Trading position (short-term; our opinion): None positions are justified from the risk/reward perspective.

On Monday, crude oil wavered between small gains and losses, but then finished the day only four cents below the Friday’s closure. Did the bears lose their claws? Or is it just the calm before the storm?

Let’s take a look at the charts below (charts courtesy of http://stockcharts.com).

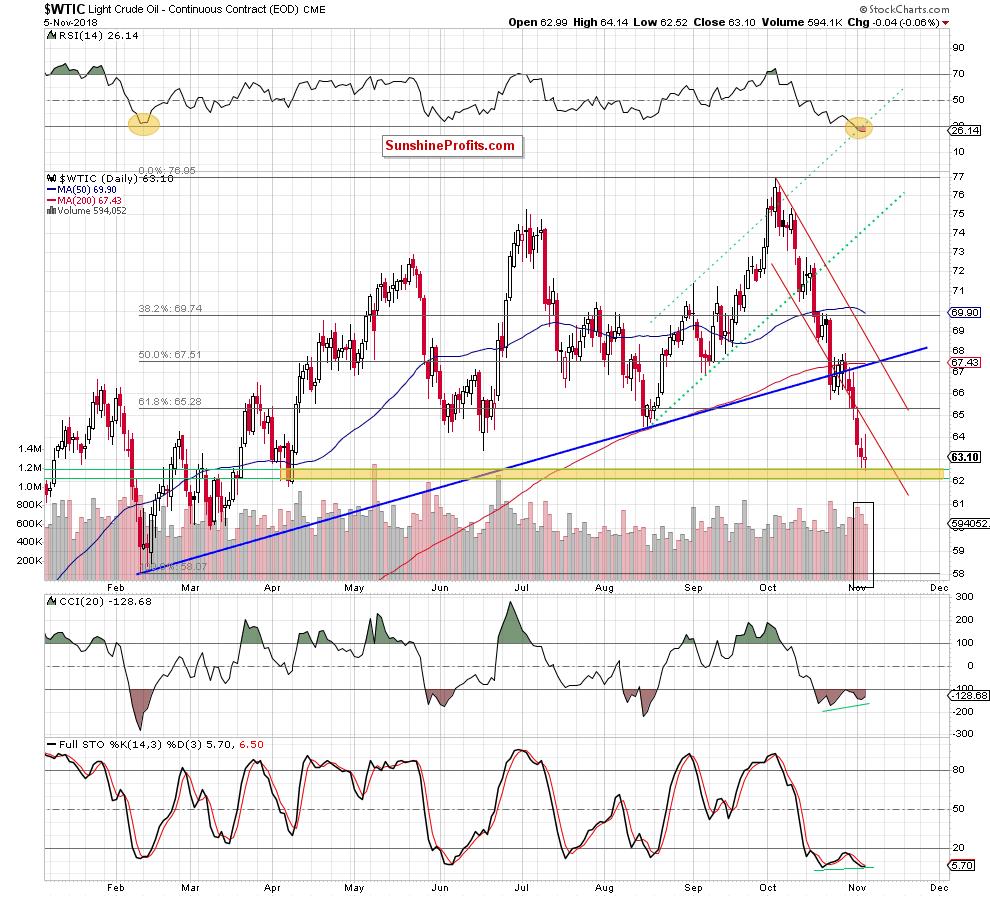

From today’s point of view, we see that although black gold slipped after the market’s open, the yellow support zone created by the 76.4% and 78.6% Fibonacci retracements and the April lows stopped the sellers, triggering a rebound in the following hours.

Although the commodity increased to $64.14, there was no comeback above the lower line of the red declining trend channel, which resulted in a pullback and a daily closure below the Friday’s closing price.

Such price action means that basically nothing changed on the market and the comments that we made on Monday remain up-to-date also today. Therefore, if you haven’t had the chance to read our yesterday’s alert, we encourage you to do so today:

Crude Oil – Anything Positive?

Finishing today’s commentary on crude oil, we would like to add that yesterday’s move materialized on smaller volume once again, suggesting that the involvement of sellers falls from session to session, which may translate into reversal in the very near future.

We will provide you with a bigger update once we see more interesting developments on the crude oil market. Meanwhile, staying on the sidelines and waiting for a confirmation/invalidation of our yesterday’s assumptions seems to be the best decision justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts