Trading position (short-term; our opinion): Short positions (with a stop-loss order at $54 and the initial downside target at $45.80) are justified from the risk/reward perspective.

On Tuesday, black gold moved a bit higher, but is this increase as positive as it might seems at the first sight?

Crude Oil’s Technical Picture

Let’s take a closer look at the charts below and try to find out (charts courtesy of http://stockcharts.com).

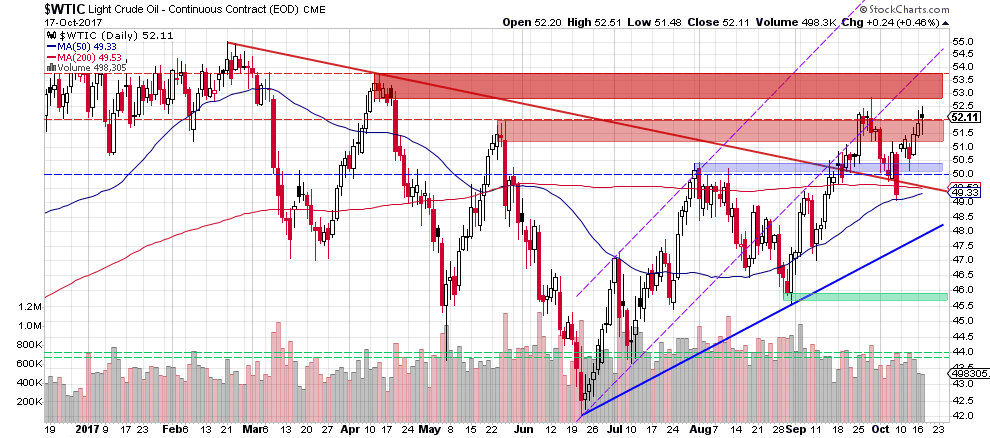

Yesterday, crude oil increased above the May high and the upper border of the red resistance zone based on it, which may seem like a bullish factor, but is this breakout as positive as it might seems at the first sight?

Looking at the daily chart, we see that there was a similar situation on September 25. However, back then, oil bulls created a big white candlestick, which materialized on visibly higher volume than yesterday’s move. Despite that upswing, the upper red resistance zone created by the April highs stopped further rally, triggering a bigger pullback.

What does it mean for light crude? As you see, yesterday’s candlestick has a small body with long shadows, which suggests indecision or the lack of clear domination of buyers or sellers, which could lead to a change of the very short-term trend – similarly to what we saw many times in the past (for example, on March 1, April 12, May 24, August 7, September 7 or September 26).

Additionally, the size of volume decreased on Tuesday compared to what we saw a day earlier, which suggests that buyers may be running out of steam.

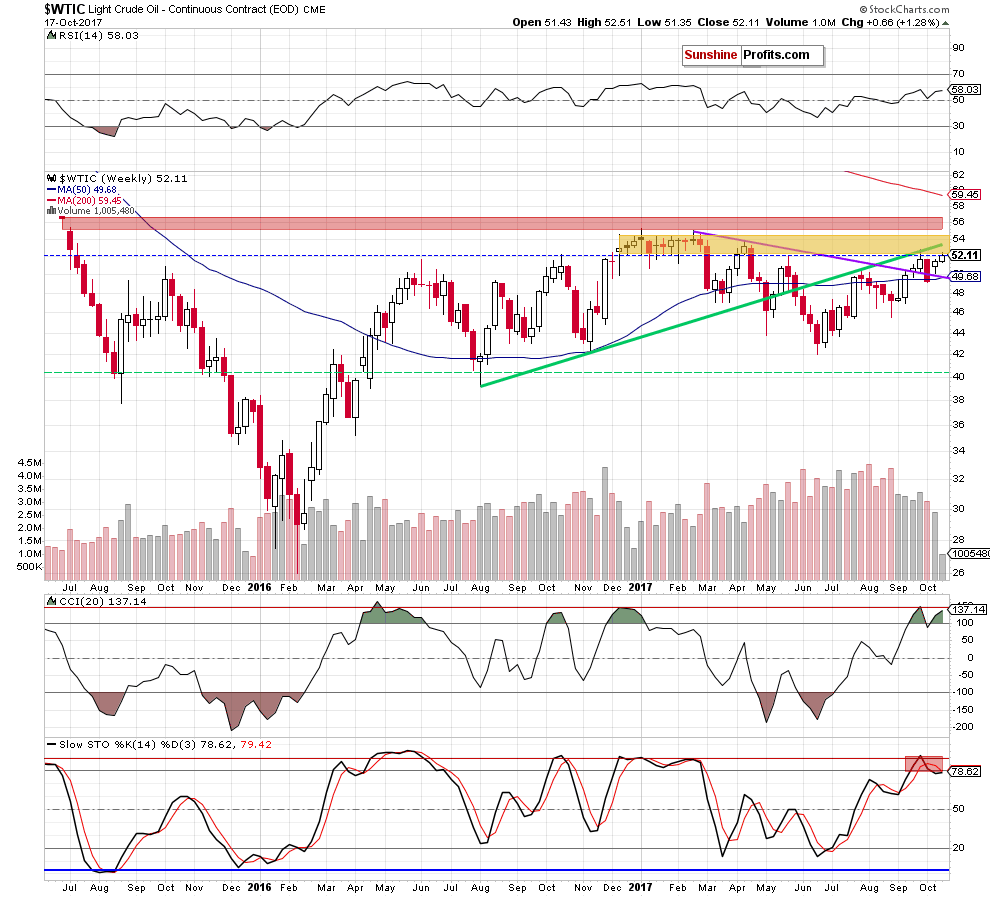

On top of that, when we take a closer look at the weekly chart below, we see that the commodity increased once again to the yellow resistance zone, which is the major resistance since the beginning of the year.

As you see, this area successfully stopped oil bulls in February, April, May and also in September, which means that as long as there is no breakout above it, the way to the higher prices will be closed and another reversal is just a matter of time (not too long time).

This scenario is also reinforced by the current position of the weekly indicators (the sell signal generated by the Stochastic Oscillator remains in play, while the CCI is close to generating it) and decreasing volume during increases.

Connecting the dots, we think that short positions continue to be justified from the risk/reward perspective as crude oil is still trading under the major resistance area, which successfully stopped increases many times earlier this year.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Short positions (with a stop-loss order at $54 and the initial downside target at $45.80) are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts