Trading position (short-term; our opinion): Profitable short positions with a stop-loss order at $71.34 and the next downside target at $66 are justified from the risk/reward perspective.

Thursday’s session brought another comeback above the previously-broken Fibonacci retracement, suggesting that the bulls could strengthen after recent declines. Do they really have enough arguments on their side to win higher prices of black gold?

Let’s examine the charts below to find out (charts courtesy of http://stockcharts.com).

Technical Picture of Crude Oil

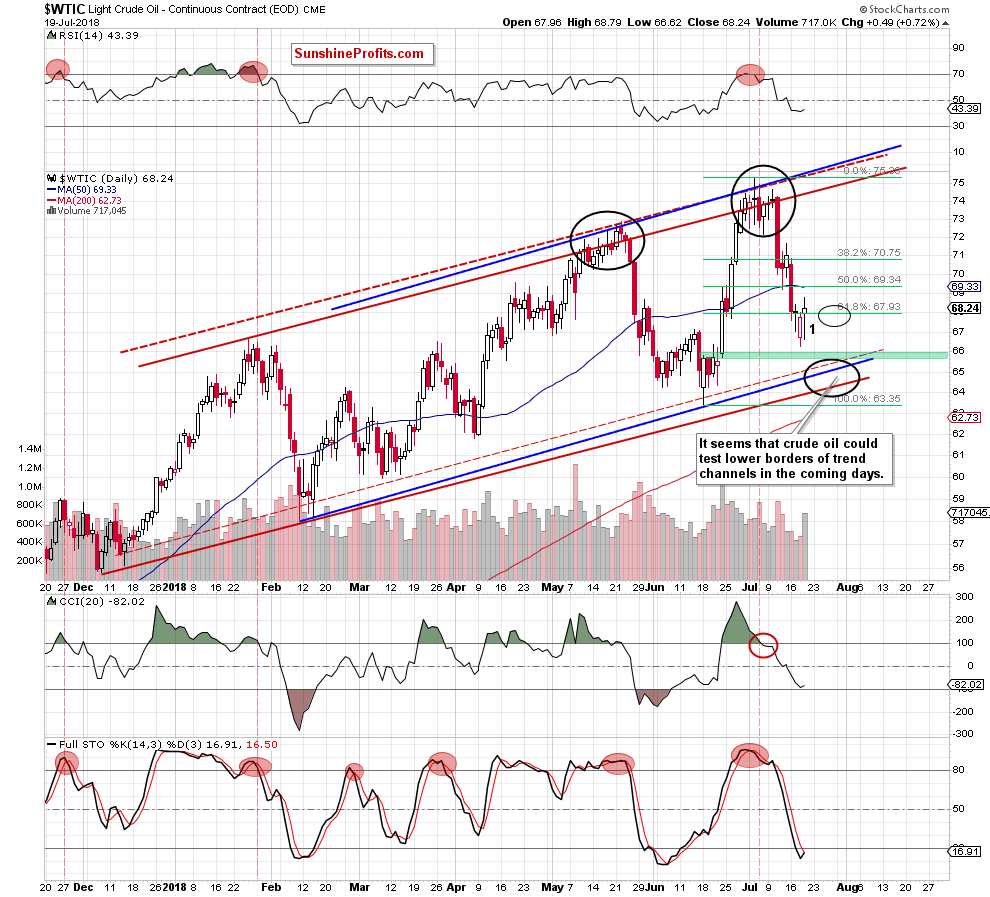

On the daily chart, we see that black gold declined after the market’s open, but the buyers bounced off sessions’ lows - similarly to what we saw in recent days. Thanks to their action, the price of light crude came back above the previously-broken 61.8% Fibonacci retracement, invalidating the earlier breakdown.

Although this is a positive development, we think that one more move to the downside is still ahead of us. Why?

Firstly, the sell signals generated by the RSI and the CCI continue to support the sellers. The Stochastic Oscillator generated a buy signal yesterday, but something similar we saw at the end of May. Back then, crude oil also rebounded, but as it turned out in the following days, it was nothing more than one-day upswing, which only paused the downward move.

When we take a look at the above chart, we see that after that “improvement” crude oil extended losses, hitting fresh lows. Therefore, we think that history will likely repeat itself once again in the coming days.

Secondly, despite yesterday’s move, the commodity is still trading under the previously-broken 50-day moving average and the 38.2% Fibonacci retracement (marked on the chart below).

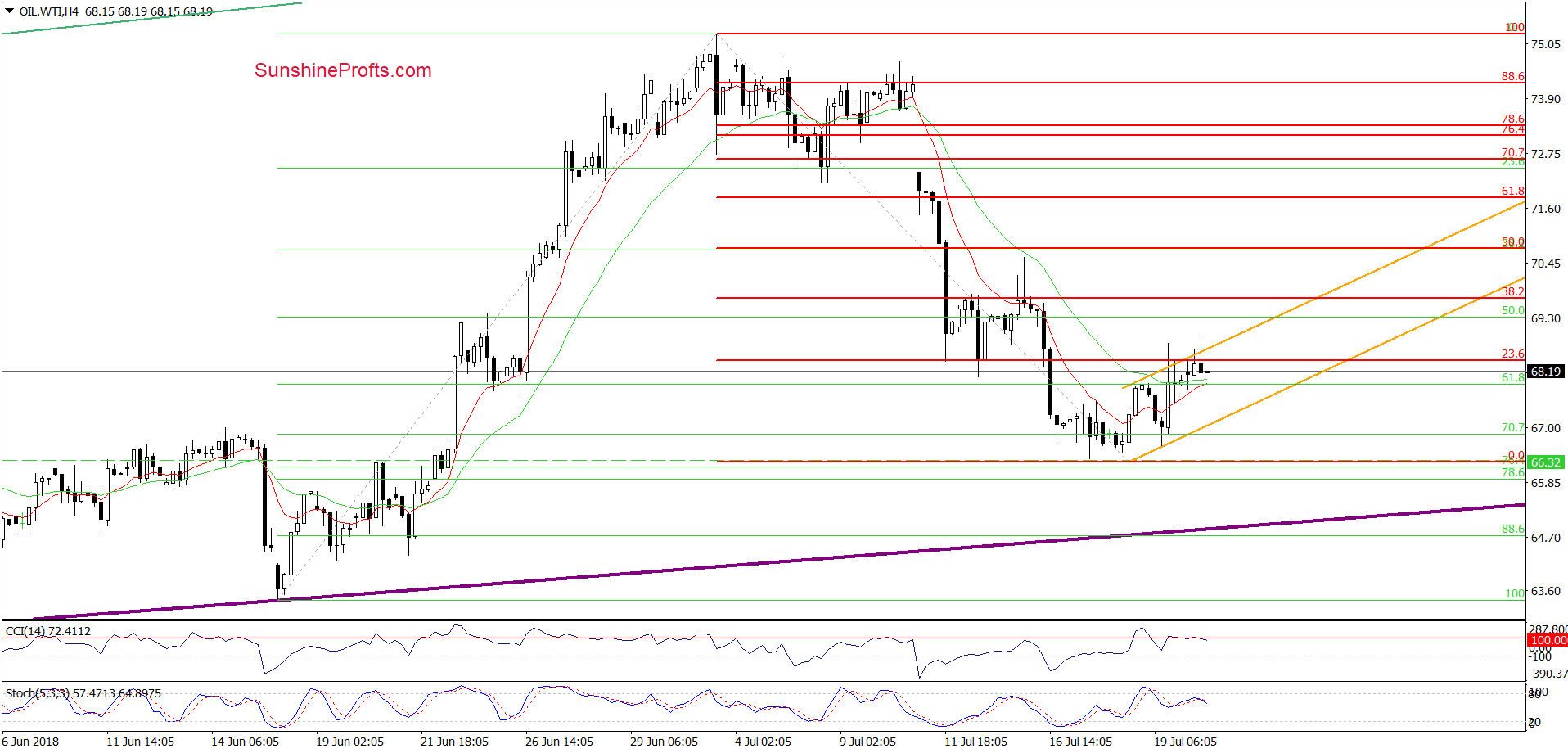

And speaking about the above chart… today, we decided zoom in our very short-term picture and add a 4-hour chart. From this perspective, we see that light crude is trading inside the orange rising trend channel, which means that as long as there is no breakout above the upper line of the formation further improvement is questionable.

Additionally, the CCI and the Stochastic Oscillator generated the sell signals, increasing the probability of further deterioration later in the day. If this is the case, we’ll likely see not only a drop to the lower border of the orange rising trend channel, but also a test of recent lows and our next downside target around $65.75-$66, where the nearest support area (marked wit green) is.

Nevertheless, if crude oil drops below it, we’ll likely see a test of lower borders of the rising trend channels in the following days (we marked this area with the black ellipse on the daily chart).

Summing up, profitable short positions continue to be justified from the risk/reward perspective as the short-term outlook remains bearish, favoringthe sellers and lower prices of crude oil in the very near future.

Trading position (short-term; our opinion): profitable short positions with a stop-loss order at $71.34 (in other words, whatever happens, our capital will not suffer) and the next downside target at $66 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts