Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Friday crude oil moved higher and invalidated the breakdown under the long-term line. Is it enough to push the commodity above the barrier of $50 in the coming week?

Let’s analyze the charts below (charts courtesy of http://stockcharts.com).

On Friday, we wrote the following:

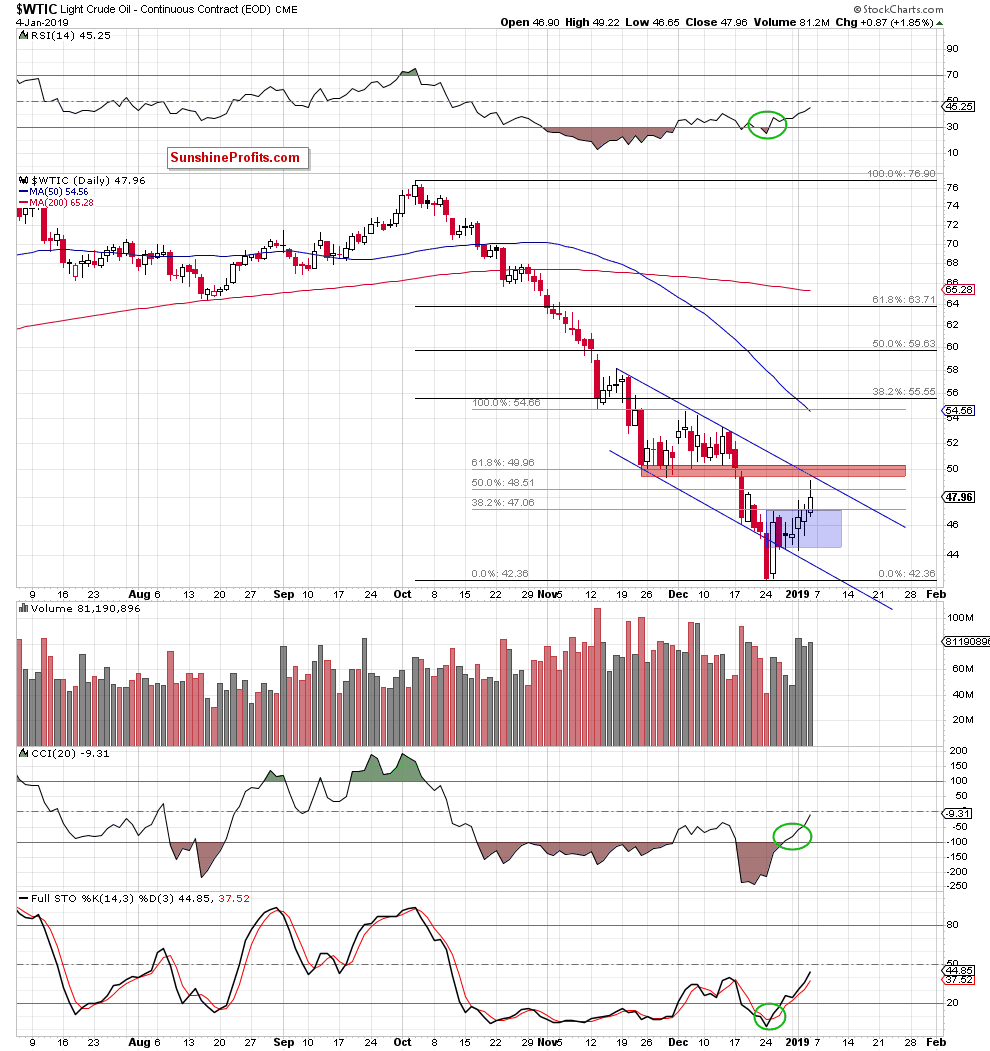

(…) light crude re-tested the Wednesday's high and the 38.2% Fibonacci retracement, but despite tiny pullback before the session closure the commodity finished the day above these resistances.

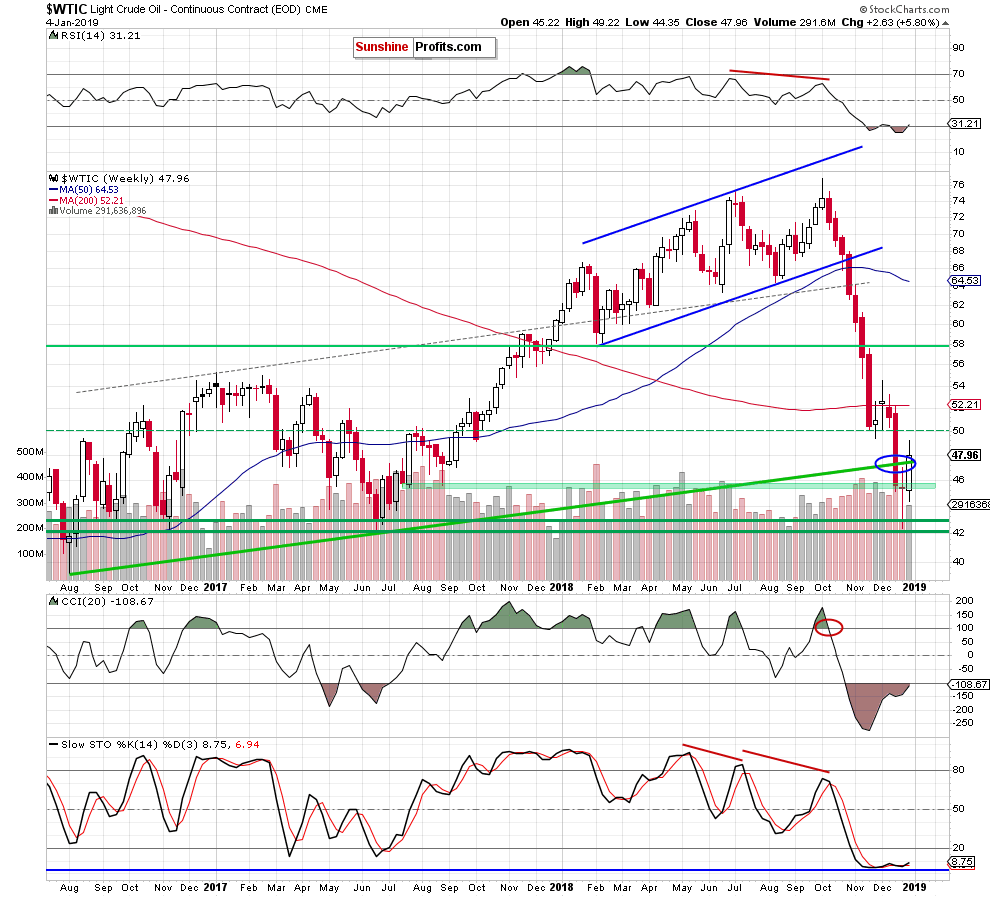

Taking this positive event into account and combining it with the buy signals generated by the indicators, it seems that oil bulls will try to push light crude higher and re-test the previously-broken long-term green line (seen on the weekly chart below) during today’s session.

From today’s point of view, we see that the buyers not only tested, but also broke above this resistance line during the last session of the previous week, invalidating the earlier breakdown.

Although this is a bullish development that suggests further improvement, we should keep in mind that the price of black gold is still trading under the red resistance zone (created by the 61.8% Fibonacci retracement, the barrier of $50, the late-November and early-December lows) and the upper border of the blue declining trend channel.

Therefore, in our opinion, higher prices will be more likely and reliable if crude oil breaks above these resistances in the following days. If this is the case and the commodity extends increases from current levels, we’ll likely see an increase to around $53.30-$54.55, where the December peaks are.

At this point it is worth noting that slightly above them we can notice the 38.2% Fibonacci retracement based on the entire October-December downward move, which serves as an additional resistance that could encourage oil bears to act once again.

However, on the other hand, if the buyers show weakness in this area and fail to break above the red zone, the price of black gold will likely pull back and test the recent lows and the lower border of the blue consolidation (around $44.35-$44.40) in the near future.

Summing up, crude oil invalidated the earlier breakdown under the long-term line, but despite this improvement is still trading under the short-term resistances based on the previously-broken lows and the upper border of the declining trend channel. Therefore, as long as there is no breakout above them another pullback can’t be ruled out.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts