Trading position (short-term; our opinion): Short positions (with the stop-loss order at $68.15 and the initial downside target at $56.57) are justified from the risk/reward perspective.

On Friday, crude oil broke above two short-term resistances, which opened the way to higher levels. But is it really as wide open as it might seem at first glance?

Let's examine the daily chart and find out (charts courtesy of http://stockcharts.com).

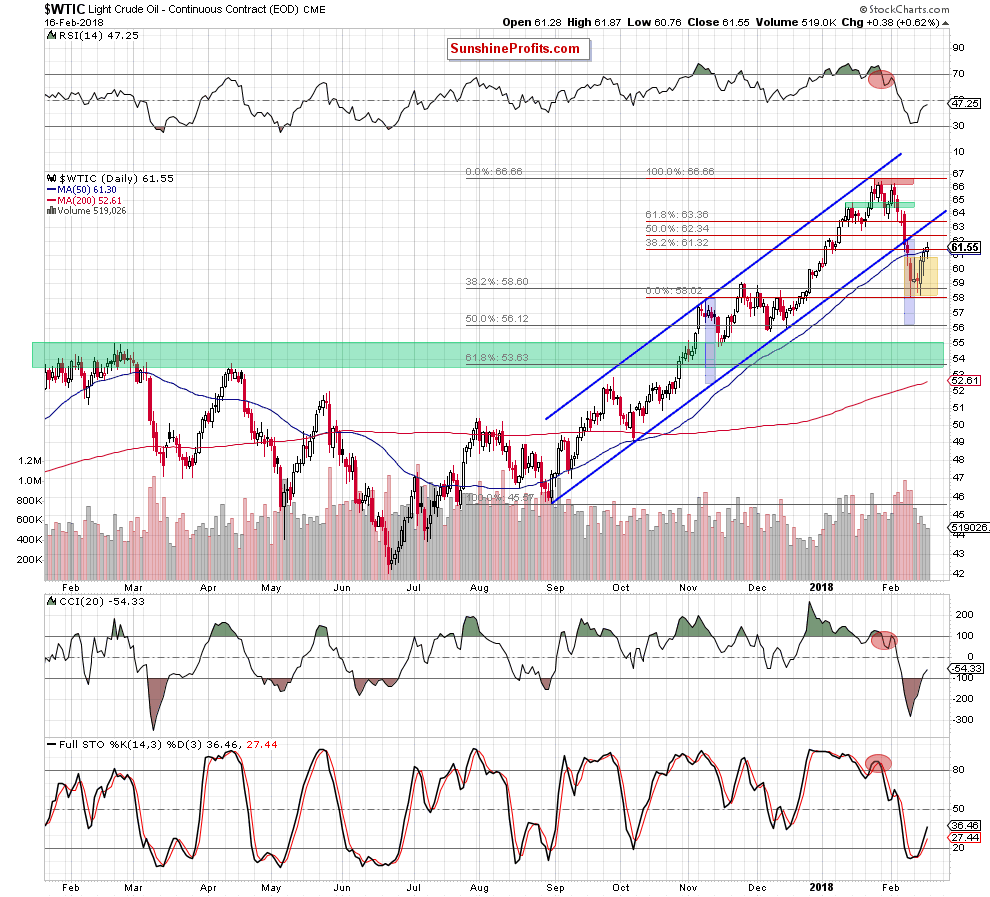

Looking at the daily chart, we see that crude oil broke above the 38.2% Fibonacci retracement and the 50-day moving average on Friday, which opened the way to higher levels.

Nevertheless, when we take a closer look at the chart, we notice that the recent upward move materialized on declining volume. The white bodies of candlesticks became smaller and smaller, which raises some doubts about oil bulls’ strength.

Additionally, black gold remains below the previously-broken lower border of the black rising trend channel, which means that as long as there is no invalidation of the breakdown under this line all upswings will be nothing more than verifications of the earlier breakdown.

Therefore, in our opinion, short positions continue to be justified from the risk/reward perspective. As always, we’ll keep you - our subscribers - informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts