Trading position (short-term; our opinion): Short positions (with the stop-loss order at $68.15 and the initial downside target at $56.57) are justified from the risk/reward perspective.

Although oil bulls managed to take the price of crude oil above $62 yesterday, this what happened in the following hours showed quite clearly that not everything went just like they assumed earlier.

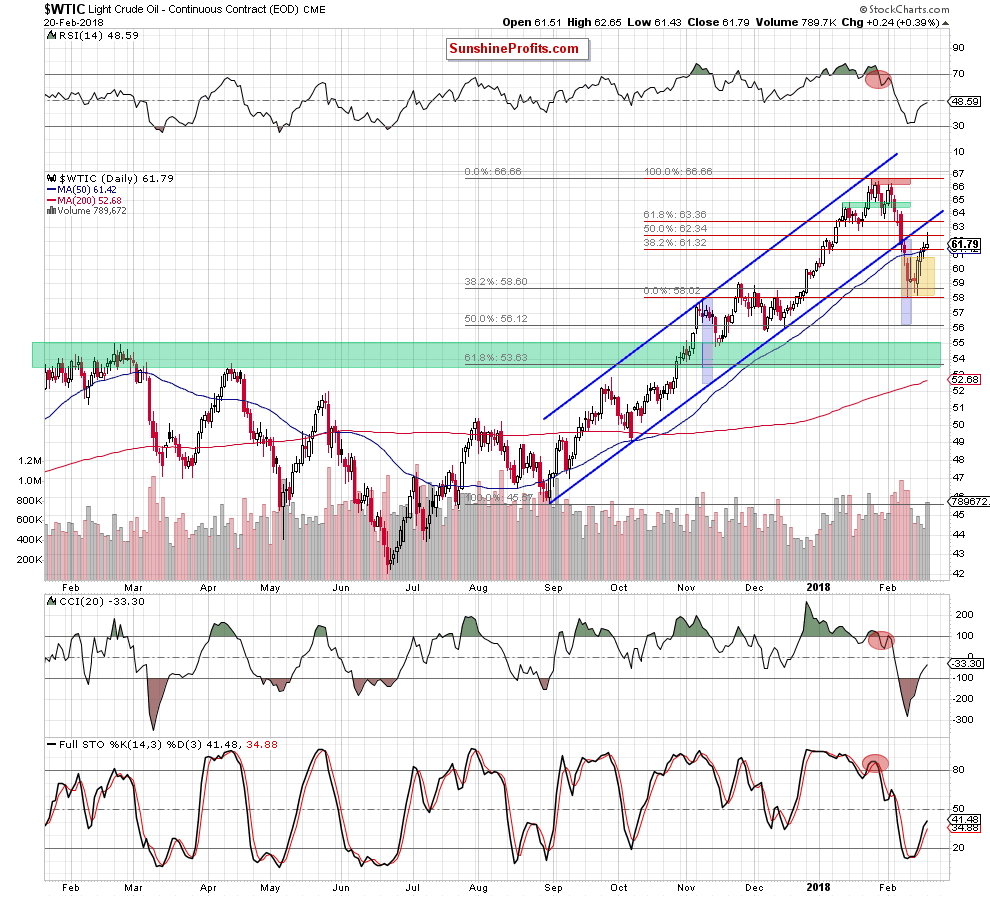

Let's examine the daily chart (charts courtesy of http://stockcharts.com).

From today’s point of view, we see that although crude oil extended gains after yesterday’s market open and climbed above the 50% Fibonacci retracement, oil bulls didn’t manage to hold gained levels, which resulted in a reversal and a quite sharp decline.

Thanks to this drop, the commodity created another white candle with a smaller body, which somewhat undermines the credibility of the indicators and the buy signals generated by them in previous days. On one hand, they suggest further improvement, but on the other hand smaller bodies shows that oil bulls’ strength decreases from session to session.

This assumption is also confirmed by yesterday's volume. As you see it increased significantly, but in our opinion, mainly because of yesterday's decline after the climb to an intraday high.

Additionally, yesterday’s candlestick looks like a shooting star (a negative formation), which gives oil bears one more reason to act in the coming days. Nevertheless, we think that another move to the downside will be more likely after the release of crude oil and its products inventories reports.

Finishing today’s alert please keep in mind that black gold remains below the previously-broken lower border of the black rising trend channel, which means that as long as there is no invalidation of the breakdown under this line all upswings will be nothing more than verifications of the earlier breakdown.

Therefore, in our opinion, short positions continue to be justified from the risk/reward perspective. As always, we’ll keep you - our subscribers - informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts