Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Yesterday, crude oil reversed and came back above the previously-broken support level. In this way, light crude invalidated the earlier breakdown, but is it enough to come back above $70 in the coming days?

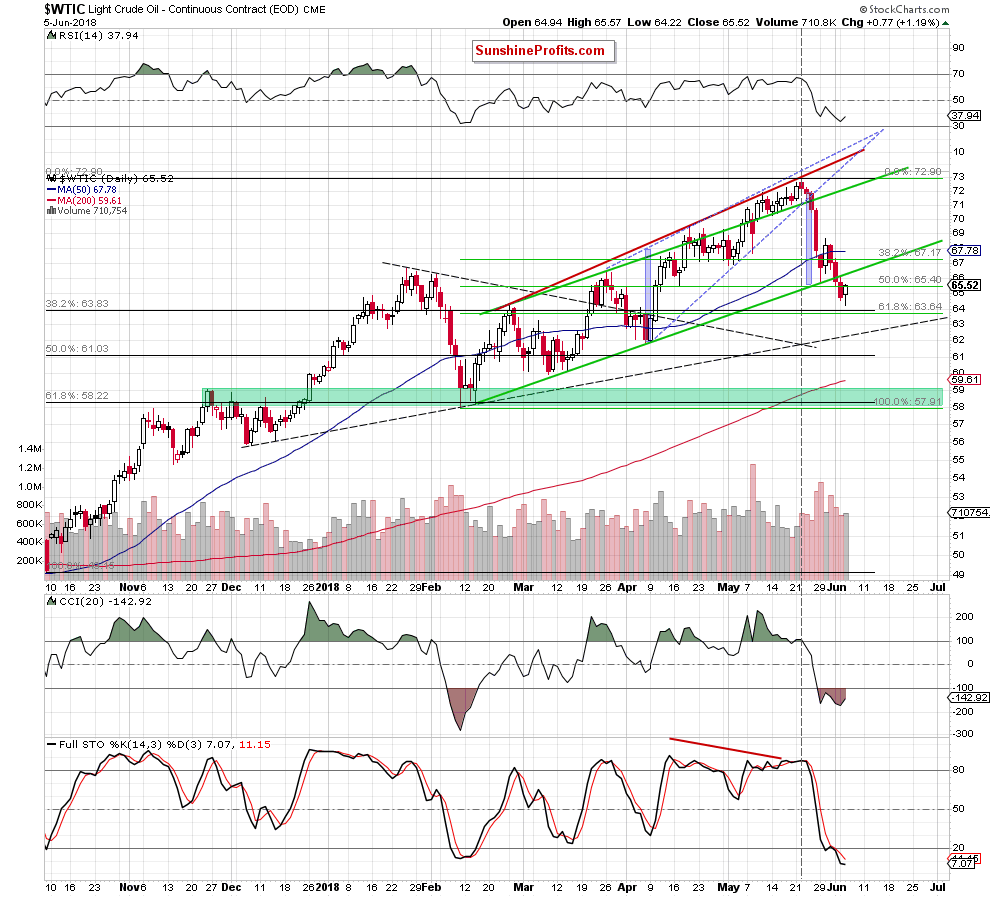

Let's take a closer look at the chart below (charts courtesy of http://stockcharts.com).

Although crude oil moved lower after yesterday’s market’s open, oil bulls stopped their opponents, triggering a rebound in the following hours. As a result, black gold came back above the previously-broken 50% Fibonacci retracement, invalidating the earlier breakdown. Additionally, yesterday’s move materialized on bigger volume than Monday’s decline, which suggests that the buyers may getting stronger in the coming days.

Nevertheless, the sell signals generated by the daily indicators remain in the cards, which together with today’s price action that we noticed before the market’s open suggests that before we see further improvement one more downswing can’t be ruled out.

If this is the case and we see such price action, oil bears could test the 38.2% retracement based on the entire October 2017-May 2018 increases (around $63.85) in the very near future (maybe even later in the day).

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts