Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Tuesday, light crude extended gains and closed the day above the short-term resistance line. What does it mean for black gold?

Crude Oil’s Technical Picture

Let’s examine the technical picture of the commodity (charts courtesy of http://stockcharts.com).

On Monday, we wrote the following:

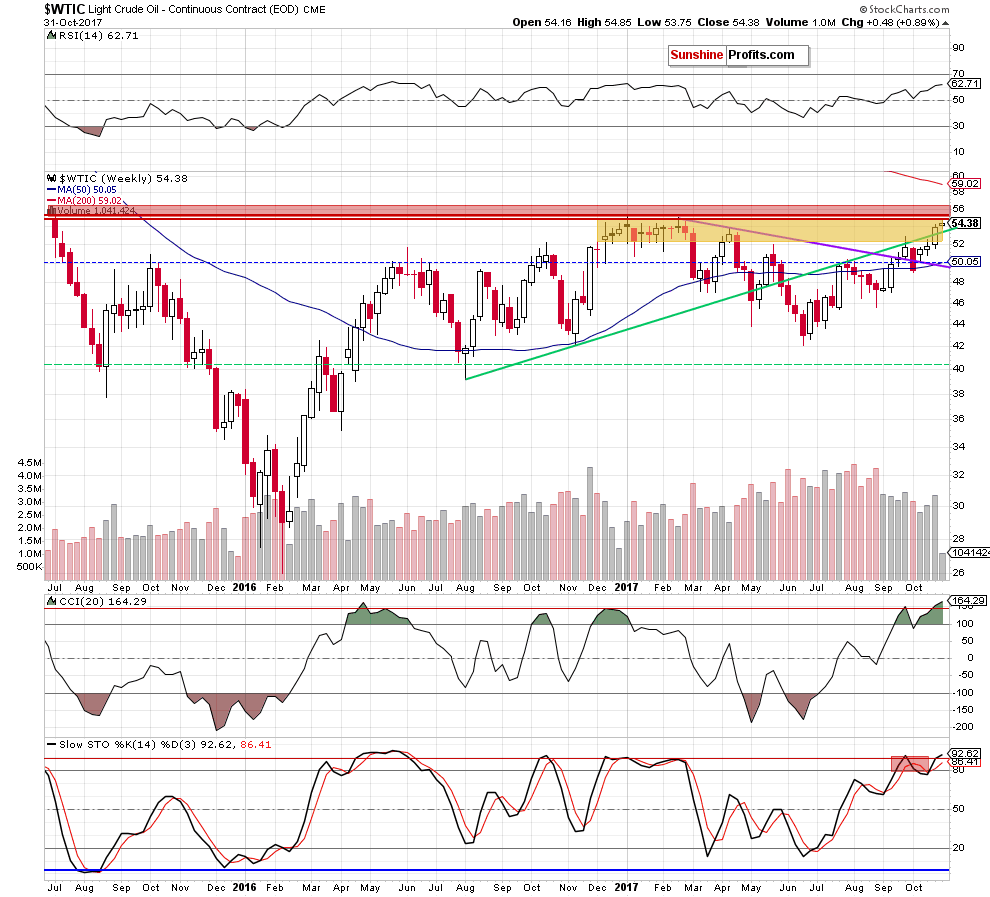

(…) crude oil moved sharply higher and closed the previous week above the long-term green line, which suggests a test of the 2017 highs in the coming days. The pro bullish scenario is also reinforced by the size of volume, which increased during recent weeks, suggesting that buyers are getting stronger.

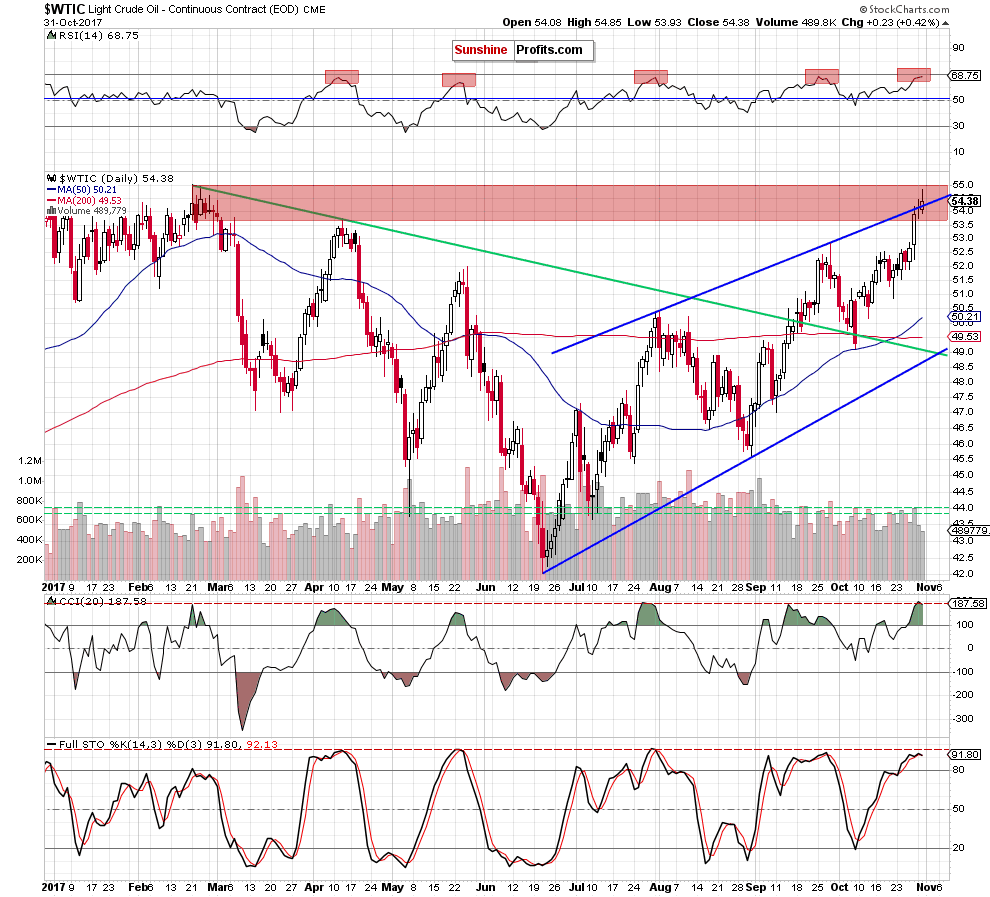

Looking at the daily chart, we see that crude oil broke above the upper blue resistance line based on the August and September highs, which suggests that we’ll see a realization of the above-mentioned scenario in the coming days.

Nevertheless, we should keep in mind that reversal and declines from there should not surprise us in the very near future. Why? We believe that the best answer to this question will be the quotes from our last Oil Trading Alert:

(…) This scenario is also reinforced by the current position of the daily indicators (we saw such high readings before important reversal in the previous months) and the situation on the medium-term chart (…) black gold remains in the yellow resistance zone, which stopped oil bulls several times in the previous months. Additionally, the RSI, the CCI and the Stochastic Oscillator climbed to the levels seen at the beginning of the year, which suggests that another reversal may be just around the corner.

Finishing today’s alert, we would also like to draw your attention to the size of volume, which accompanied recent upswings. As you see, it visibly declines since the beginning of the week, which suggests that oil bulls may run out of steam and increases the probability of lower prices of crude oil in the very near future.

Summing up, crude oil remains in the key resistance zone, which together with the current position of the indicators and the size of volume increase the probability of reversal in the following days. Therefore, if we see important bearish developments, we’ll consider opening short positions.

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts