Trading position (short-term; our opinion): Short position with a stop-loss order at $60.22 and the initial downside target at $50.38 in crude oil is justified from the risk/reward perspective.

Yesterday was the first down day this week in crude. Can we expect yet a new attempt to move higher? If so, then what are its chances of success? They say the brightest flame burns quickest. It’s about the path, the sequence of movements and their grand logic and probability. What is the near future likely to bring to the crude oil trading floor?

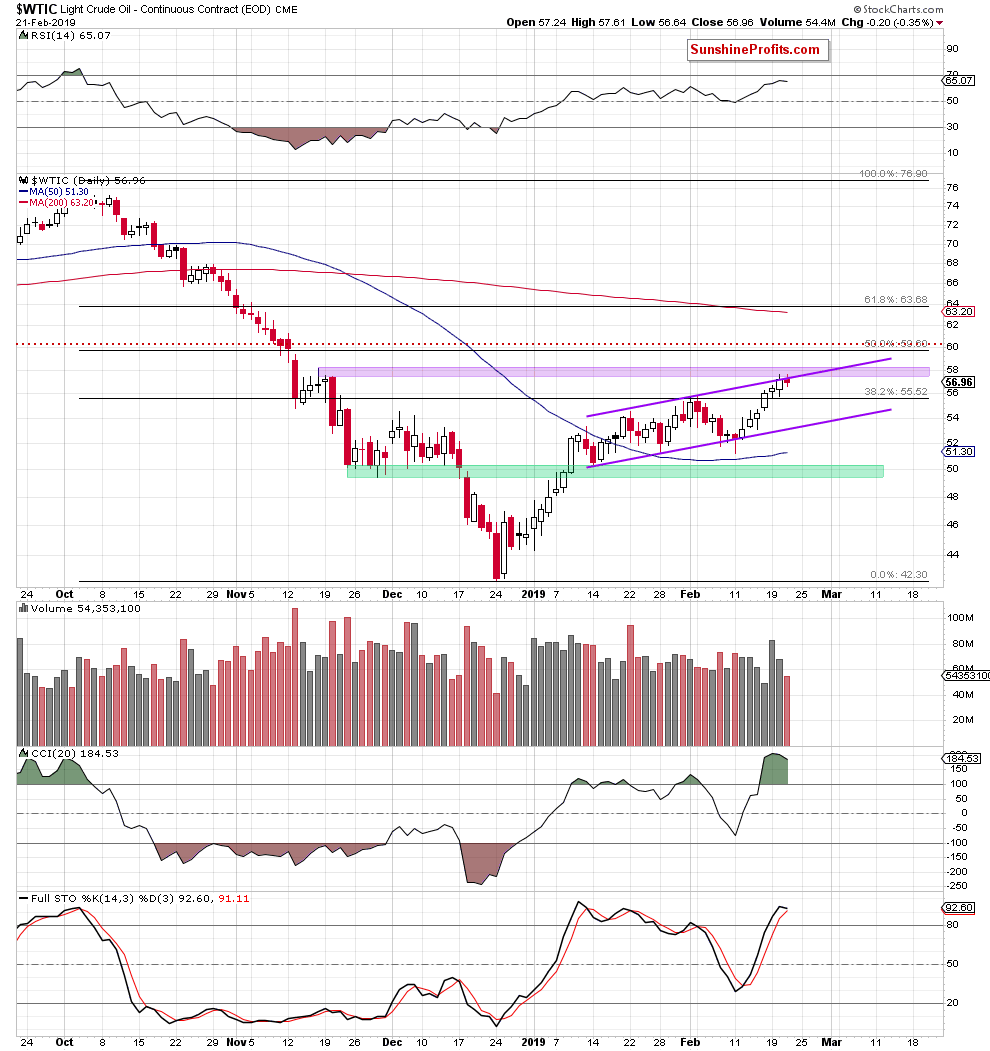

Let’s examine the chart below (chart courtesy of http://stockcharts.com).

Although oil bulls tried to go higher yesterday, their feeble gains quickly evaporated. Black gold slipped back below the previously broken upper border of the purple rising trend channel, invalidating the earlier tiny breakout for the second day in a row.

Taking all these into account, we believe that absent a proof to the contrary, our yesterday’s observations remains relevant also today:

(….) crude oil ventured a bit above the upper border of the purple rising trend channel only to close the day right on that upper purple line.

(…) Additionally, black gold moved to the purple resistance zone based on mid-November peaks, and the CCI and Stochastics are in their overbought areas. These factors suggest that the space for gains is limited and reversal in the coming day(s) remains very likely.

If that’s the case, the first downside target would be the lower border of the purple rising trend channel (currently at around $53.20).

Earlier today, crude oil has been making headway and currently trades at around $57.70. This is still deep inside the purple resistance zone and within expectation of what a breakout attempt looks like. It’s the daily indicators and their positions that are the important points here. Namely, the limited room for further gains they offer despite today’s move. Time indeed doesn’t look to be on bulls’ side.

Trading position (short-term; our opinion): Short position with a stop-loss order at $60.22 and the initial downside target at $50.38 in crude oil is justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist