Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

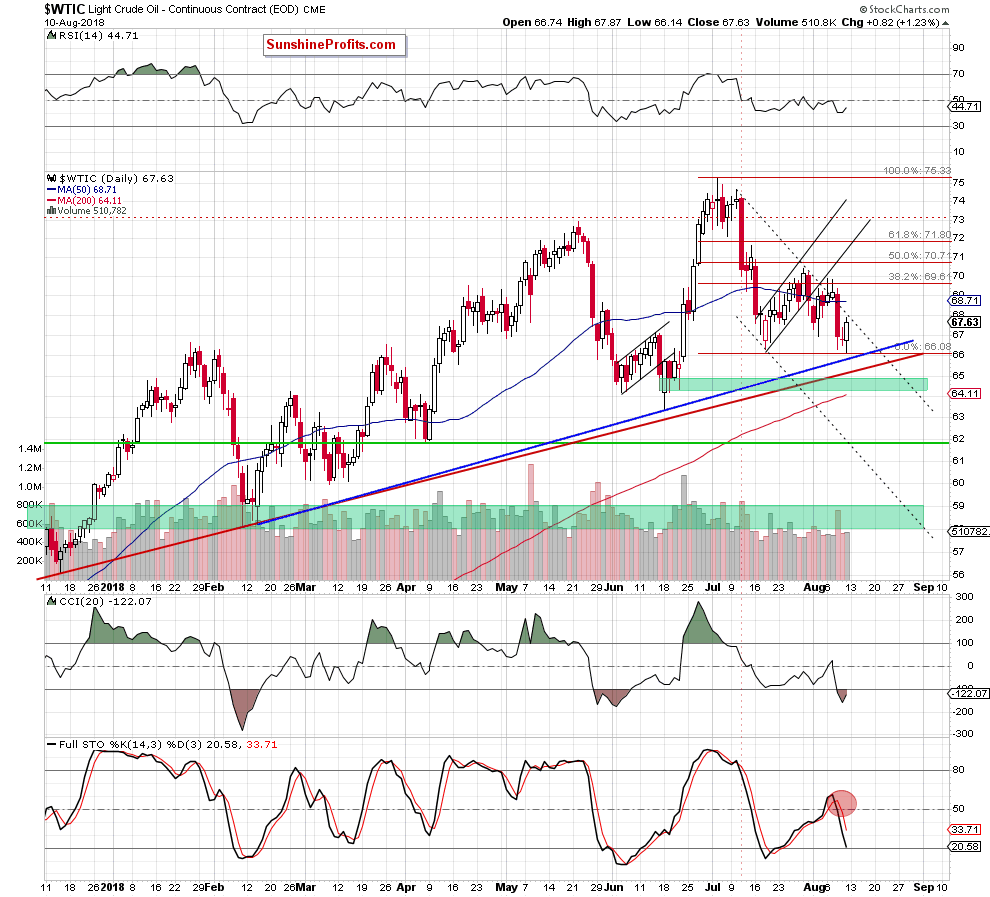

Although Friday’s session brought a fresh summer low in black gold, oil bulls didn’t give up without fight. As a result, light crude gained 1.23% and came back to the previously-broken resistance line. But did it change anything in the short-term picture?

Let’s examine the charts below (charts courtesy of http://stockcharts.com).

Technical Picture of Crude Oil

Quoting our Friday’s alert:

(…) investors created a doji candlestick, which suggests that some uncertainty crept onto the market.

(…) Additionally, yesterday’s price action materialized on smaller volume than earlier declines, which suggests that the interest of oil bears to continue pushing the price down could have weakened.

What does it mean for black gold?

Although the sell signal generated by the Stochastic Oscillator continues to support the sellers and lower values of the commodity in the very near future (yes, we think that one more downswing and a fresh “summer” low can’t be ruled out), we believe that the probability of reversal from here (…) is too big to justify the continued holding of short positions.

(…) Therefore, (…) closing short positions and taking profits off the table (as a reminder, we opened our short positions when crude oil was trading at around $73.16) is justified from the risk/reward perspective.

From today’s point of view, we see that crude oil hit a fresh summer low just as we had expected. Nevertheless, despite this development, the proximity to two medium-term support lines (the blue line based on February and June lows and the red one based on December 2017 and February 2018 lows) encouraged oil bulls to fight for higher prices.

Thanks to their determination, black gold bounced off session’s low and increased to slightly below the previously-broken black dotted line based on July peaks. Nevertheless, we didn’t see a test of this resistance. Instead, the commodity pulled back a bit, which suggests that one more downswing may be just around the corner – especially when we factor in the sell signal generated by the Stochastic Oscillator.

If this is the case and oil bears push light crude lower, we’ll see a re-test of the recent lows or even a drop to the above-mentioned medium-term support lines. However, in our opinion, re-opening short positions is not justified from the risk/reward perspective at the moment of writing this alert as the space for declines seems too small. Therefore, sitting on recent profits and waiting for another profitable opportunity seems to be the best investment idea for the moment.

Before we summarize today’ Oil Trading Alert, let’s check how Friday’s move affected the broader picture of crude oil? Let’s start with the medium-term chart.

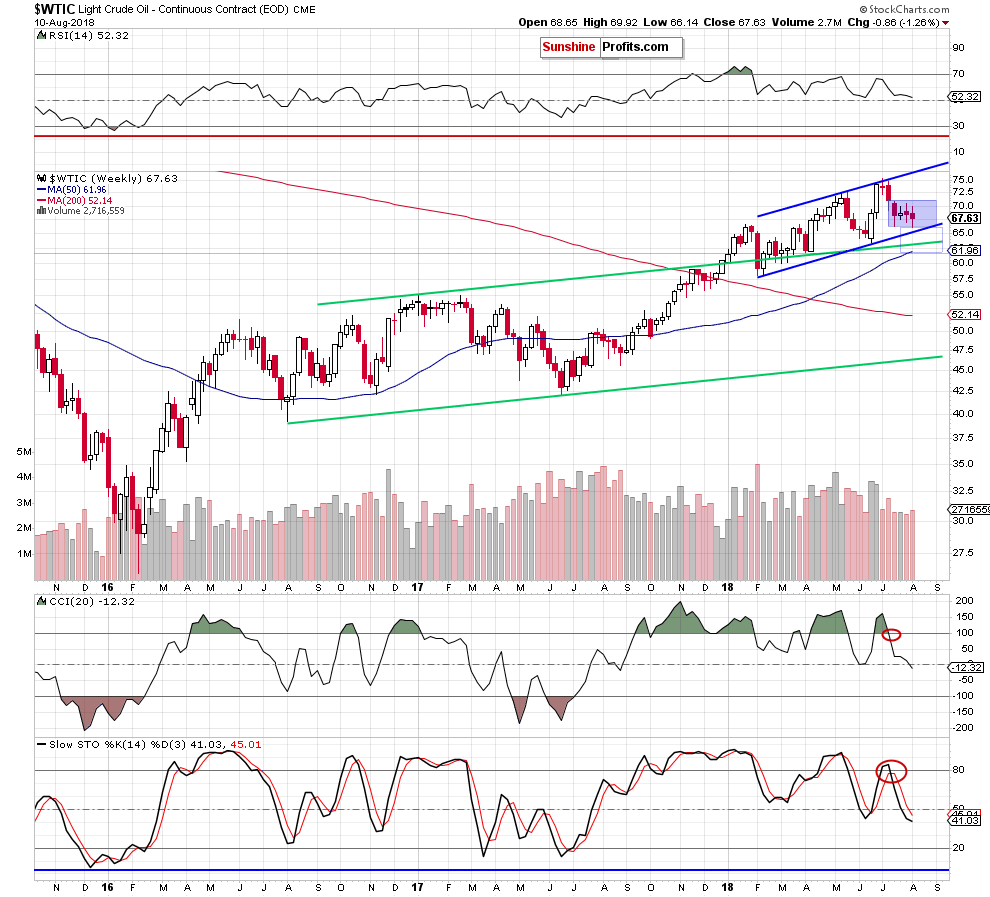

Looking at the weekly chart, we see that although crude oil hit a fresh multi-week low, the overall situation hasn’t changed much as black gold is still trading inside the blue consolidation slightly above the lower border of the blue rising trend channel.

Therefore, in our opinion, as long as there is no weekly closure under the above-mentioned blue support line, lower prices of the commodity and another significant move to the downside are doubtful.

Nevertheless, taking into account the medium-term sell signals generated by the CCI and the Stochastic Oscillator, it seems that oil bears will try to go south once again in the coming weeks – especially when we factor in the long-term picture of the commodity. Let’s take a look at the chart below.

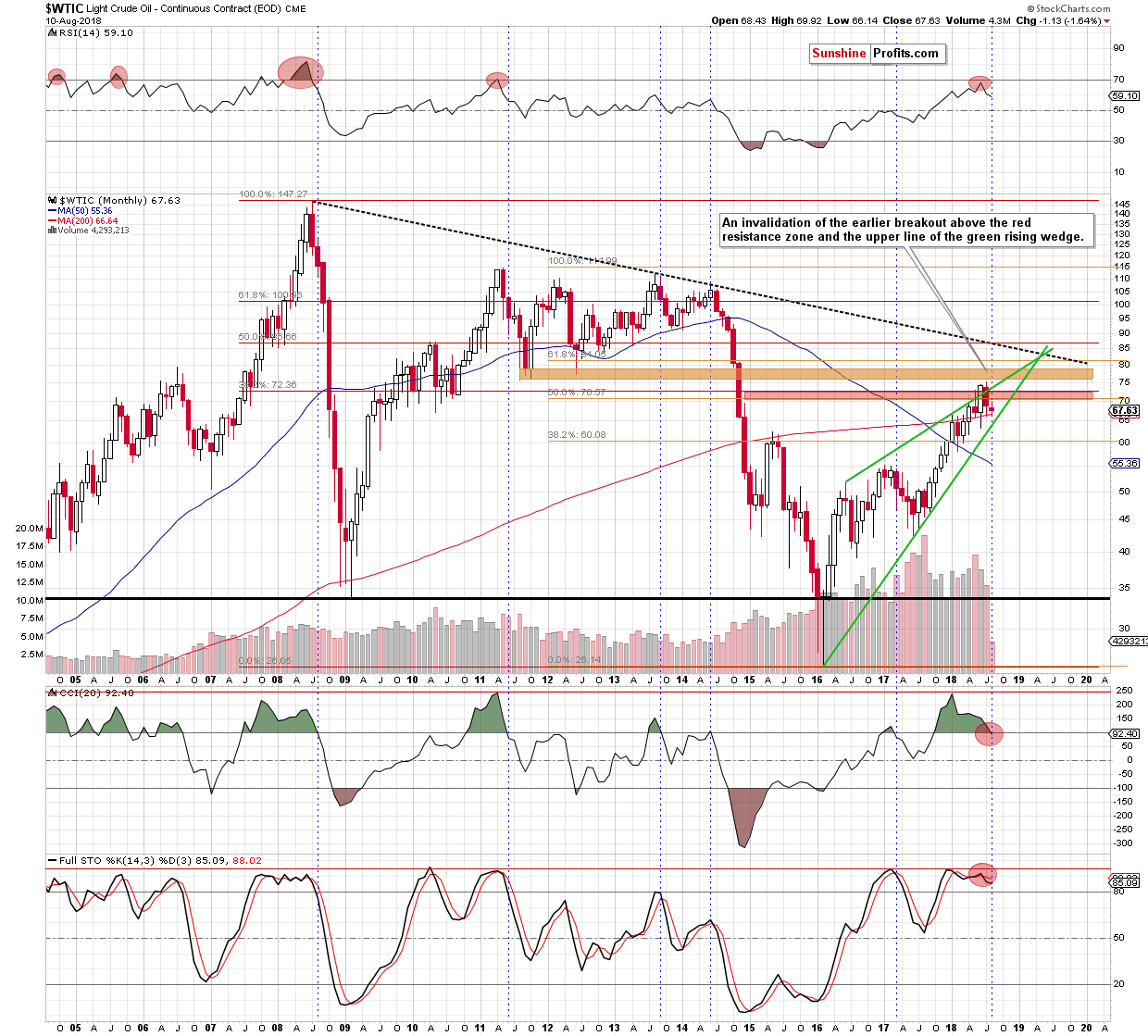

From the monthly perspective, we see that black gold remains under the upper border of the green rising wedge and the red zone, which means that an invalidation of the earlier breakouts above these resistances and its negative impact on the price are still in effect, suggesting lower values of the commodity in the coming month(s).

However, such scenario will be more likely and reliable only if crude oil finally closes the month below the 200-month moving average (the nearest very important support, which continues to keep declines in check since May) and drops under the lower border of the green rising wedge (currently around $64.30).

If we see such negative combination of technical factors, we’ll re-open short positions. Until this time, waiting at the sidelines for a confirmation or invalidation of the above is justified from the risk/reward perspective.

Summing up, crude oil bounced off recent lows and approached the very short-term black dotted resistance line. Although this is a positive sign, we think that as long as there is no confirmed breakout above it, higher prices of light crude are not likely to be seen and a re-test of the recent lows is likely – especially when we factor in the sell signal generated by the daily Stochastic Oscillator and bearish signals generated by the medium-term indicators.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts