Trading position (short-term; our opinion): Short position with a stop-loss order at $58.37 and the initial (!) downside target at $50.38 in crude oil is justified from the risk/reward perspective.

The bears won the day yesterday. Their gains were much larger, but still, they won. The bulls are taking serious revenge today. Does the current move translate into a change in outlook and what should we do in light of it anyway?

Let’s examine the charts below (charts courtesy of http://stockcharts.com).

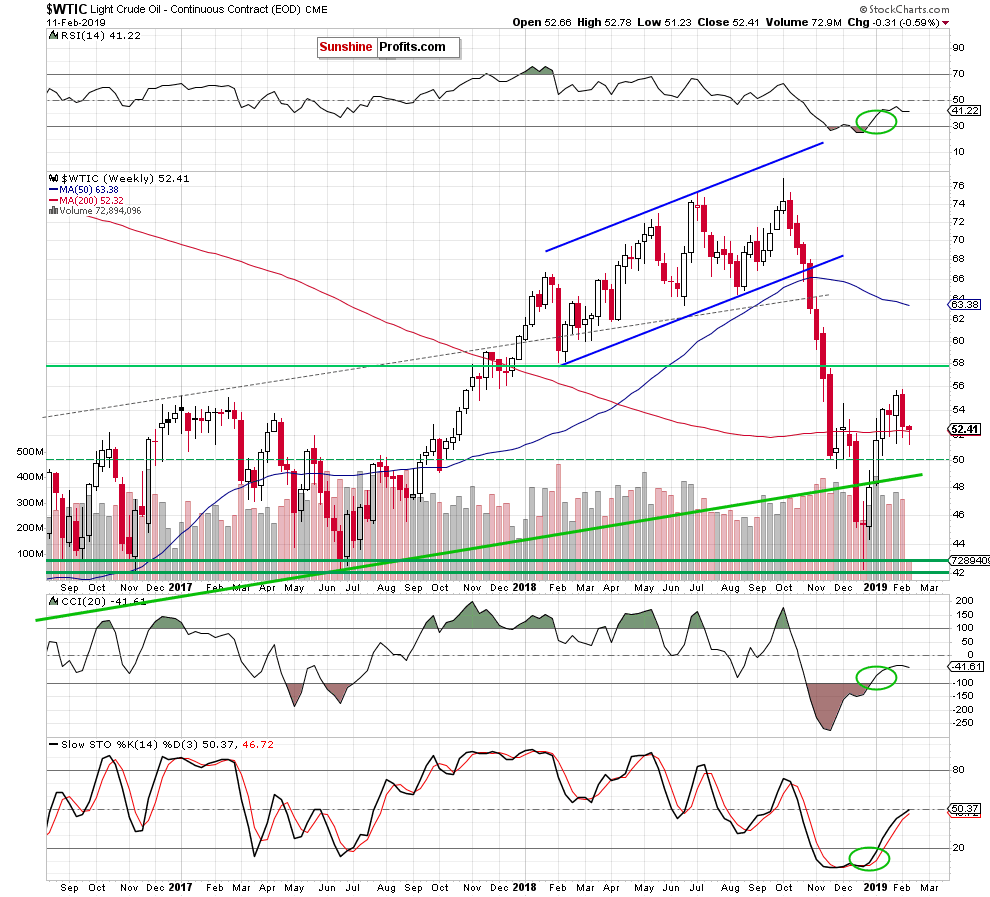

Starting with the weekly one, we see that the 200-week moving average has so far provided some interim support to the bulls. The weekly indicators are however still curling in a bearish way.

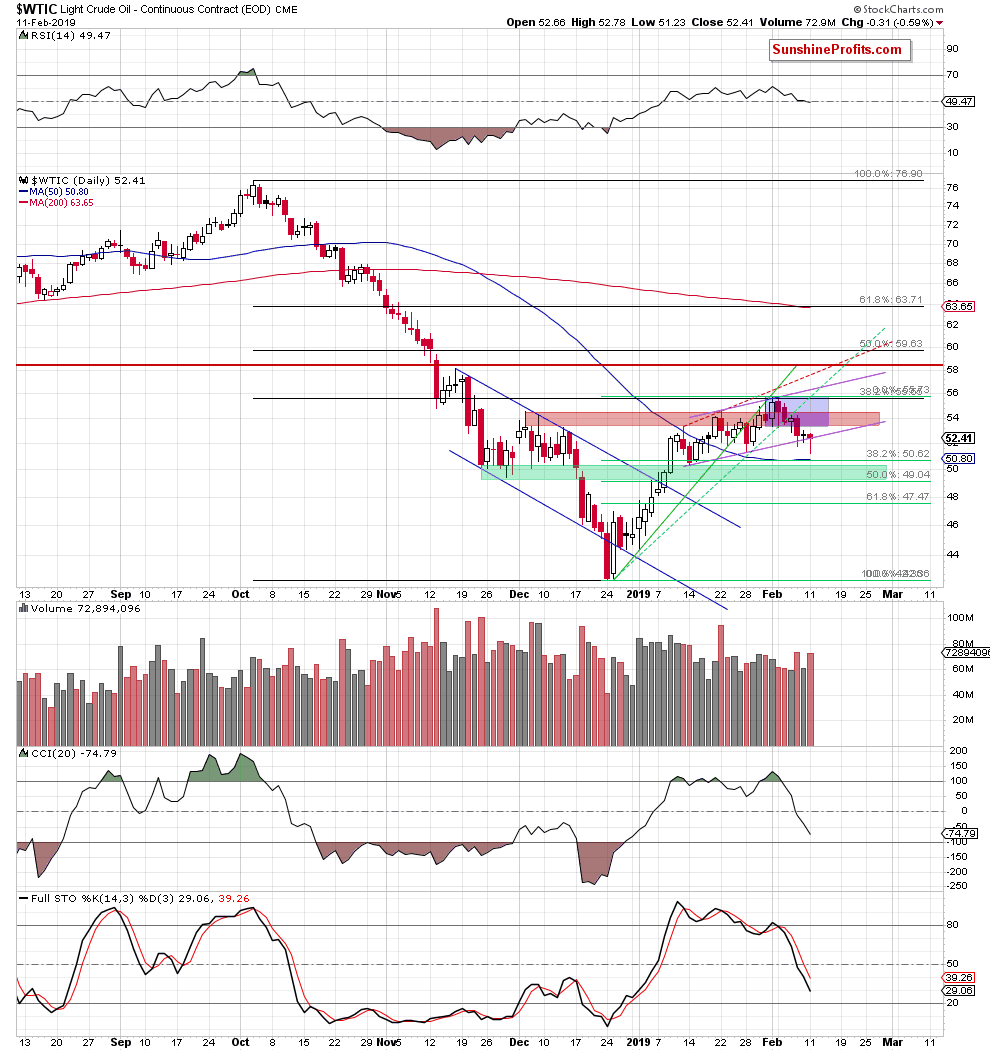

Yesterday, oil bears took the price of black gold lower after the market’s open, which resulted in a breakdown below the lower border of the purple rising trend channel. This development was short-lived as the proximity to the 200-week moving average (on the weekly chart) and to the 50-day moving average (on the daily chart) encouraged the buyers to act.

As a result, black gold rebounded and closed the day slightly above the lower line of the purple channel, invalidating the earlier intraday breakdown. This could translate into further improvement in the very near future. And indeed – oil has been recovering in today’s trading (it’s around $53.80 at the moment of writing these words) and is currently testing the red resistance zone.

Nevertheless, as long as the price of light crude is trading (on a closing basis and absent other clues) below the previously broken lower border of the blue consolidation and the red resistance zone, all upswings could be nothing more than a verification of the earlier breakdowns. Additionally, the sell signals generated by the daily indicators and the bearish engulfing pattern formation about which we wrote yesterday, continue to support the sellers. Another attempt to move lower in the following days (even if we see first an upswing resulting in verification of the breakdowns) is still favored by the odds.

Summing up, the already profitable short position continues to be justified from the risk/reward perspective as crude oil is currently still trading below the major short-term resistances on a closing basis and the sell signals generated by the indicators continue to support the sellers and another downswing in the near future.

Trading position (short-term; our opinion): Short position with a stop-loss order at $58.37 and the initial (!) downside target at $50.38 in crude oil is justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.