Trading position (short-term; our opinion): Short positions (150% of the regular size of the position) with the stop-loss order at $68.15 and the initial downside target at $58.10 are justified from the risk/reward perspective.

On Thursday, crude oil wavered between small gains and losses, but finally finished the day 0.27% above Wednesday’s closing price. Will we see black gold under $62 in the coming week?

Technical Analysis of Crude Oil

Let's examine the charts below (charts courtesy of http://stockcharts.com).

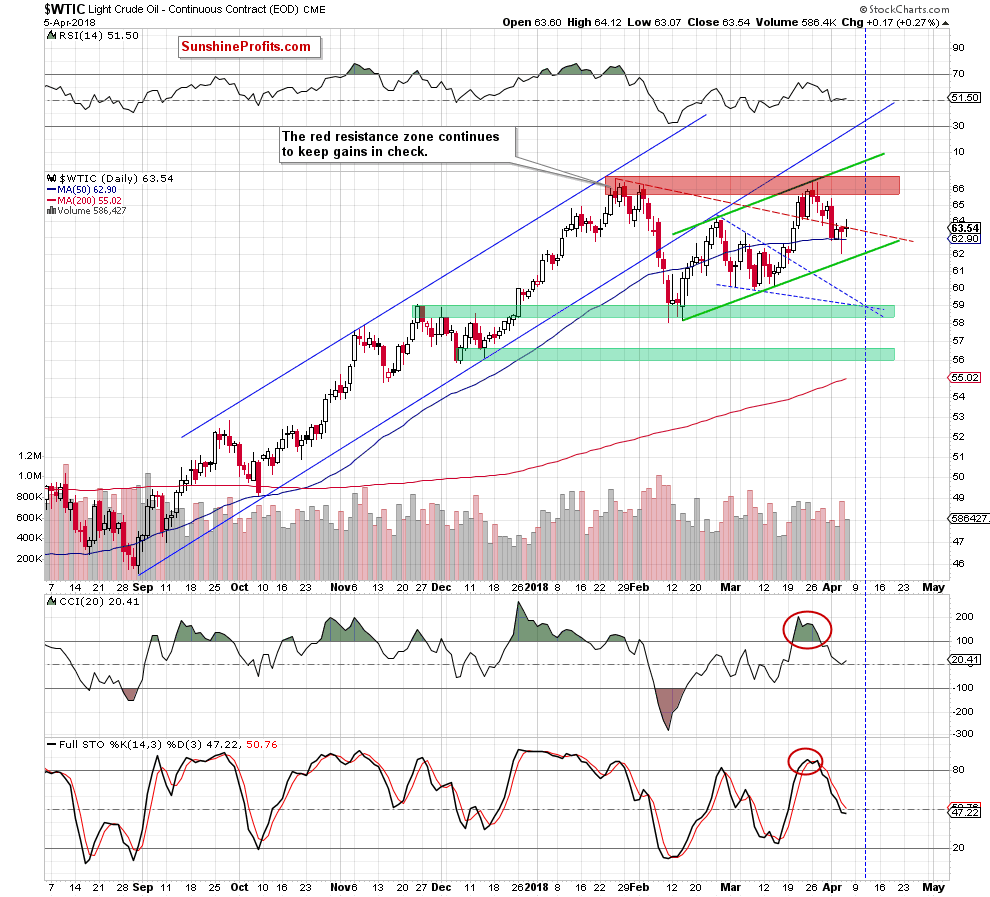

Looking at the daily chart of black gold, we see that the overall situation in the very short term (not to mention the short term or the medium term) hasn’t changed much as crude oil is still trading slightly under the red declining dashed line based on the January and February peaks and a bit above the 50-day moving average.

Thanks to yesterday’s price action light crude created a doji candlestick, which shows some uncertainty among investors about the direction of another bigger move. Nevertheless, in our opinion, all negative technical factors remain in the cards, supporting oil bears and lower prices of crude oil.

What negative factors? We believe that the best answer to this question will be the quote from our yesterday’s alert:

(…) light crude closed another day (for the third time in a row) under the previously-broken red declining dashed line based on the January and February peaks. Additionally, (…) the sell signals generated by the indicators, (…) continue to support the bears.

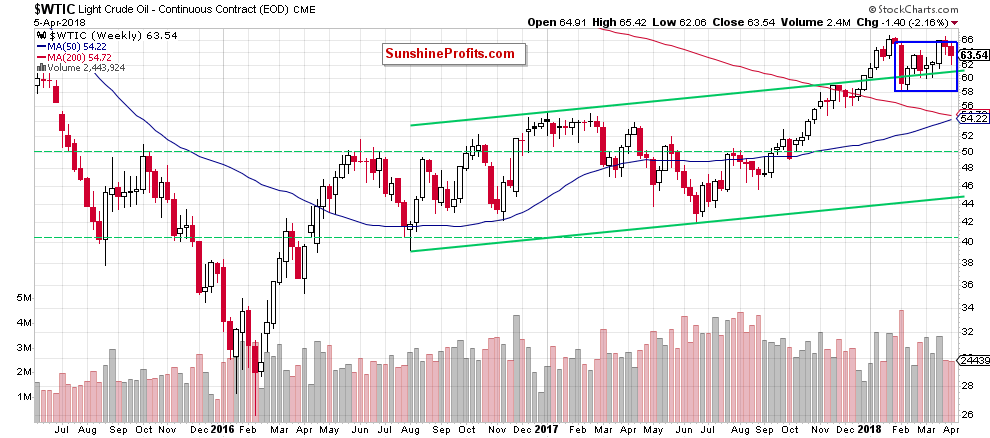

On top of that, crude oil is still trading inside the blue consolidation seen on the weekly chart below, which means that an invalidation of the earlier tiny above the upper border of the blue consolidation and its negative impact on the price remain in effect, suggesting further deterioration and (at least) a test of the green support line (the upper line of the green rising trend channel), which is currently around $61.

Summing up, short positions continue to be justified from the risk/reward perspective as crude oil closed another session under the previously-broken short-term support/resistance line, which together with the sell signals generated by the indicators supports oil bears and increases the probability of another move to the downside.

Trading position (short-term; our opinion): Short positions (150% of the regular size of the position) with the stop-loss order at $68.15 and the initial downside target at $58.10 are justified from the risk/reward perspective. As always, we’ll keep you - our subscribers - informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts