Trading position (short-term; our opinion): Half of the short position (with the stop-loss order at $77.23 and the next downside target at $69.20) is justified from the risk/reward perspective.

Although oil bulls took black gold higher during Friday’s session, their opponents showed quite quickly that they would not let them to take away the chance to form a pro-bearish candlestick formation and erased almost half of the earlier rebound. What’s next for the price of the commodity?

Let’s take a look at the charts below (charts courtesy of http://stockcharts.com).

In our Thursday's commentary on black gold, we wrote the following:

(…) In our opinion, if the bears manage to extend (…) decline, we’ll see a drop to the next support area (marked with the purple ellipse) (…) created by the upper line of the black dotted triangle, the 50% Fibonacci retracement and the lower border of the green rising trend channel.

On Friday, we added:

(…) we see that oil bears realized the above-mentioned plan very quickly (…), which confirms their strength (…). Nevertheless, we should keep in mind that the above-mentioned zone is based on strong supports, which can result in a rebound later in the day (…).

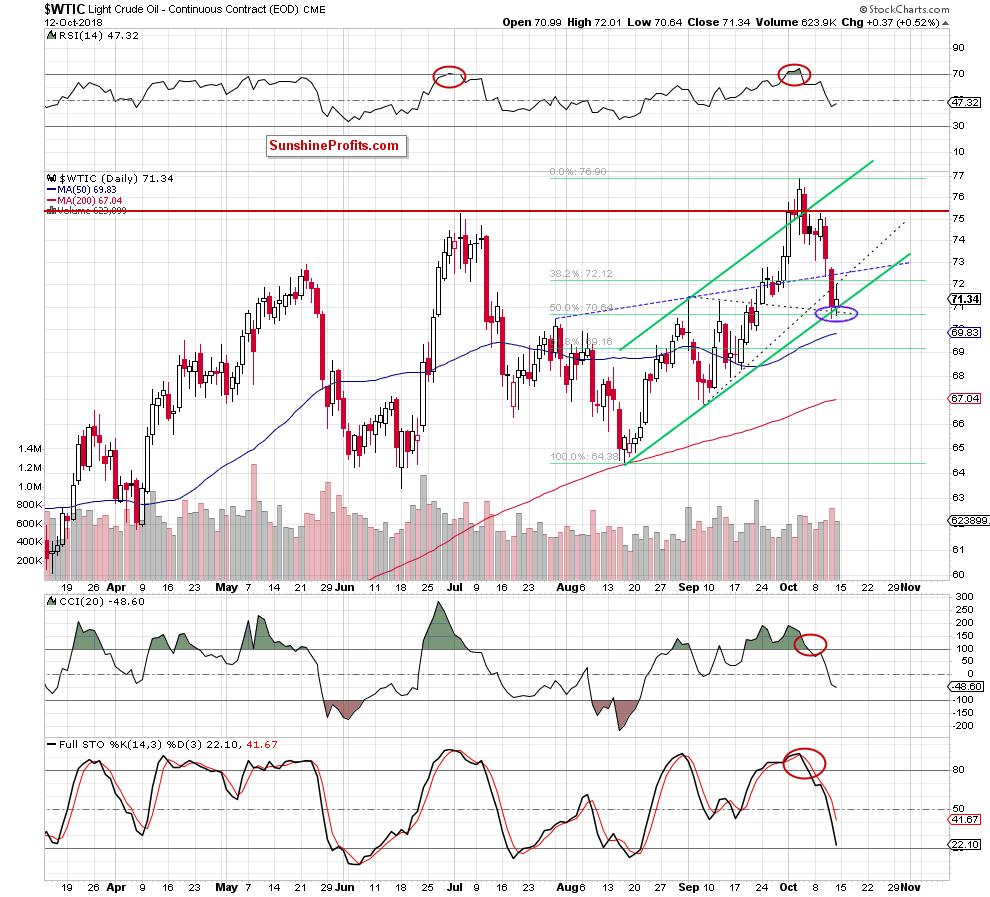

Looking at the daily chart, we see that crude oil moved lower after Friday’s market open and re-tested the strength of the mentioned supports. Despite this deterioration, oil bulls regained control and pushed the price of the commodity higher in the following hours – just as we had expected.

Thanks to their “attack”, light crude climbed to $72, which resulted in another test – a test of the previously-broken lower border of the black dotted triangle. However, as it turned out quite quickly, this improvement was very temporary and crude oil pulled back, erasing almost half of the entire Friday’s rebound.

Such price action looks like a verification of the earlier breakdown under the triangle and shows that oil bulls are weaker than their opponents (despite the fact that light crude gained 0.52% at the end of the last session of the previous week), which can translate into another downswing in the very near future – maybe even later in the day.

This scenario is also reinforced by the sell signals generated by the daily indicators and Friday’s volume. Why? In spite of the Friday increase, the buyers' engagement was smaller than the bear's engagement during the Thursday's decline, which raises doubts about their strength to generate another bigger move to the north.

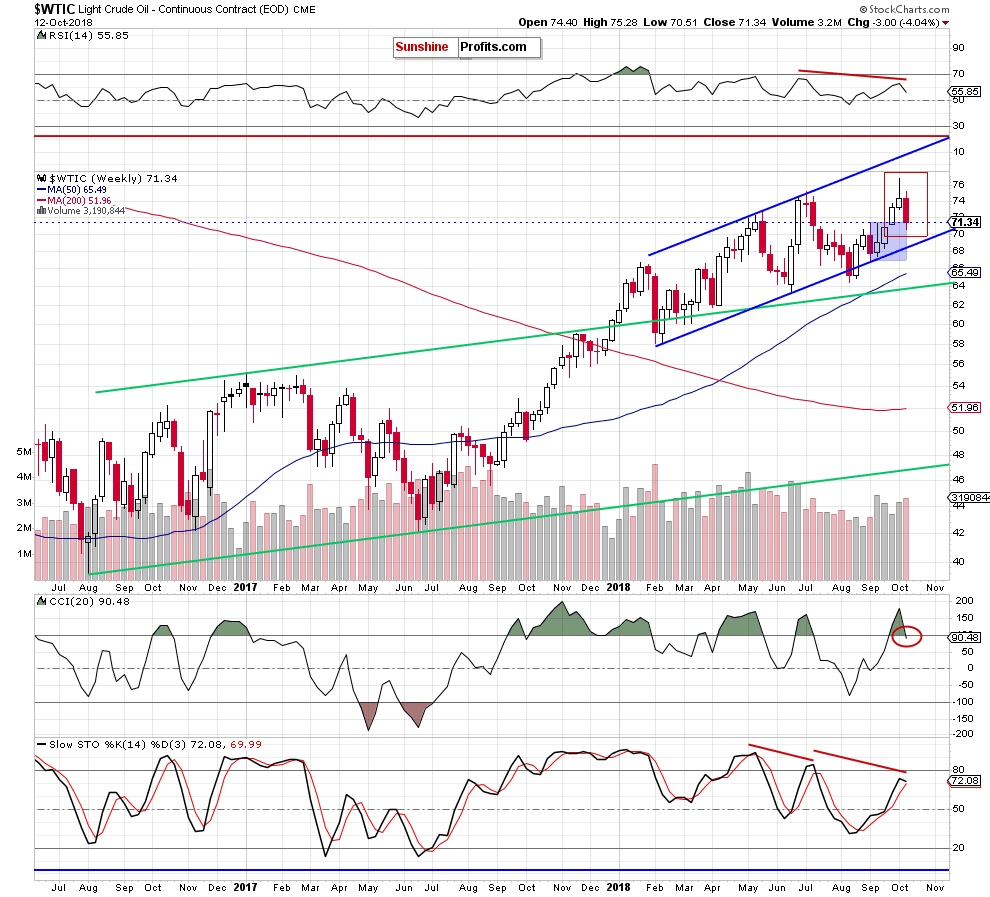

Additionally, thanks to the last week’s price action, market participants created the pro-declining candlestick formation on the weekly chart. Let’s take a look below.

From this perspective, we see that although crude oil rebounded slightly on Friday, the evening star has become a pro-bearish fact, giving the sellers one more reason to act (as a reminder, more about this pattern we wrote in our last Oil Trading Alert, therefore, if you haven’t had the chance to read it, we encourage you to do so today).

On top of that, the last week’s drop materialized on bigger volume (compared to what we saw during the time when the previous two white candles were created), which increases the probability that black gold will head south in the coming days – especially when we factor in the quote from our Friday’s alert:

(…) Looking at the current position of the weekly indicators, we think that the pro-declining scenario remains in the cards. Why? First, the CCI generated a sell signal. Second, there are clearly visible negative divergences between the RSI, the Stochastic Oscillator and the price of the commodity. (…), a similar situation in the Stochastic Oscillator took place when the May and July peaks were formed. Back then, bearish divergences preceded a bigger move to the downside, which resulted in a test of the lower border of the blue rising trend channel. Therefore, if the history repeats itself once again, we can see further deterioration in the coming week(s).

Nevertheless, in our opinion, another bigger decline will be more likely and reliable if the price of the commodity drops below the lower border of the green rising trend channel and the 50% Fibonacci retracement.

If we see such price action, we’ll probably significantly increase short positions. As always, we’ll keep you - our subscribers - informed should anything change.

Trading position (short-term; our opinion): Half of the short position (with the stop-loss order at $77.23 and the next downside target at $69.20) is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts