Trading position (short-term; our opinion): Long position in crude oil with target price at $54.48 and stop-loss at $49.87 is justified from the risk/reward perspective.

Although crude oil pulled back a bit during Friday’s session, the commodity closed another week above the previously-broken long-term line. Are there any other positive technical factors on the horizon that will encourage the buyers to fight for higher prices of black gold in the coming week?

Let’s take a closer look at the chart below (charts courtesy of http://stockcharts.com).

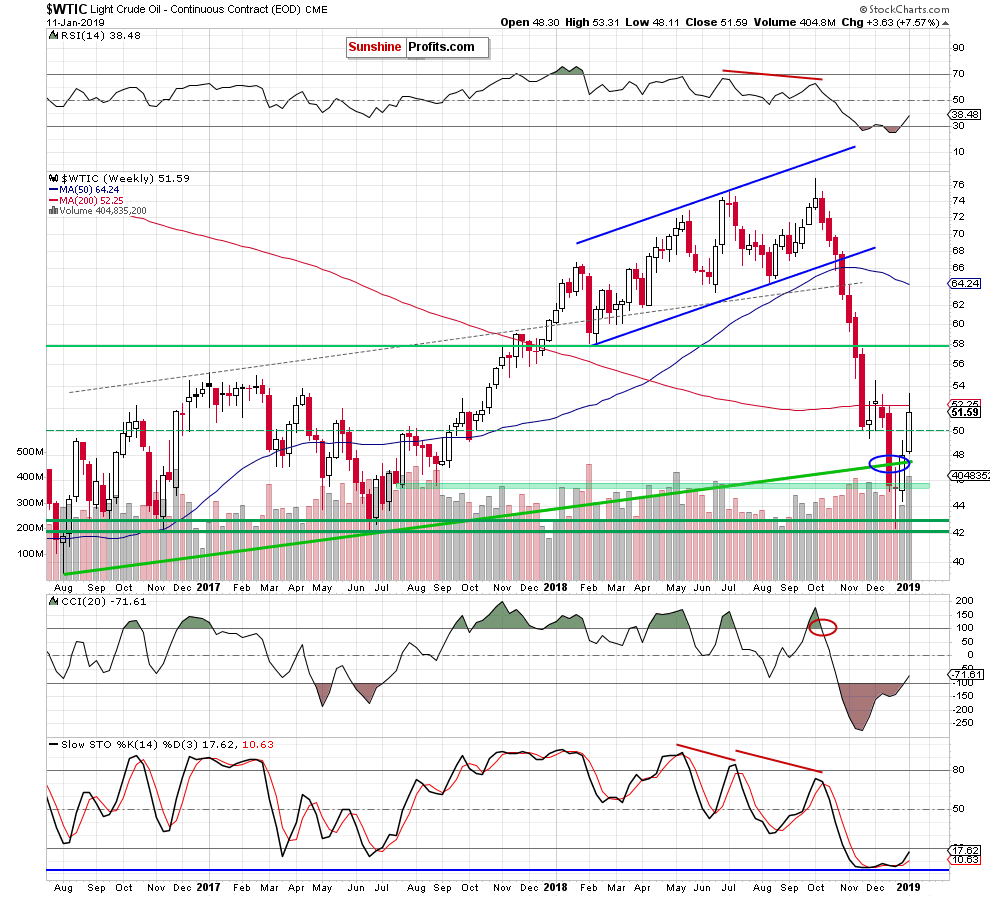

Today’s Oil Trading Alert will be quite short as crude oil increased in the previous week once again, reaching the previously-broken 200-week moving average. Although this resistance triggered a pullback before Friday’s closure, the commodity is still trading well above the previously-broken long-term green line (we saw another weekly closure above this line, which serves now as the nearest support) and the buy signals generated by the RSI, the CCI and the Stochastic Oscillator remain in the cards, supporting oil bulls and another attempt to move higher in the coming week.

Additionally, the volume that accompanied the last week’s increase was significant, which confirms the commitment of the buyers in last week's growth. Taking all the above into account, we continue to believe that the outlook remains bullish and long positions are justified from the risk/reward perspective.

If anything changes, we will keep you - our subscribers - informed.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager