Trading position (short-term; our opinion): Long positions (with the stop-loss order at $65.10 and the next upside target at $73.47) are justified from the risk/reward perspective.

Thursday’s session revealed oil bulls’ weakness, which was quickly used by their rivals. The sellers' attack contributed to the price drop below $ 69, but are all pro-growth plans already lost?

Let’s examine the charts below (charts courtesy of http://stockcharts.com).

Technical Picture of Crude Oil

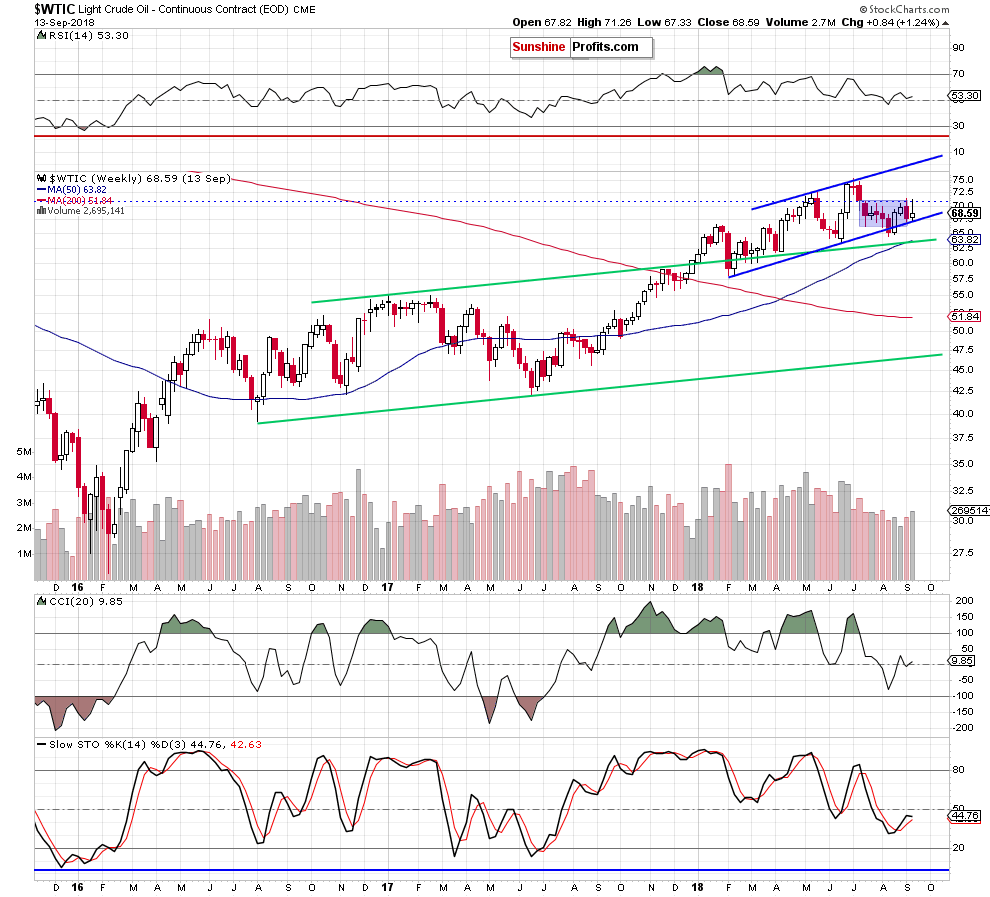

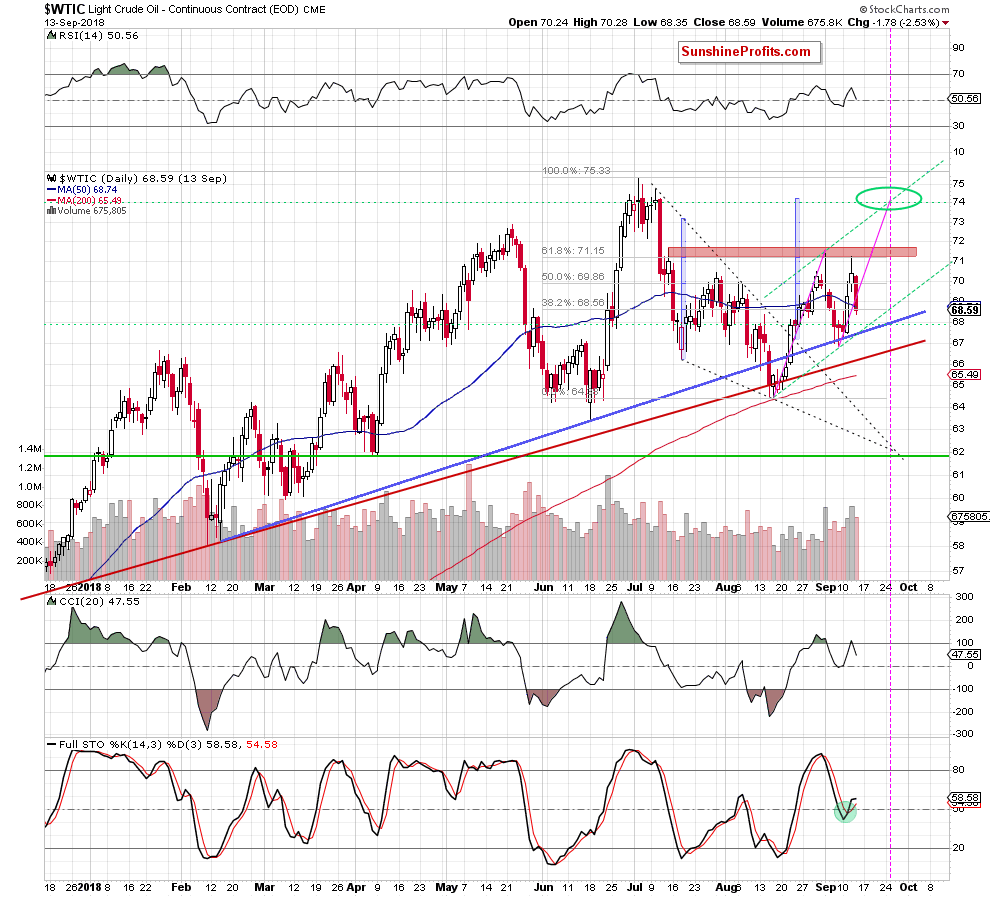

Looking at the above chart, we see that although crude oil moved quite sharply lower during yesterdays session, the commodity remains above the medium-term blue support line (the lower border of the rising trend channel marked on the weekly chart) and the green dashed support line (a potential lower border of the very short-term rising trend channel), which suggests that as long as there is no daily/weekly closure below these very important supports a bigger move to the downside is questionable and another rebound is very likely (especially when we factor in the buy signals generated by the medium-term indicators and the buy signal generated by the daily CCI).

Taking all the above into account, we continue to think that long positions are justified from the risk/reward perspective (a potential reverse head and shoulders formation about which we wrote in our previous alerts still remains in the cards). We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): Long positions (with the stop-loss order at $65.10 and the next upside target at $73.47) are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts