Trading position (short-term; our opinion): None positions are justified from the risk/reward perspective.

The first sessions of the new month were unfortunately not too favorable for oil bulls. Thanks to the determination of their opponents, the price of black gold fell below $ 65, the mid-August low and even under the minimum from June. Will this negative combination of factors be enough for the bears to dominate on the trading floor in the coming week?

Let’s take a look at the charts below (charts courtesy of http://stockcharts.com).

The broader pictures of crude oil (both weekly and monthly) continues to favor oil bears and lower prices of black gold (you could read more about his issue in our Friday’s alert). Nevertheless, in today’s Oil Trading Alert, we decided to focus only on the short-term perspective. Why? Let’s examine daily chart to find out.

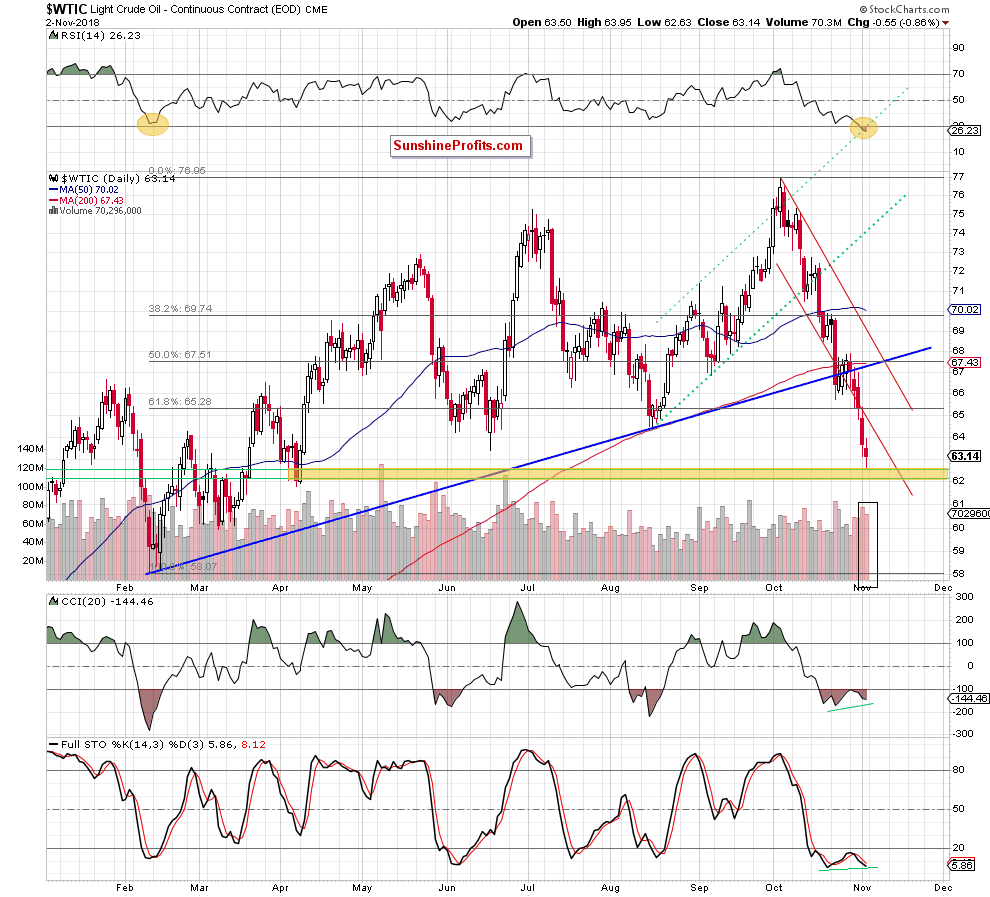

Looking at the daily chart, we see that crude oil extended losses during Friday’s session, which resulted in a third closure in a row under the lower border of the very short-term red declining trend channel.

Although this is a negative development, there are several technical factors that could encourage oil bulls to fight in the very near future.

First, the commodity slipped to the yellow support area created by the 76.4% and 78.6% Fibonacci retracements and the April lows.

Second, the RSI slipped to its lowest level since early February (we marked both cases with the yellow ellipses). Back then, even a bit higher reading of the indicator (around 31) preceded a very important reversal, which triggered a bigger move to the upside in the following weeks.

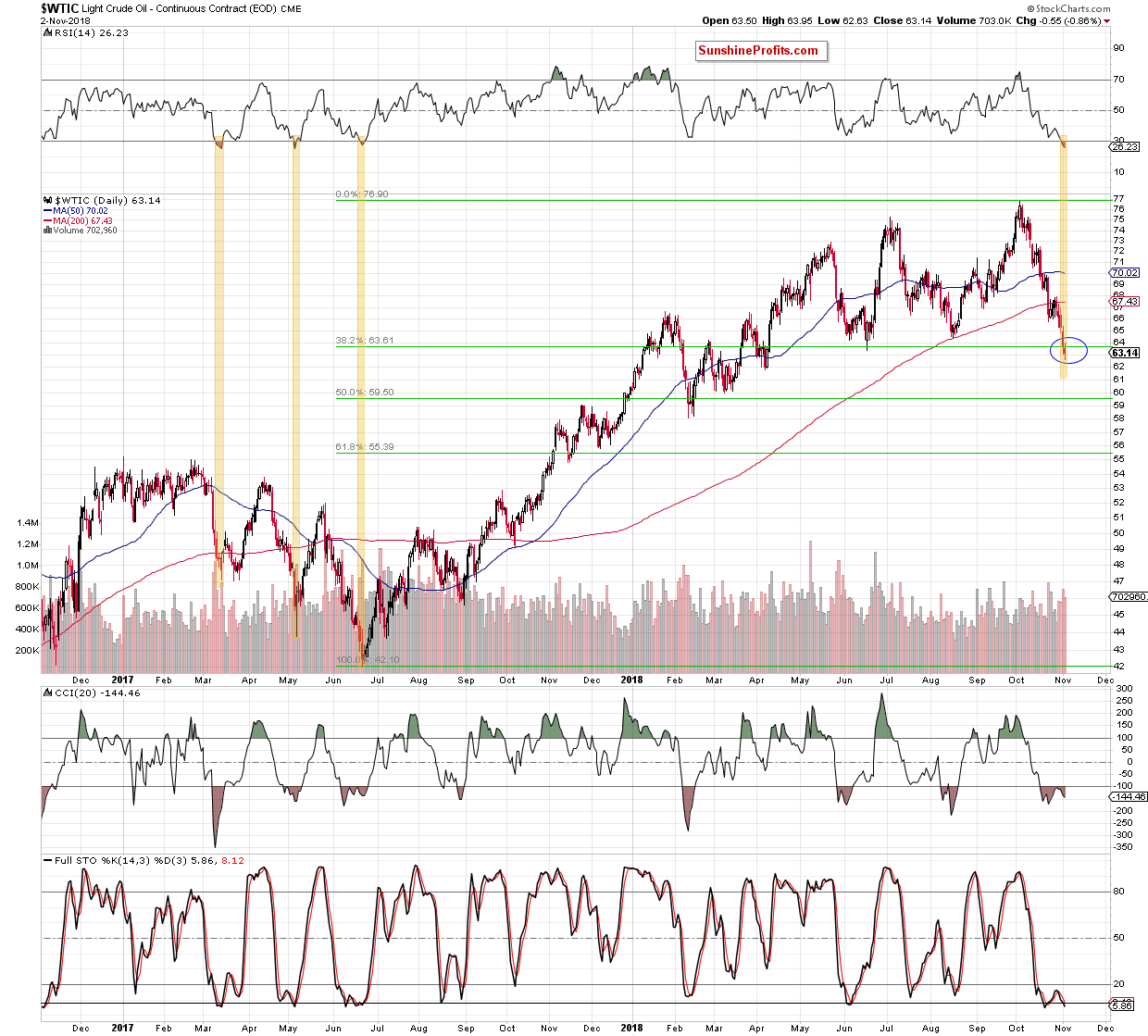

At this point it is also worth noting that since the beginning of 2017 the RSI slipped under the level of 30 only 3 times. What were the consequences? Look at the chart below and see for yourself.

From this perspective, we see that in all previous cases similar drops below 30 also preceded reversals and bigger upward moves in the following days, which increases the probability that history will repeat itself once again in the very near future.

Third, there are bullish divergences between the CCI, the Stochastic Oscillator and the price of black gold, which will likely translate into buy signals later this week.

Fourth, Friday’s decline materialized on smaller volume, which aroused our vigilance. Why? Because another profitable opportunity can be just around the corner – especially when we factor in all other factors described in today's alert.

Fifth (last but not less important), thanks to Friday’s drop, the commodity slipped slightly below the 38.2% Fibonacci retracement based on the entire June 2017 – October 2018 upward move (we marked it with the blue ellipse on the second chart). Such price action suggests that as long as there is no confirmation of the breakdown, a rebound from here is very likely.

At this point, it is worth noting that the price of light crude tested this retracement for the first time since late August 2017. In other words, all previous corrections were shallower (in several cases, the price didn’t even approach this retracement), which shows that oil bulls fell somewhat from strength after months of increases.

What could it mean for black gold?

In our opinion, a bigger move to the downside, which is in line with the broader picture of the commodity. Nevertheless, we think that before we see such price action a bigger rebound from current levels and a climb to: the previously-broken lower line of the blue rising trend channel marked on the weekly chart in our Friday’s alert (around $67), to the 38.2% Fibonacci retracement based on the entire October – November downward move (around $68) or even a test of the strength of lower border of the green rising wedge (around $69.60) is more likely that another sharp move to the south.

Connecting the dots, we will continue to monitor the market in the coming days and if we see a confirmation/invalidation of the above, we’ll consider opening positions. As always, we’ll keep you - our subscribers - informed should anything change.

Trading position (short-term; our opinion): At the moment of publishing this alert none positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts