Trading position (short-term; our opinion): Long positions (with the stop-loss order at $65.10 and the initial upside target at $70.37) are justified from the risk/reward perspective.

On Wednesday, black gold gained 1.43% after the EIA weekly report showed that crude oil inventories declined by 2.6 million barrels in the week to Aug 24, beating analysts’ forecasts. Thanks to this fundamental support, the commodity broke above the recent consolidation and approached the August peak hit at the beginning of the month. Will we see higher prices of light crude in the following days?

Let’s examine the chart below (charts courtesy of http://stockcharts.com).

Technical Picture of Crude Oil

Yesterday, we commented the current situation in crude oil in the following way:

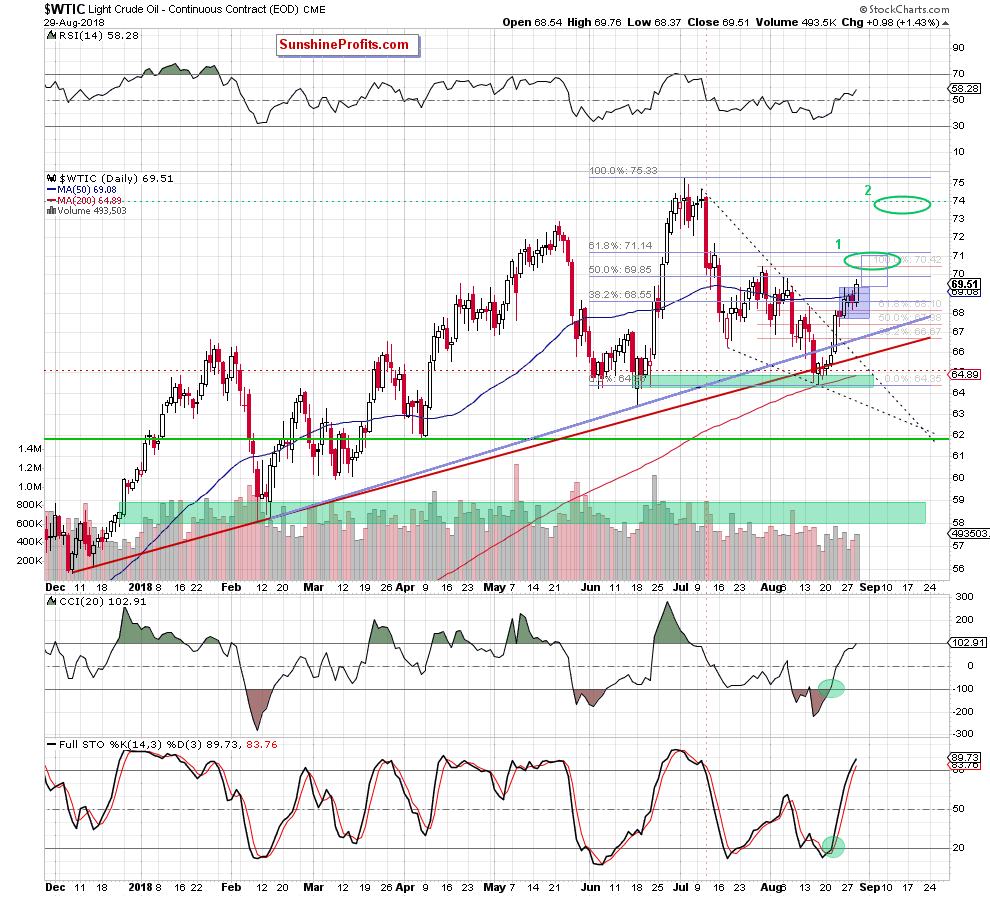

(…) the commodity stuck in the blue consolidation between the previously-broken 61.8% Fibonacci retracement (the third closure above this level in a row, which means that the breakout is confirmed) and the 50-day moving average, which continues to keep gains in check.

However, the buy signals generated by the indicators remain in the cards, supporting oil bulls and another attempt to move higher in the very near future.

From today’s point of view, we see that the situation developed in tune with our assumptions and the price of crude oil increased during yesterday’s session.

Thanks to this upswing, the commodity broke above the upper border of the very short-term blue consolidation, which suggests further improvement and an upward move to around $70.84, where the size of increase will correspond to the height of the above-mentioned consolidation.

If this is the case and we see such price action, light crude will hit our initial upside target (we marked it with the first green ellipse) in the coming day(s). Slightly above it is also the 61.8% Fibonacci retracement, which will be the next target for the buyers.

What’s interesting, in this area is also one more target, which could attract the buyers like a magnet. Let’s take a look at the chart below.

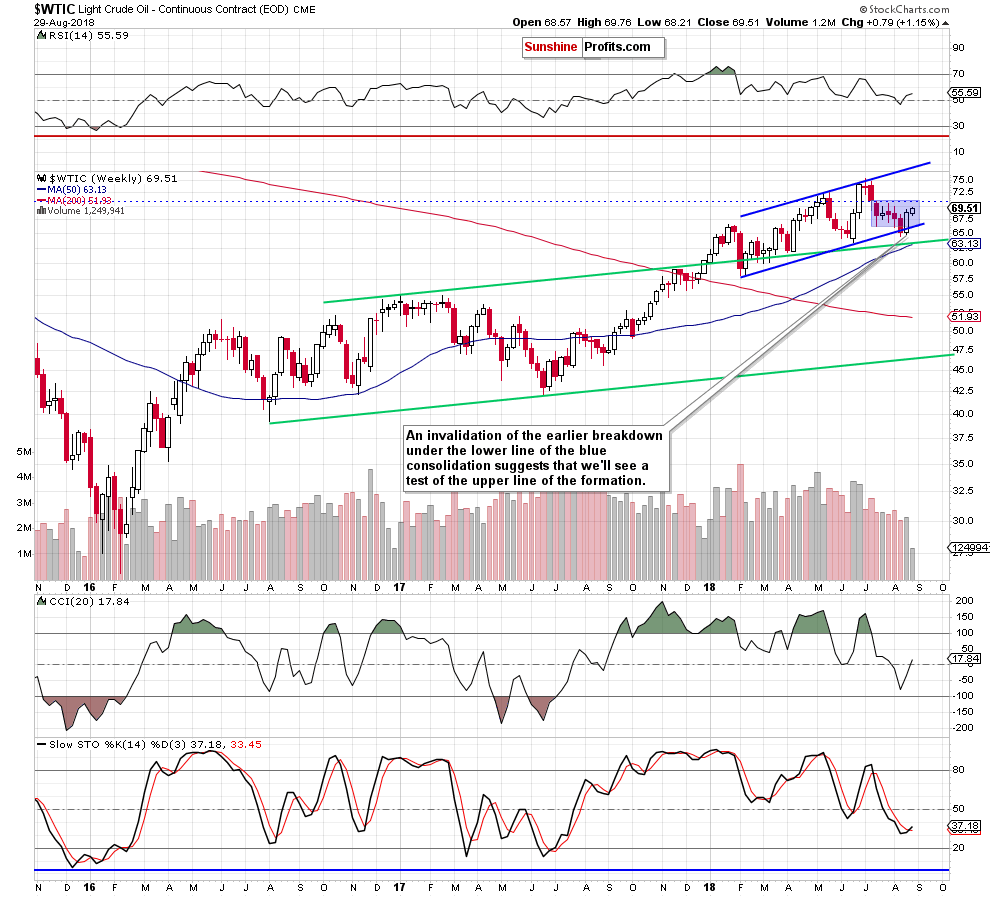

Looking at the medium-term chart, we see that the last week’s invalidation of the earlier breakdown under the lower border of the blue rising trend channel and the lower line of the blue consolidation encouraged oil bulls to act in recent days.

Additionally, the Stochastic Oscillator generated a buy signal, giving the buyers one more reason to act. Taking these facts into account, we think that crude oil could test the upper border of the blue consolidation (around $70.43-$70.87) in the coming week(s).

Finishing today’s alert, please keep in mind what we wrote yesterday:

(…) if this quite solid resistance zone is broken, oil bulls could climb even to around $74, where the price was very often at the turn of June and July (the upper green ellipse seen on the daily chart).

Summing up, long positions continue to be justified as crude oil extended gains and broke above the upper line of the very short-term consolidation. Such price action together with the buy signals generated by the indicators increases the probability that we’ll see further improvement and a climb to our upside target in the very near future.

Trading position (short-term; our opinion): Long positions (with the stop-loss order at $65.10 and the initial upside target at $70.37) are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

On an administrative and personal note, there will be no Alerts posted on Monday as the markets are closed in the U.S. (Labor Day) and as far as Friday (tomorrow) is concerned, there will be no regular Gold & Silver-, Oil-, and Forex Trading Alerts. The note is personal due to the reason behind tomorrow’s changes in our regular publication schedule. Przemyslaw and I are getting married on Saturday and we’ll need more offline time tomorrow for the final preparations. Yet, if something major happens, you’ll still receive a quick message with the details, so while we’re not going to write regular Alerts, we will keep you informed if anything major changes.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts