Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Wednesday, oil bears showed that they are not going to give up without a fight and erased almost the entire Tuesday’s rebound. Does it mean that one move to the downside is still ahead of us?

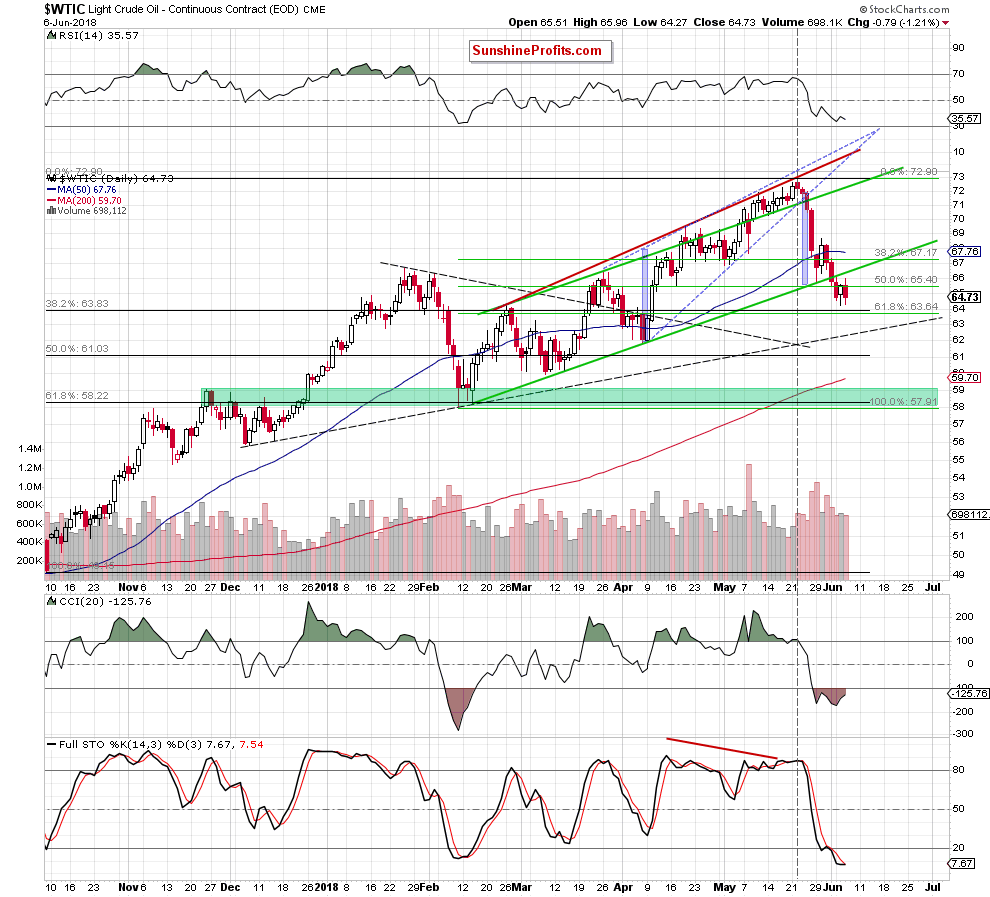

Let's take a closer look at the chart below (charts courtesy of http://stockcharts.com).

Yesterday, crude oil increased a bit after the market’s open, but oil bulls didn’t even manage to push the commodity to the previously-broken lower border of the green rising trend channel. This show of weakness triggered a decline, which erased almost entire Tuesday’s rebound.

Thanks to this price action light crude came back below the 50% Fibonacci retracement, which increases the probability that we’ll see a realization of our yesterday’s scenario in the following day(s):

(...) Nevertheless, (…) before we see further improvement one more downswing can’t be ruled out.

If this is the case and we see such price action, oil bears could test the 38.2% retracement based on the entire October 2017-May 2018 increases (around $63.85) in the very near future (maybe even later in the day).

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts