Trading position (short-term; our opinion): Long position in crude oil with target price at $54.48 and stop-loss at $49.87 is justified from the risk/reward perspective.

Crude oil closed Friday’s session above several important resistances, but despite these improvements their rivals took the price of black gold lower earlier today. What could it mean for the commodity?

Let’s take a closer look at the charts below (charts courtesy of http://stockcharts.com).

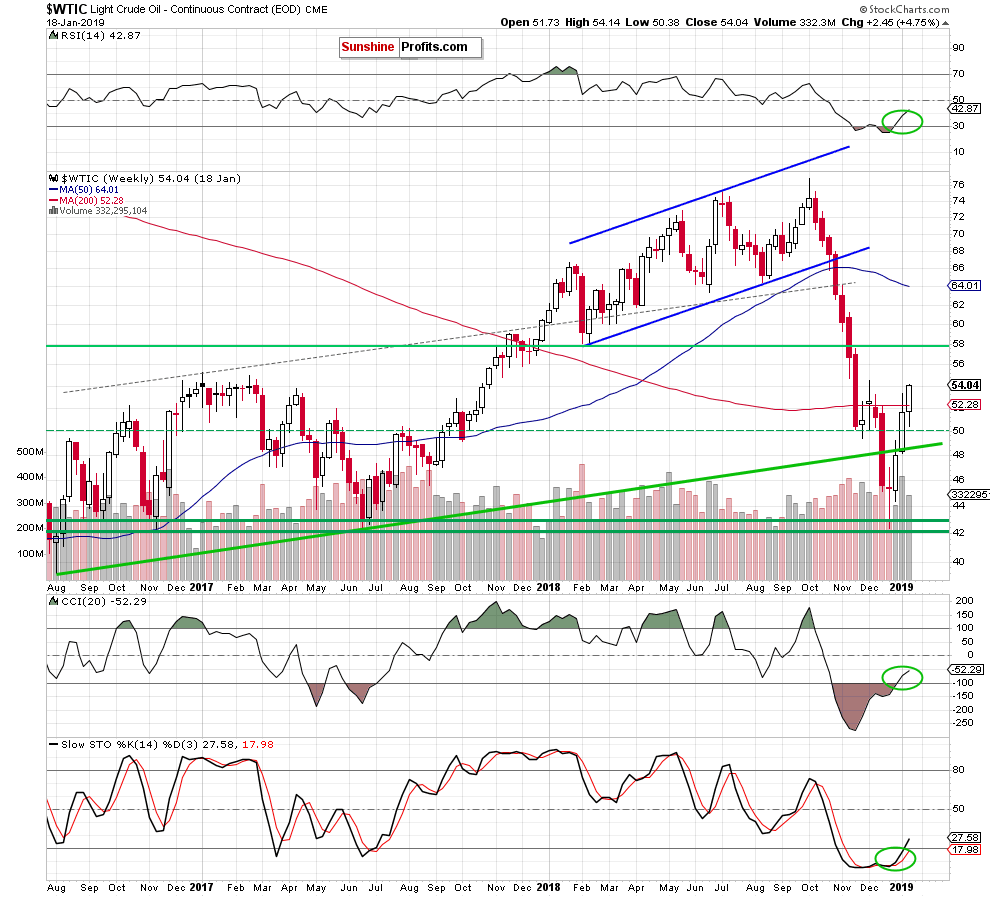

Looking at the medium-term chart, we see that the commodity closed the previous week above the 200-week moving average for the first time since the beginning of December, invalidating the earlier breakdown below it, which is a bullish development. Additionally, the buy signals generated by the indicators remain in the cards, supporting oil bulls and higher prices of light crude.

Nevertheless, despite these positive signs, the volume, which accompanied the last week’s move was smaller than week earlier. This means that fewer oil bulls were involved in shopping, which shaped the last white candle, suggesting a pullback.

How did this price action affect the very short-term chart?

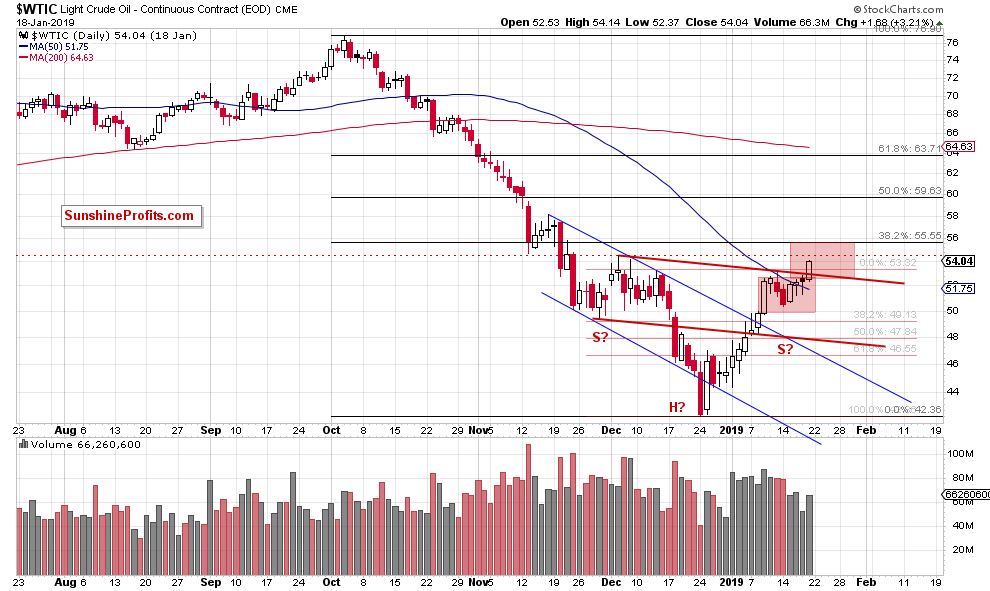

The first thing that catches the eye on the daily chart is a breakout above the red declining resistance line and another daily closure above the 50-day moving average. Additionally, Friday’s volume was higher than day earlier, which is another positive sign.

Despite all these pro-bullish developments, the sellers took control after today’s market open and pushed the commodity lower, which means that if the buyers do not manage to stop them before the session closure, we’ll likely see an invalidation of Friday’s breakouts. If we see such price action, we’ll likely close our long position and consider opening short positions. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): Long position in crude oil with target price at $54.48 and stop-loss at $47.96 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager