Trading position (short-term; our opinion): Short positions (150% of the regular size of the position) with the stop-loss order at $68.15 and the initial downside target at $58.10 are justified from the risk/reward perspective.

Yesterday’s news that China proposed tariffs on major U.S. imports pushed black gold sharply lower after the market’s open. However, in the following hours, the price of the commodity rebounded supported by an unexpected decline in crude oil inventories and information that the U.S. expressed willingness to negotiate a resolution on trade. How did these turbulences affect the short-term picture of crude oil?

Technical Analysis of Crude Oil

Let's examine the charts below (charts courtesy of http://stockcharts.com).

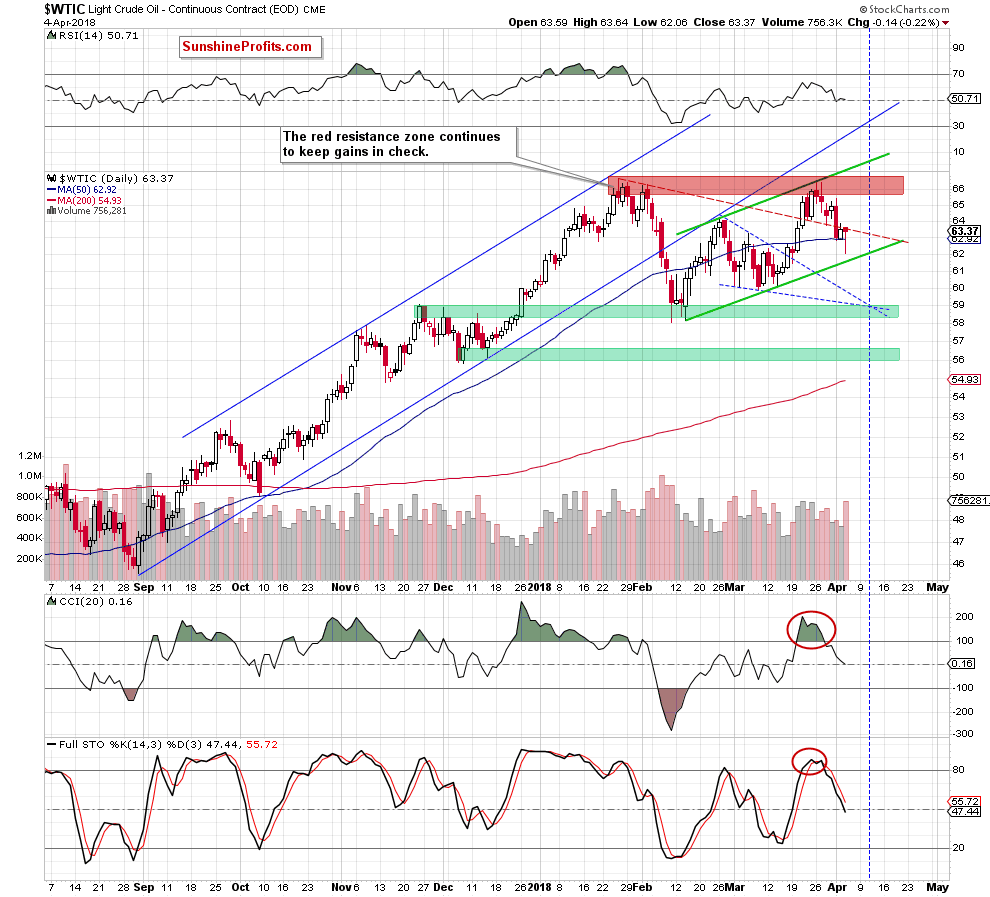

As we wrote in the title of today's alert after yesterday’s session we noticed something bullish and something bearish. Looking at the daily chart, we clearly see that although crude oil extended losses after the market’s open, oil bulls managed to stop the sellers and trigger a rebound, which took black gold above the previously-broken 50-day moving average.

In this way, the buyers invalidated the earlier breakdown, which is a positive signal – especially when we factor in the fact that there was no daily closure under this support in recent days.

On the other hand, despite this improvement, light crude closed another day (for the third time in a row) under the previously-broken red declining dashed line based on the January and February peaks.

Additionally, Tuesday’s and Wednesday’s rebounds look like a verification of the earlier breakdown, which raises the probability of another move to the downside. This scenario is also reinforced by the sell signals generated by the indicators, which continue to support the bears.

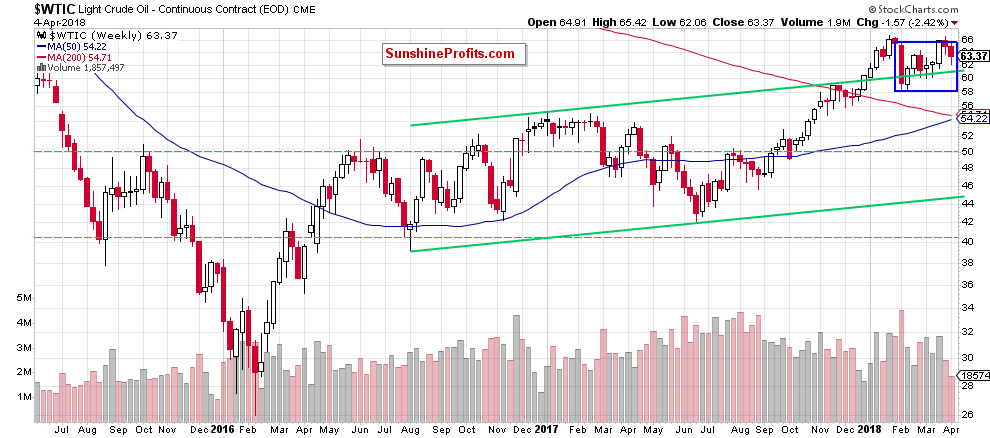

On top of that, crude oil is still trading inside the blue consolidation seen on the weekly chart below, which means that an invalidation of the earlier tiny above the upper border of the blue consolidation and its negative impact on the price remain in effect, suggesting further deterioration and (at least) a test of the green support line (the upper line of the green rising trend channel), which is currently around $61.

Summing up, short positions continue to be justified from the risk/reward perspective as crude oil closed another session under the previously-broken short-term support/resistance line, which looks like a verification of the earlier breakdown. Additionally, the sell signals generated by the indicators remain in the cards, supporting the sellers and increasing the probability of further declines in the coming days.

Trading position (short-term; our opinion): Short positions (150% of the regular size of the position) with the stop-loss order at $68.15 and the initial downside target at $58.10 are justified from the risk/reward perspective. As always, we’ll keep you - our subscribers - informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts