Trading position (short-term; our opinion): No position in crude oil is justified from the risk/reward perspective. In other words, we are closing our long position and taking profits off the table

Connecting the 2018 bottom and the lowest intraday price of 2019 created a steep support line alongside which the crude oil has been rising steadily so far. But then the previous week changed it all when the price of black gold failed to move higher. Despite some intraday strength, crude oil ended the previous week in the red. The momentum was lost. Some will say that it’s just a pause and the uptrend will be resumed shortly, but will they be right?

Let’s examine the charts below to find out (charts courtesy of http://stockcharts.com).

In our Oil Trading Alert posted on January 24, 2019 we wrote the following:

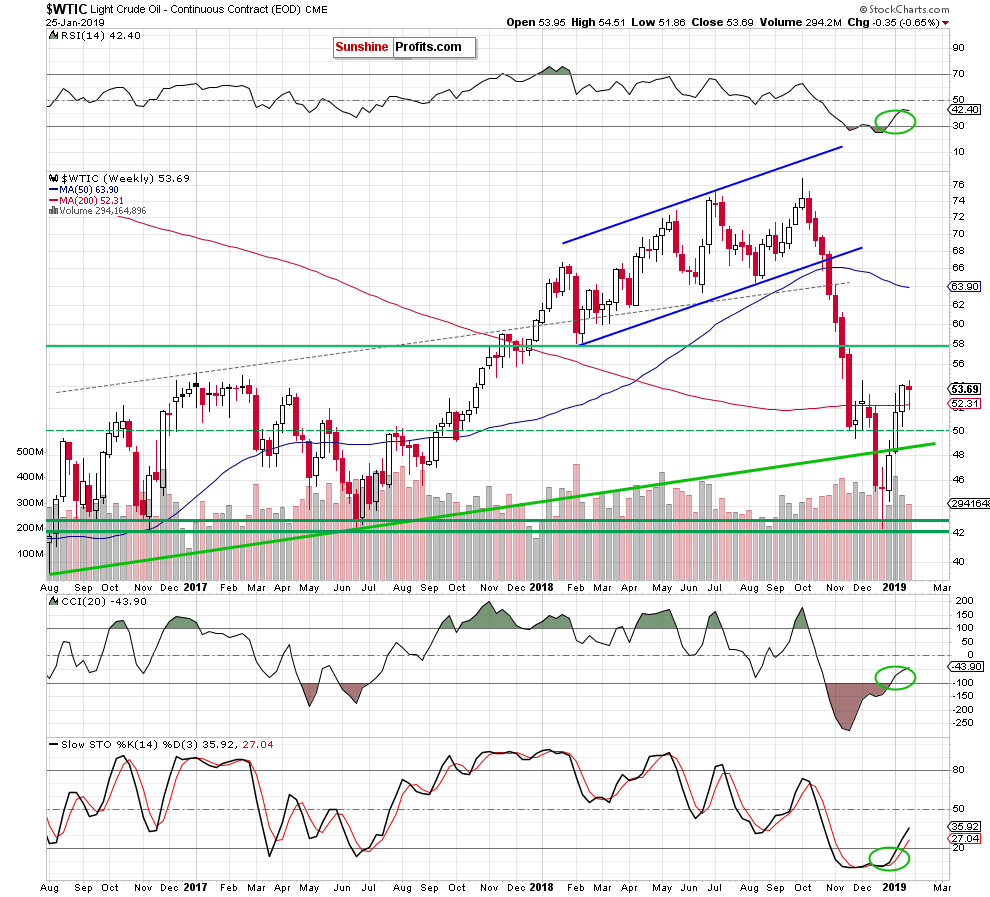

(…) crude oil is still trading above the 200-week moving average and the buy signals generated by the indicators remain in the cards, supporting oil bulls and higher prices of black gold in the coming weeks.

Crude oil price closed Friday's session on an encouragingly high note, though the long lower knot and candlestick formation warrants caution as it presages a likely short-term deterioration.

Can we learn more by looking at the daily chart?

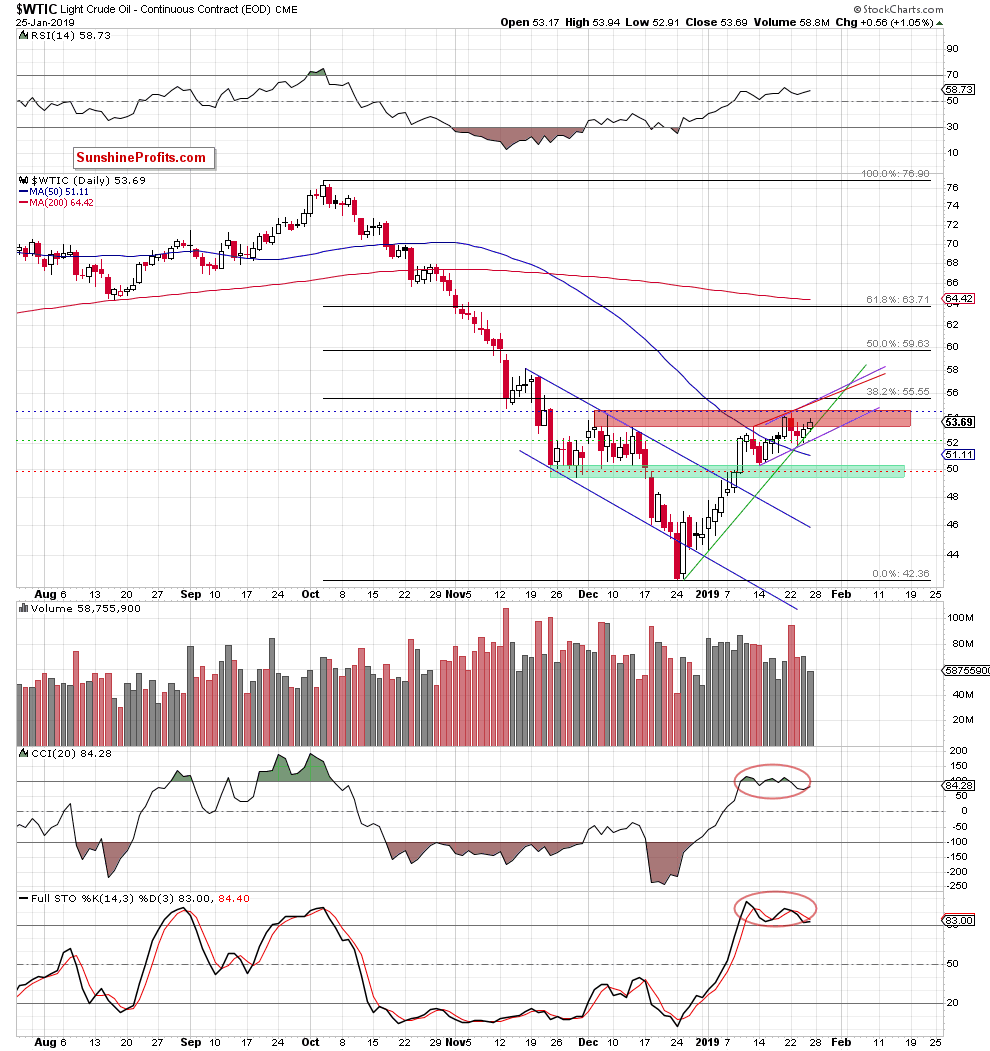

Friday's price action looks indeed strong on the surface. Taking a look under the hood, lower volume is a cautionary sign. Weakening volume in an uptrend that suggests exhaustion of buyers and we see that when examining the three spurts higher from the late December 2018 lows. And let's not forget the red resistance zone that stopped the buyers around a week ago.

In the introduction paragraph, we mentioned the steep green support line and the lower border of the purple short-term channel – while they both remain intact after Friday close, the daily indicators are not looking super strong even though we have seen similar meandering of theirs in mid-January 2019 already.

What can we make out of this?

When in doubt, stay out. When there are both: good bullish (the commodity remains above the green support line based on the December and early-January lows, the 200-week and 50-day moving averages and the very short-term purple support line based on the previous January lows) and bearish (Friday’s upswing materialized on smaller volume, sell signals generated by the daily indicators remain in play, the red resistance zone created by the December peaks continue to keep gains in check) arguments, it is better to give priority to capital protection and wait for other opportunities.

Therefore, we decided to close our long positions and take profits off the table (as a reminder, we had opened them when crude oil was trading at about $51.80). The decision was vindicated as crude oil price has been heading lower in Monday's trading and is currently at $52.75.

If we see any reliable signs of the bulls’ or the bears’ strength (for example, a breakout above the 38.2% Fibonacci retracement or a daily closure under the lower border of the purple rising trend channel) we’ll consider opening next position. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No position in crude oil is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager