Trading position (short-term; our opinion): Short position with a stop-loss order at $58.37 and the initial (!) downside target at $50.38 in crude oil is justified from the risk/reward perspective.

On Thursday, oil price looked like it’s breaking down, only to reverse the very next day and make a 2019 closing high. Let’s examine the implications for us and draw the right conclusions – are the implications bullish or bearish?

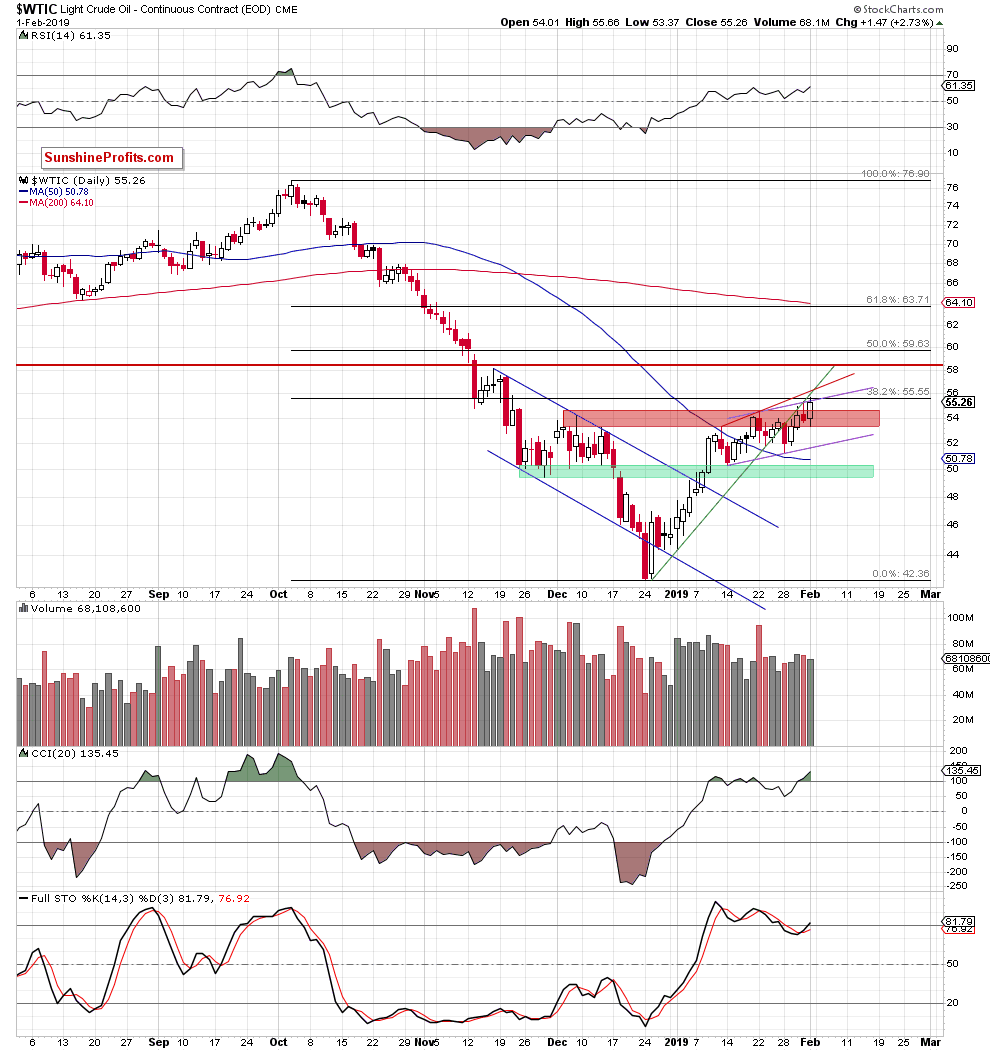

Let’s examine the charts below to find out (charts courtesy of http://stockcharts.com).

On Friday, the black gold price increased and closed the day above the December peak. It looks like a bullish development. Unfortunately for the bulls, only at first sight.

Should oil bears be worried? In our opinion, no. There are many reasons why not. Despite the upswing, oil finished the day still below the upper border of the rising purple trend channel and also below the rising green line based on December and January lows. We wrote already that the breakdown below the green line has been fully confirmed and Friday’s price action looks like yet another verification of the earlier breakdown. The high probability of oil price decline in the next days remains intact.

Additionally, the volume accompanying Friday’s upside move was smaller than the volume marking Thursday’s decline. More importantly, the volume of the upswing since the start of 2019 has been much stronger than the volume of the modest, zigzag-shaped upswing in the second half of January 2019. Both of these hint at bulls’ weakness.

On top of that, although oil bulls took light crude above the 38.2% Fibonacci retracement, this move is barely visible from today’s point of view and anyway it was shortly invalidated. This means yet another breakout invalidation - of the 38.2 Fibonacci retracement and of the previously mentioned upper border of the purple trend channel.

Taking the above into account, the odds favor the move to the downside and short position is justified from the risk/reward perspective. At a minimum, we are likely to see a drop to the lower border of the purple rising trend channel in the very near future. If this support doesn’t hold, the next downside targets would be the 50-day moving average (currently at around $50.78) and the green support zone around the $50 mark.

Trading position (short-term; our opinion): Short position with a stop-loss order at $58.37 (we decided to move it a bit higher) and the initial (!) downside target at $50.38 in crude oil is justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.