Trading position (short-term; our opinion): Short position with a stop-loss order at $58.37 and the initial (!) downside target at $50.38 in crude oil is justified from the risk/reward perspective.

Oil price upswing looks to be on. After all, the price went higher for three consecutive days. And it’s marginally higher in the pre-US session trading today. Let’s examine whether there are any cracks appearing below the surface. If so, do they look reliable?

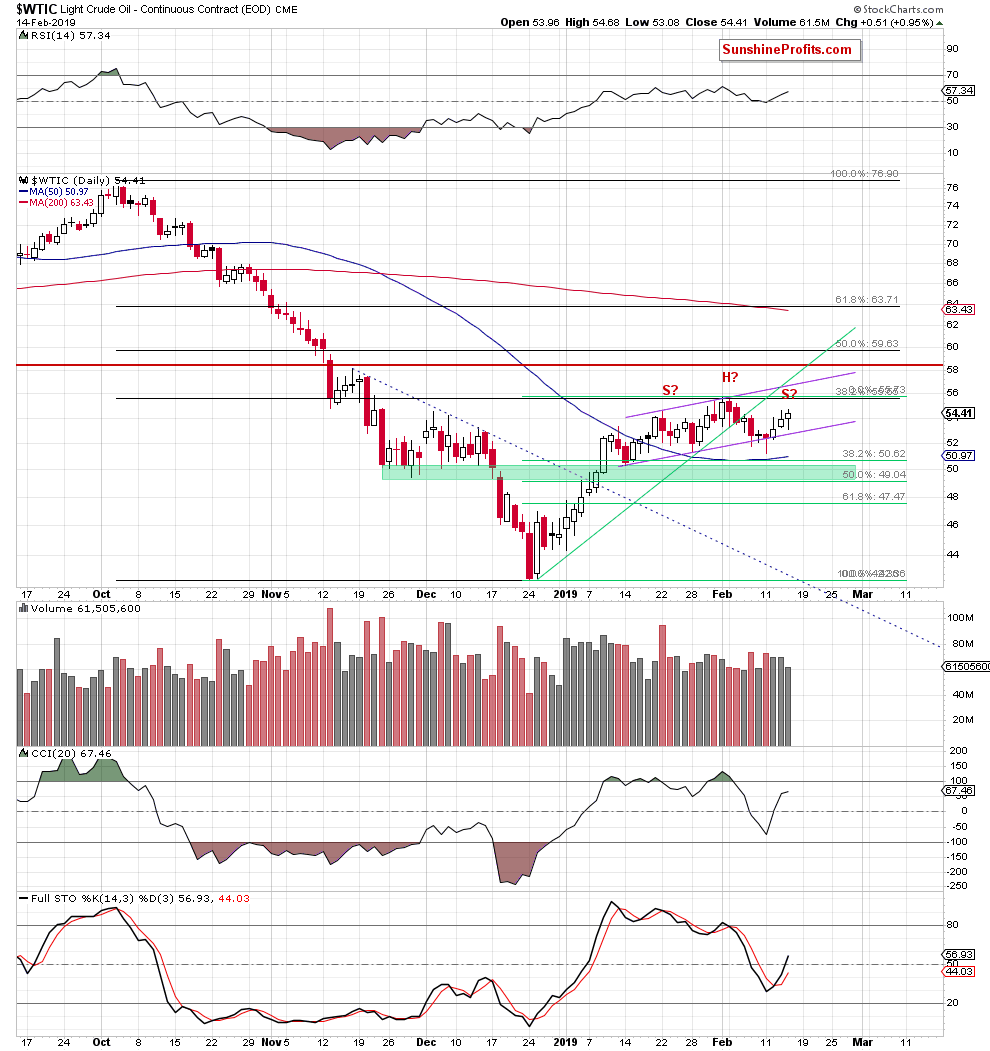

Let’s examine the chart below (chart courtesy of http://stockcharts.com).

Yesterday, oil bulls extended gains and took the commodity above $54. Yet again, they were partially rebutted and the daily gain ended up being more modest than during the two previous white-candle days. Also note the significant lower knot – the buyers were successful this time at repelling their opponents. That is, this time.

Another bearish indication is the decrease in yesterday’s volume compared to both immediately preceding days. This raises doubts about buyers’ commitment to the price upswing. Therefore, the bearish head and shoulders pattern remains in progress and the current upside move looks like creating the right arm of the formation.

Additionally, there are important resistance levels close to the current price. It means that what we wrote in our last commentary remains up-to-date:

(…) Black gold is still trading below both the 38.2% Fibonacci retracement and the upper border of the purple rising trend channel. These two were strong enough to stop the bulls earlier this month already.

There is also the bearish engulfing pattern on the weekly chart. Today’s trading will provide us with another weekly close and we’ll get more information to analyze and base our actions upon.

Connecting the dots, our yesterday’s summary remains valid today, too:

Summing up, the short position continues to be justified from the risk/reward perspective as all the above mentioned factors favor the sellers and another move to the downside in the coming days.

Trading position (short-term; our opinion): Short position with a stop-loss order at $58.37 and the initial (!) downside target at $50.38 in crude oil is justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.