar in the coming week.

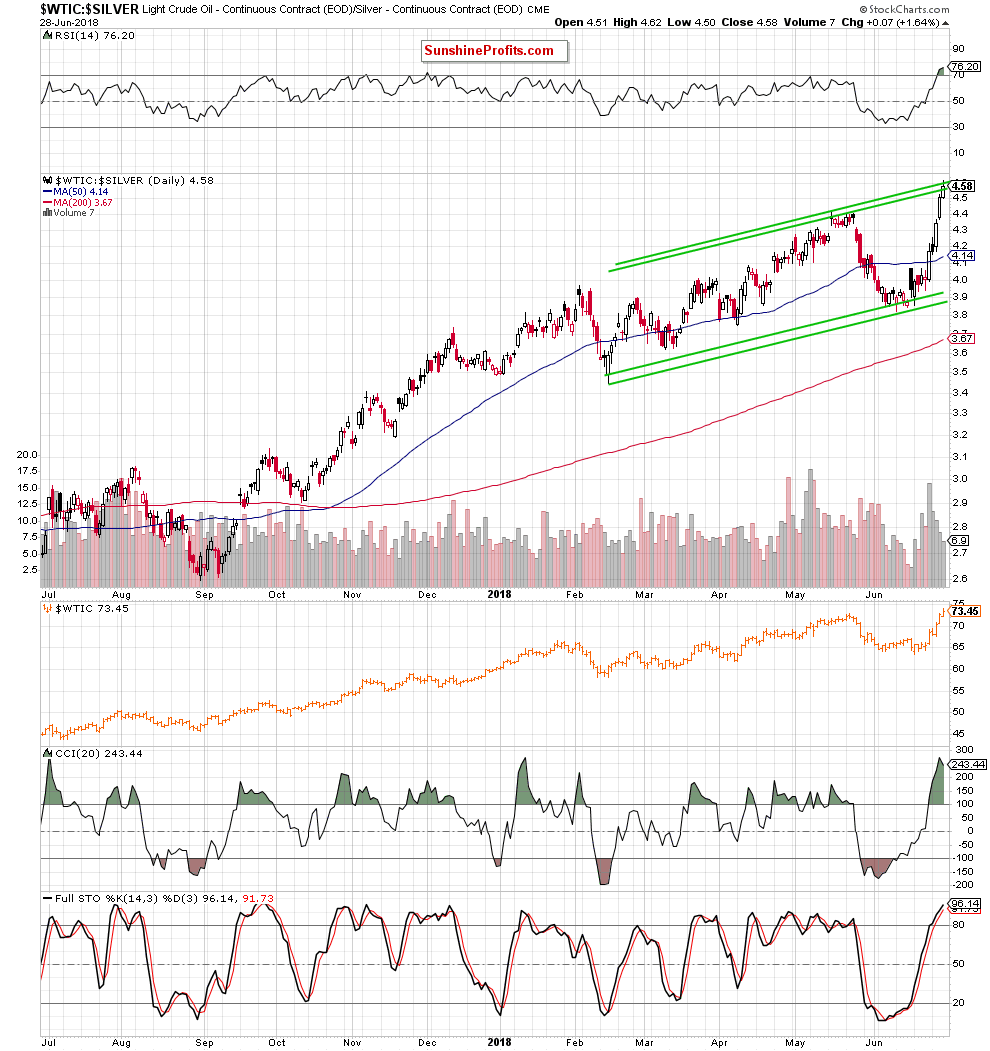

Having said that, let’s focus on the relationship between crude oil and silver.

In this case, we can also see that the ratio moved to the resistance area created by the upper lines of the green rising trend channels (in terms of an intraday highs/lows and daily opening/closures) and the RSI increased to its higher level since July 2017.

All these factors increase the probability of reversal in the very near future – especially if we see one more day with declining volume. Nevertheless, the level of today's closure will be important not only for the rising trend channels discussed above but will likely also affect the tone of the monthly chart. As a reminder, the price of light crude climbed slightly above the upper border of the red resistance zone (created by the 38.2% retracement based on the entire 2008-2016 downward move), but the breakout is not confirmed by a monthly closure above this resistance.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts