Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Thursday, crude oil gained 0.59% as bullish EIA report continued to weigh on investors’ sentiment. In this environment, light crude climbed above $49. Will we see higher prices in the coming days?

Crude Oil’s Technical Picture

Let’s take a closer look at the charts and find out (charts courtesy of http://stockcharts.com).

Quoting our previous Oil Trading Alert:

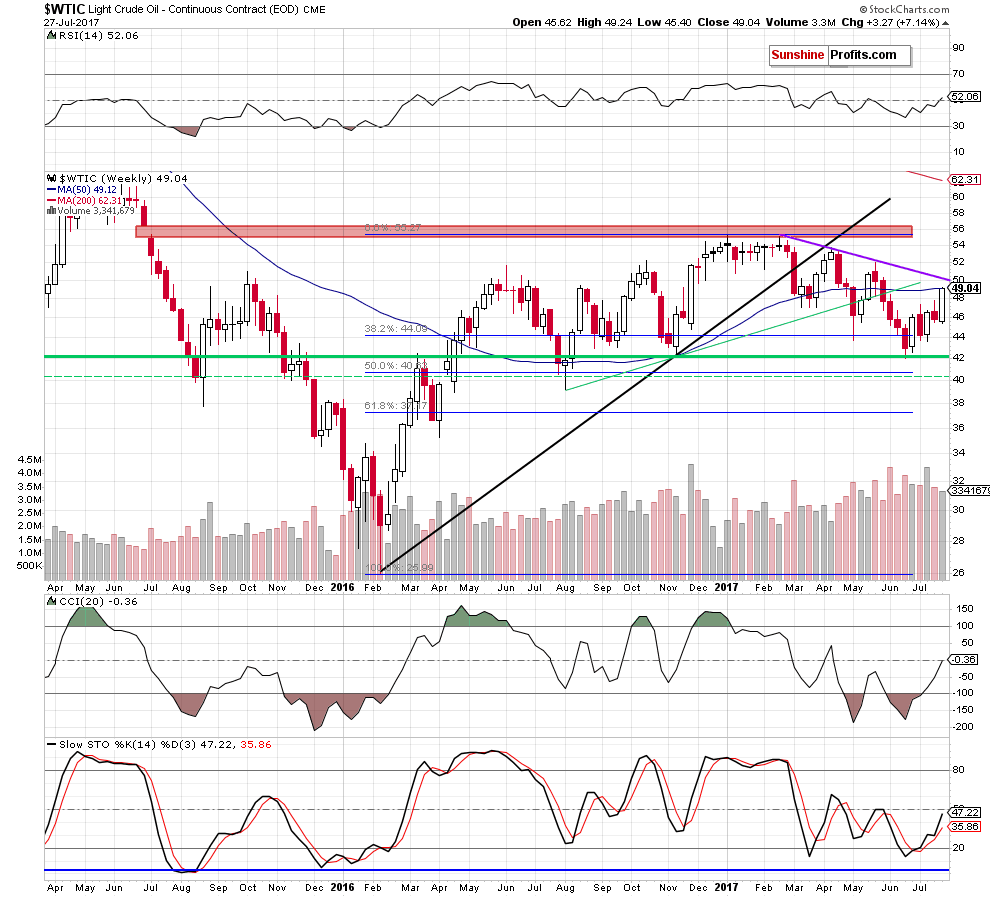

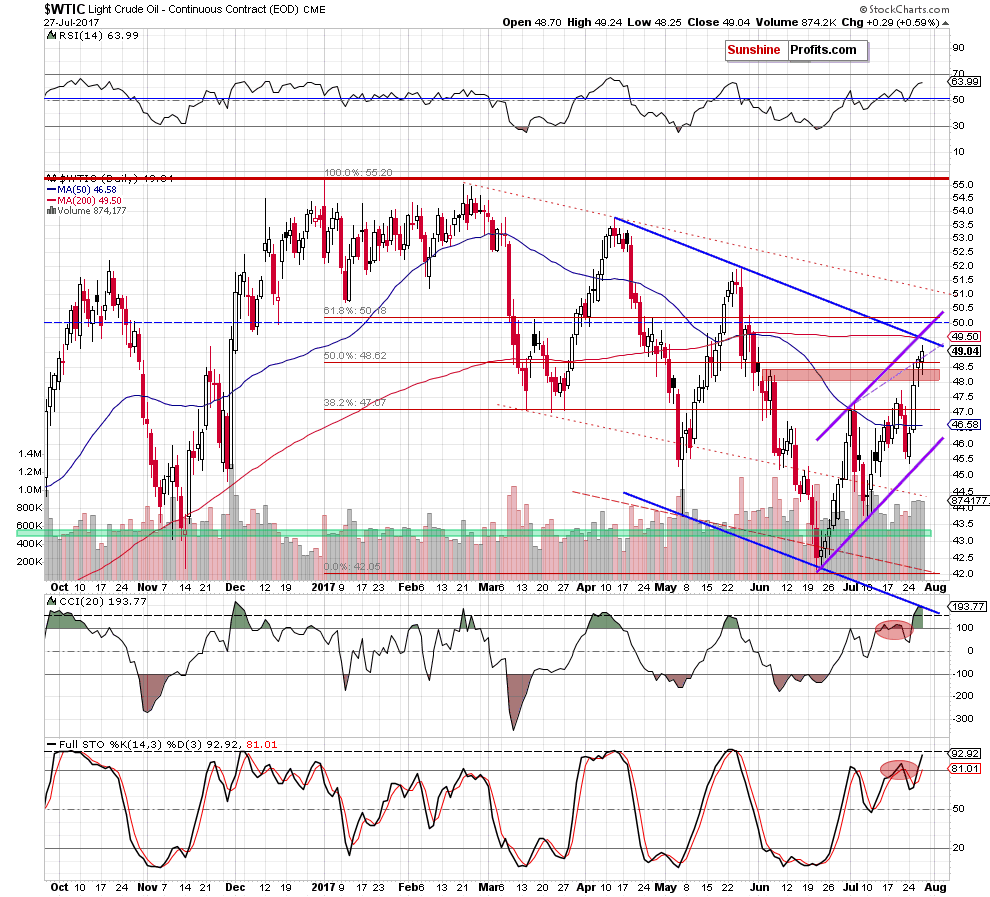

(…) although crude oil moved lower after the market’s open, oil bulls stopped further deterioration, triggering a rebound. As a result, light crude not only climbed above Tuesday’s high, but also broke above the red resistance zone and the 50% Fibonacci retracement (based on the entire 2017 downward move), opening the way to higher levels.

From today’s point of view, we see that the situation developed in line with the above scenario and oil bulls pushed the black gold higher, climbing above $49.

What’s next for the commodity?

We believe that the best answer to this question will be the quote from our Wednesday’s commentary:

(…) the space for gains seems limited as the upper border of the purple rising trend channel, the upper border of the blue declining trend channel and the 50-week moving average are not far from yesterday’s levels. Therefore, we think that even if light crude increases slightly (…), the combination of these resistances will be strong enough to stop oil bulls and trigger reversal and declines in the coming days.

Summing up, crude oil extended gains above the red resistance zone and the 50% Fibonacci retracement, which suggests a test of the resistance zone created by the upper border of the purple rising trend channel and the upper border of the blue declining trend channel in the coming day(s).

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts