Trading position (short-term; our opinion): None positions are justified from the risk/reward perspective.

Tuesday's session was the worst day for oil bulls since the beginning of the year. Due to the sellers' attack and the breakdown under the February low, the price of black gold dived below $55. Is there anything on the charts that can encourage buyers to fight for higher prices of the commodity?

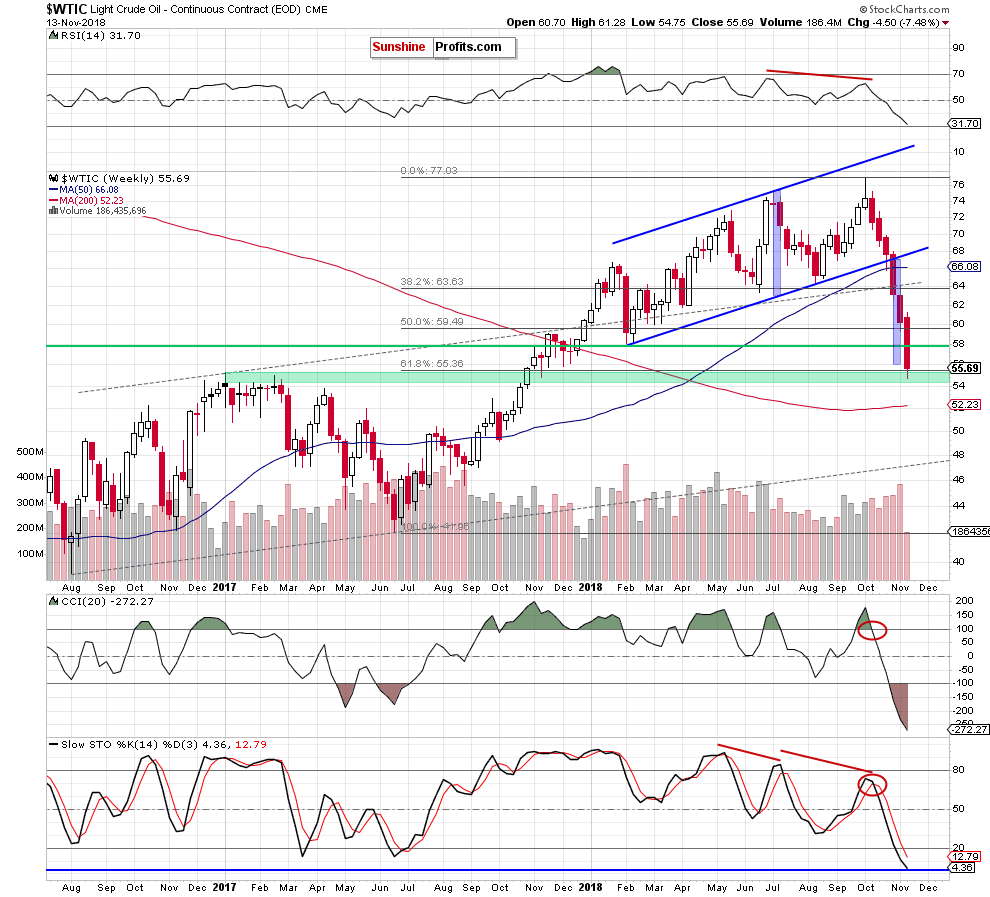

Let’s examine the medium-term chart to find out (charts courtesy of http://stockcharts.com).

In our last commentary, we wrote the following:

(…) the sellers managed to finish the day under the March low, which increases the probability that we’ll see a test of the blue support area (marked on the weekly chart) created by the February lows in the very near future.

What could happen if this support is broken? It seems that in the case of a such bearish scenario, the sellers could take the price of black even to the next support area around $55-$55.49, which is created by the 61.8% Fibonacci retracement and the early 2017 peaks.

From today’s point of view, we see that the situation developed in line with the above scenario and crude oil slipped to the green support zone created by the 61.8% Fibonacci retracement and the early 2017 highs.

Although the bears managed to take the commodity even a bit below this area, oil bulls closed their ranks and triggered a tiny (compared to the earlier decline) rebound, which invalidated the earlier breakdown under these supports.

This positive event triggered further improvement after today’s market open, which suggests that we may see a rebound from November lows in the coming days – especially when we factor in the current position of the daily indicators.

Nevertheless, as long as there are no more reliable factors that could confirm oil bulls’ strength waiting at the sidelines seems justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): none positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts