Trading position (short-term; our opinion): Profitable short positions with a stop-loss order at $71.34 and the next downside target at $66 are justified from the risk/reward perspective.

A rising trend channel, the Fibonacci retracements, a proximity to the support zone and signals generated by the indicators. How to put together these puzzles to learn more about the future of oil?

Let’s examine the charts below to find out (charts courtesy of http://stockcharts.com).

Technical Picture of Crude Oil

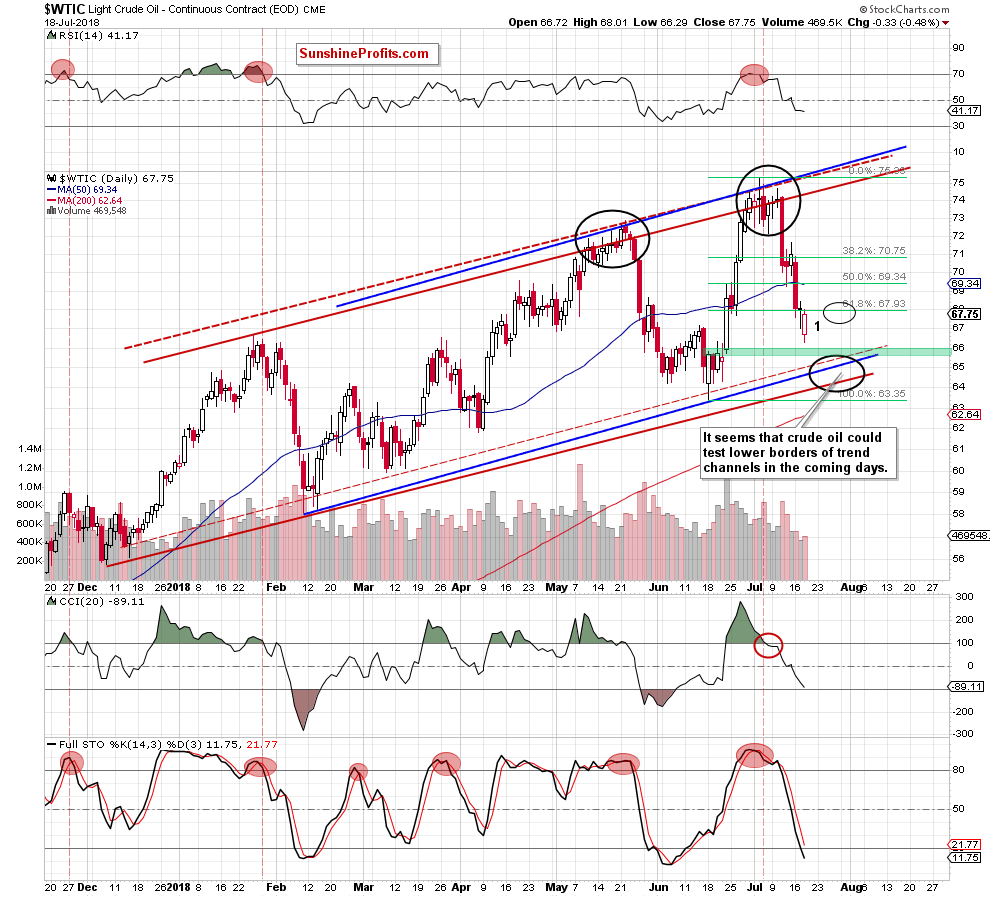

Looking at the daily chart, it's hard to resist the impression that Wednesday's session was a repetition of what we saw the day before. As you can see in the above chart, light crude moved lower after the market’s open, but oil bulls managed to trigger a rebound in the following hours, which resulted in a comeback above the previously-broken 61.8% Fibonacci retracement.

This time, however, the commodity didn’t close the session above this resistance, but pulled back, finishing the day under the retracement. Such price action looks like a verification of the earlier breakdown, which increases the probability that another attempt to move lower is just ahead of us – especially when we factor in the sell signals generated by the daily indicators and the size of yesterday’s rebound.

At this point, you can ask: what's wrong with it? Well, we believe that one picture is worth more than a lot of words, so let's look at the chart below.

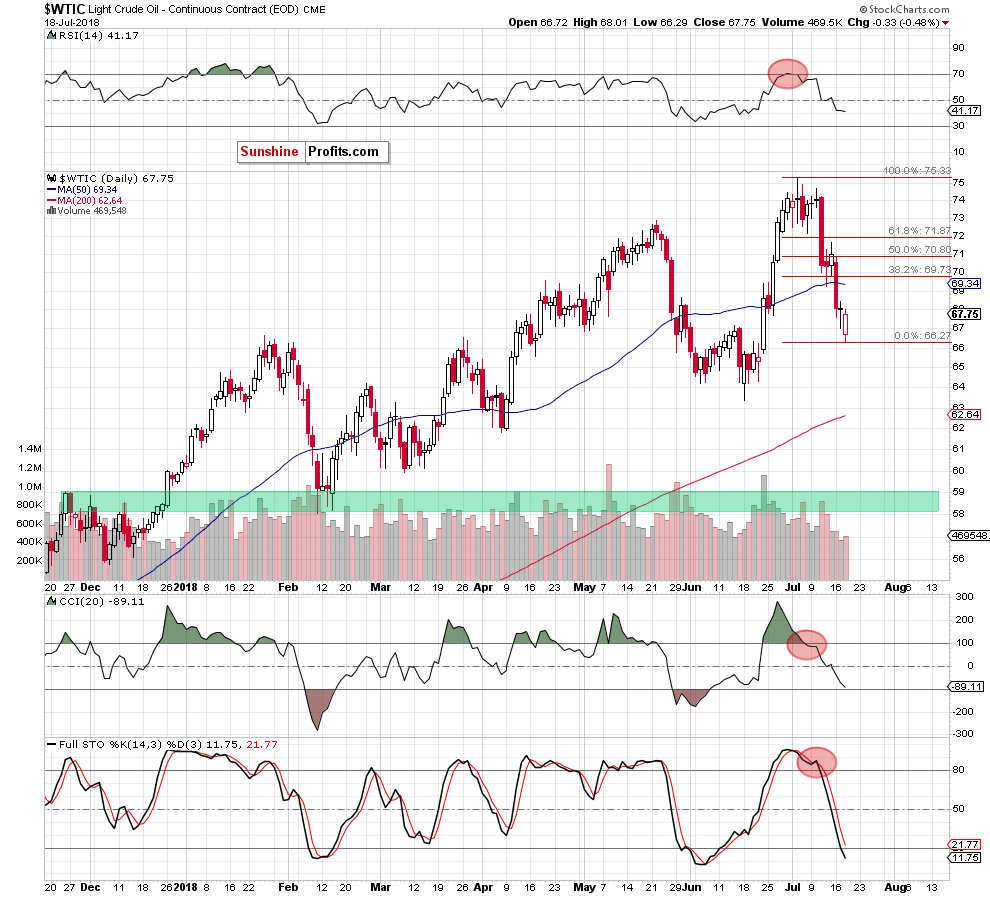

From this perspective, we see that yesterday’s move to the upside was tiny compared to the earlier decline as it didn’t even climb above Tuesday’s high, not to mention the rise to the 50-day moving average or a jump to the first important Fibonacci retracement.

Taking all the above into account, we think that the situation in the short term remains unchanged and the outlook is bearish. Therefore, in our opinion, further deterioration and a drop to our downside targets is just a matter of time (probably a very short time).

Finally, the most important question is: how low can crude oil falling the coming days?

We believe that the next downside target will be around $65.75-$66, where the nearest support area (marked wit green) is. Nevertheless, if crude oil drops below it, we’ll likely see a test of lower borders of the rising trend channels in the following days (we marked this area with the black ellipse on the daily chart).

Summing up, profitable short positions continue to be justified from the risk/reward perspective as all negative factors about which we wrote in our previous alerts remain in the cards, supporting oil bears and lower prices of crude oil in the coming week.

Trading position (short-term; our opinion): profitable short positions with a stop-loss order at $71.34 (in other words, whatever happens, our capital will not suffer) and the next downside target at $66 are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts