Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Although oil bulls triggered a move to the upside after yesterday’s market open, they were not strong enough to keep gained levels. This show of weakness encouraged their opponents to act. How did the Tuesday battle end and what could be its consequences?

Let’s examine the charts below (charts courtesy of http://stockcharts.com).

Technical Picture of Crude Oil

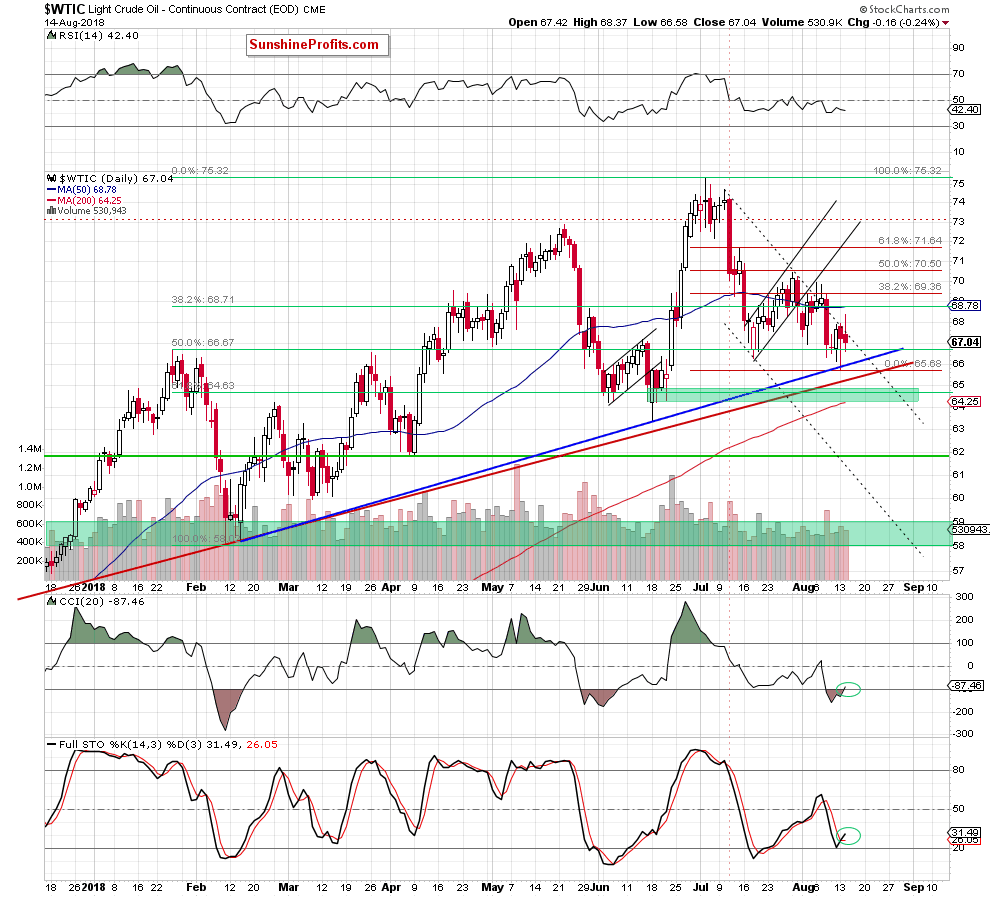

The first thing that catches the eye on the daily chart is another unsuccessful attempt to go above the back dotted line based on July peaks. As we mentioned earlier, although oil bulls pushed black gold higher after yesterday’s market open, they didn’t even manage to reach the previously-broken 50-day moving average (not to mention a climb to the 38.2% Fibonacci retracement).

Their weakness, resulted in a sharp pullback, which took the price of light crude under the above-mentioned back dotted resistance line. In this way, oil bears invalidated the earlier small breakout and closed another day below this nearest resistance, which doesn’t bode well for their opponent and higher values of crude oil.

What can this mean for black gold in the near future?

In our opinion, another test of the strength of the blue (or even red) support line.

Nevertheless, we should keep in mind that the CCI and the Stochastic Oscillator generated buy signals, which in combination with the medium-term picture about which we wrote on Monday increases the likelihood that this area will withstand the selling pressure in the coming days.

How yesterday’s price action affected the the medium-term chart? Let’s check.

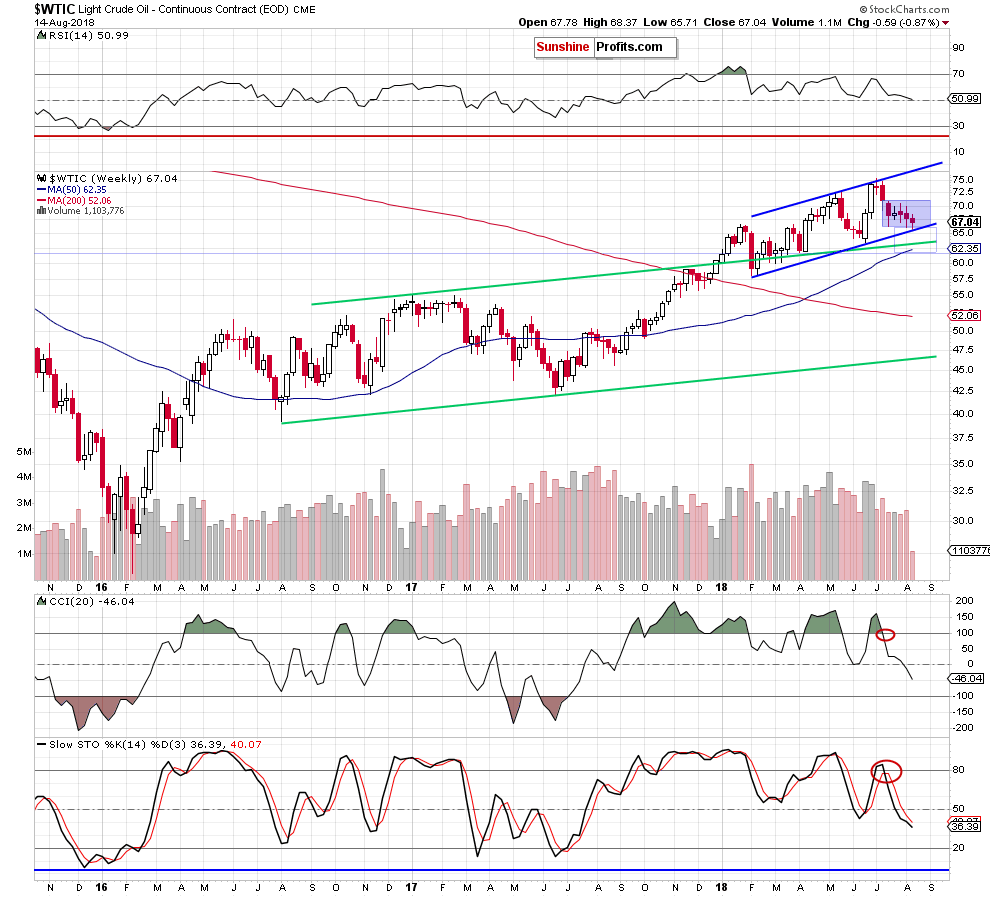

From this perspective, we see that the overall situation hasn’t changed much as the commodity remains inside the blue consolidation slightly above the lower border of the blue rising trend channel.

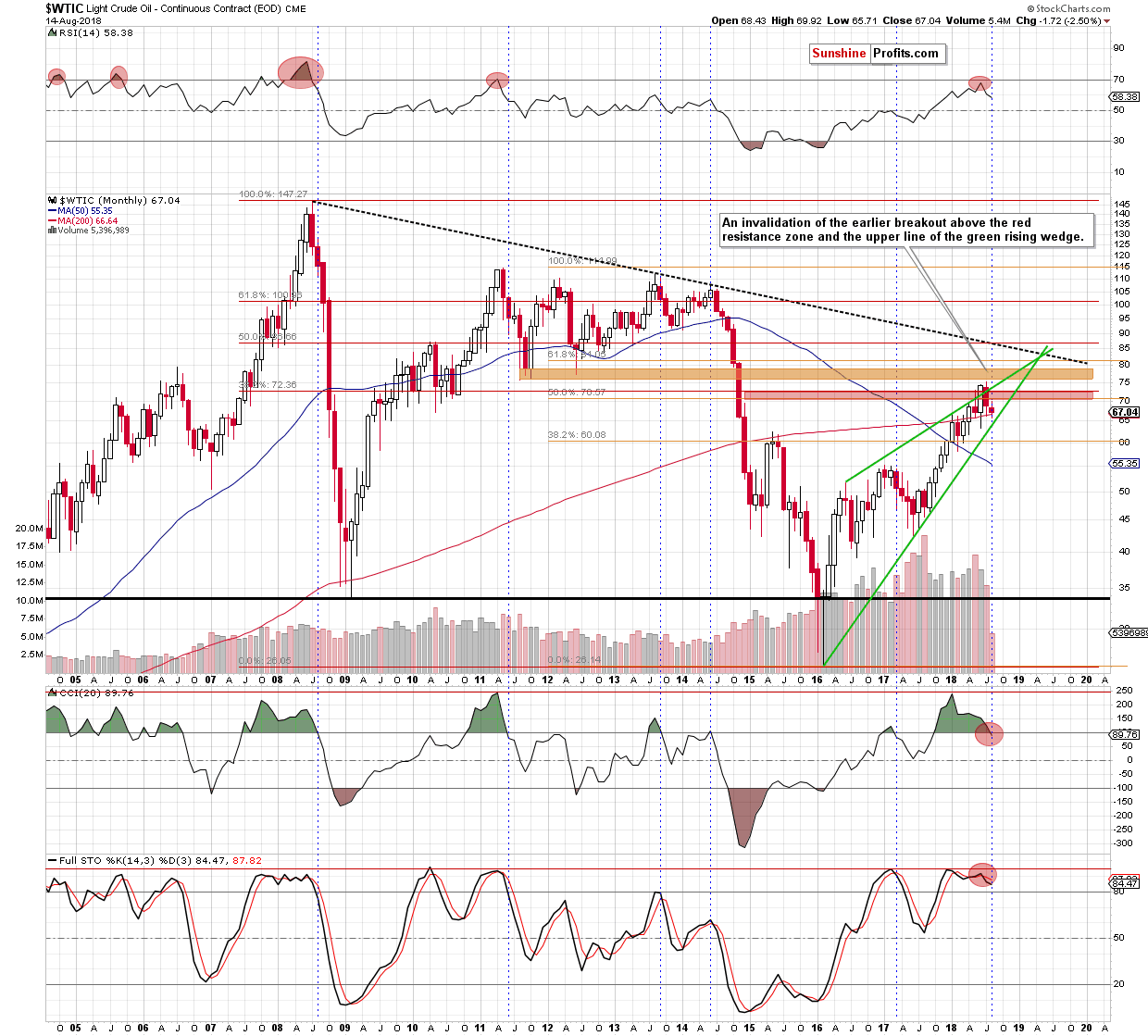

Therefore, we continue to believe that as long as there is no weekly closure under the above-mentioned blue support line, lower prices of the commodity and another significant move to the downside are doubtful – especially when we factor in the fact that the 200-month moving average continues to keep declines in check (since May).

Connecting the dots, if we see more reliable negative technical factors (like breakdown under the medium-term support lines), we’ll consider re-opening short positions. Until this time, waiting at the sidelines for a confirmation or invalidation of the above is justified from the risk/reward perspective.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts