Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

After a moment of breath that we could observe during Wednesday’s session, oil bulls again got into trouble. Their lack of strength in the fight against rivals led to a fresh low and a comeback below the long-term support line. Can it be even worse?

Let’s analyze the charts below (charts courtesy of http://stockcharts.com/).

In our yesterday’s Oil Trading Alert, we wrote the following:

(…) Despite the fact that this attitude of the buyers looks quite promising, (…), we think that the bulls have no reasons for joy and celebration yet. Why?

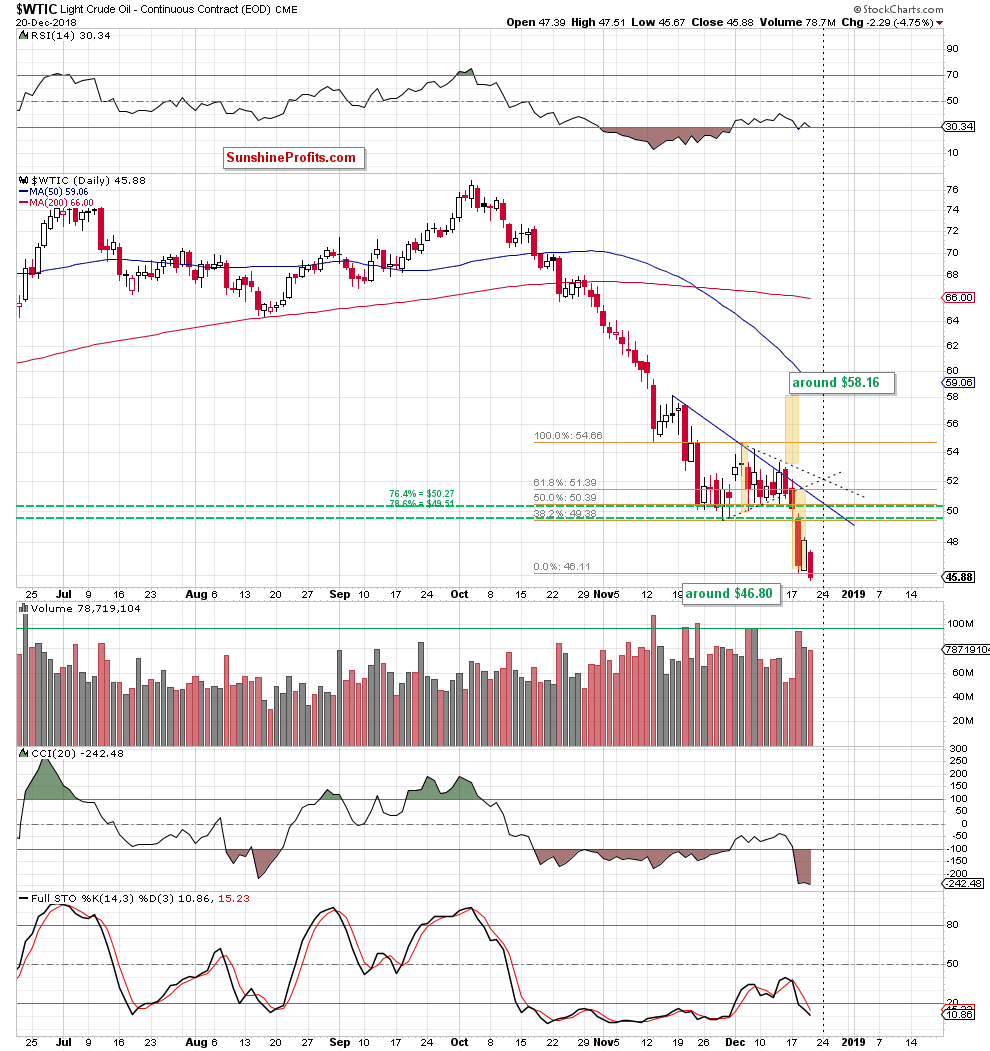

First, although the commodity moved higher and gained over 3% during yesterday’s session, light crude is still trading not only under the previously-broken lows, but also well below the very short-term blue declining resistance line, which succesfully stopped the buyers many thimes earlier this month.

Such price action suggests that as long as there is at least an invalidation of the drop below late-November and December lows, all upswings can be nothing more than just verifications of the earlier breakdown.

Second, yesterday’s move to the upside materialized on smaller volume than Tuesday’s drop, which raises some doubts about the bulls’ strngth.

Third, the sell signal generated by the Stochasic Oscillator continues to support the sellers and ower values of light crude in the coming days.

Taking all the above into account, we believe that, as we wrote above, until black gold is trading below the previous lows, one more move to the south can’t be ruled out.

From today’s point of view, we see that the situation developed in line with the above scenario and crude oil moved lower once again on Thursday.

How did this drop affect the medium-term perspective?

Before we answer to this question, let’s recall the quotes from our last alert:

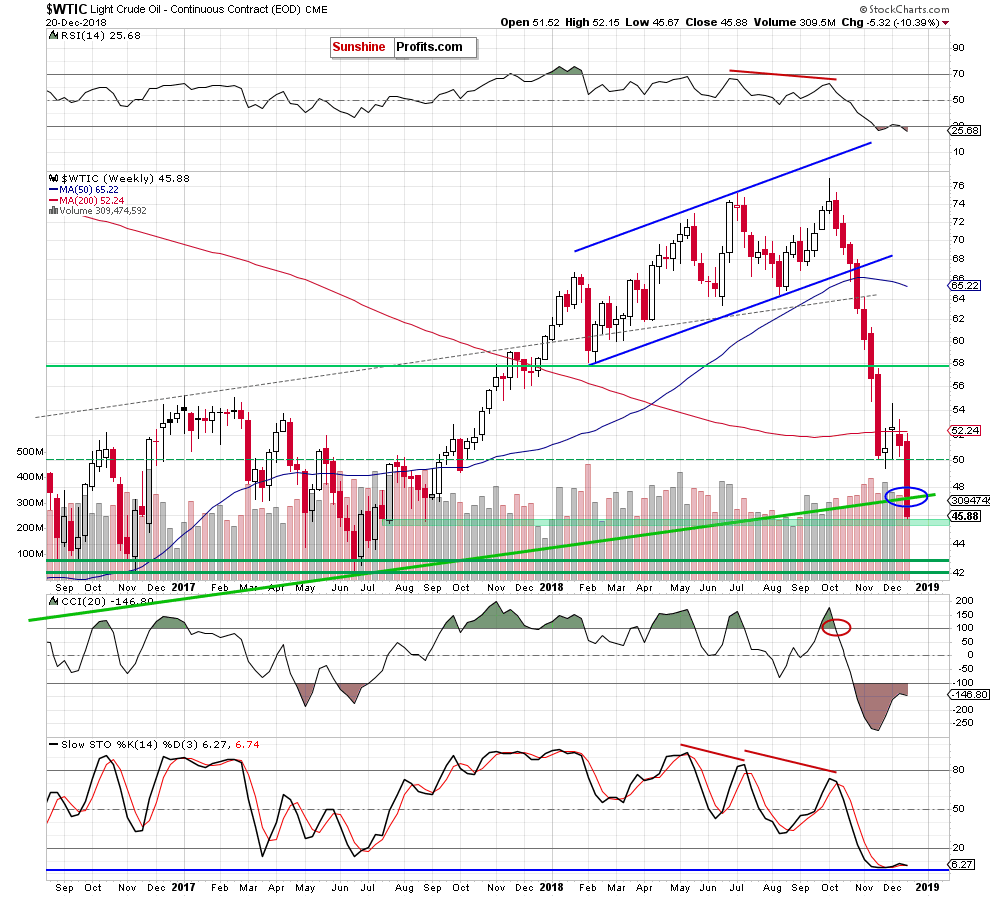

The first thing that catches the eye on the weekly chart is an invalidation of the earlier breakdown under the long-term green rising support line. Is this a positive even? Yes. But can we trust it? In our opinion, no. Why?

Because although oil bulls invalidated Tuesday’s breakdown please keep in mind that the week is not over yet and until we see a weekly closure above this line, we should treat yesterday's event with moderate optimism.

Looking at the above chart, we see that the premature joy of the bulls became their loss. From this perspective, we see that the price of black gold turned south and hit a fresh low during yesterday’s session.

Although crude oil approached the green support zone (marked on the weekly chart), we think that one more downswing and a realization of the bearish scenario from Wednesday is very likely in the coming day(s):

(…) In our opinion, if the commodity extends losses from current levels, crude oil will test (at least) the green support zone based on the late-July and late-August lows (around $45.40-$45.62) in the very near future.

At this point, it is worth noting that in this area there is one more additional support, which can encourage the buyers to act. What do we mean by that? Let’s take a look at the long-term chart below.

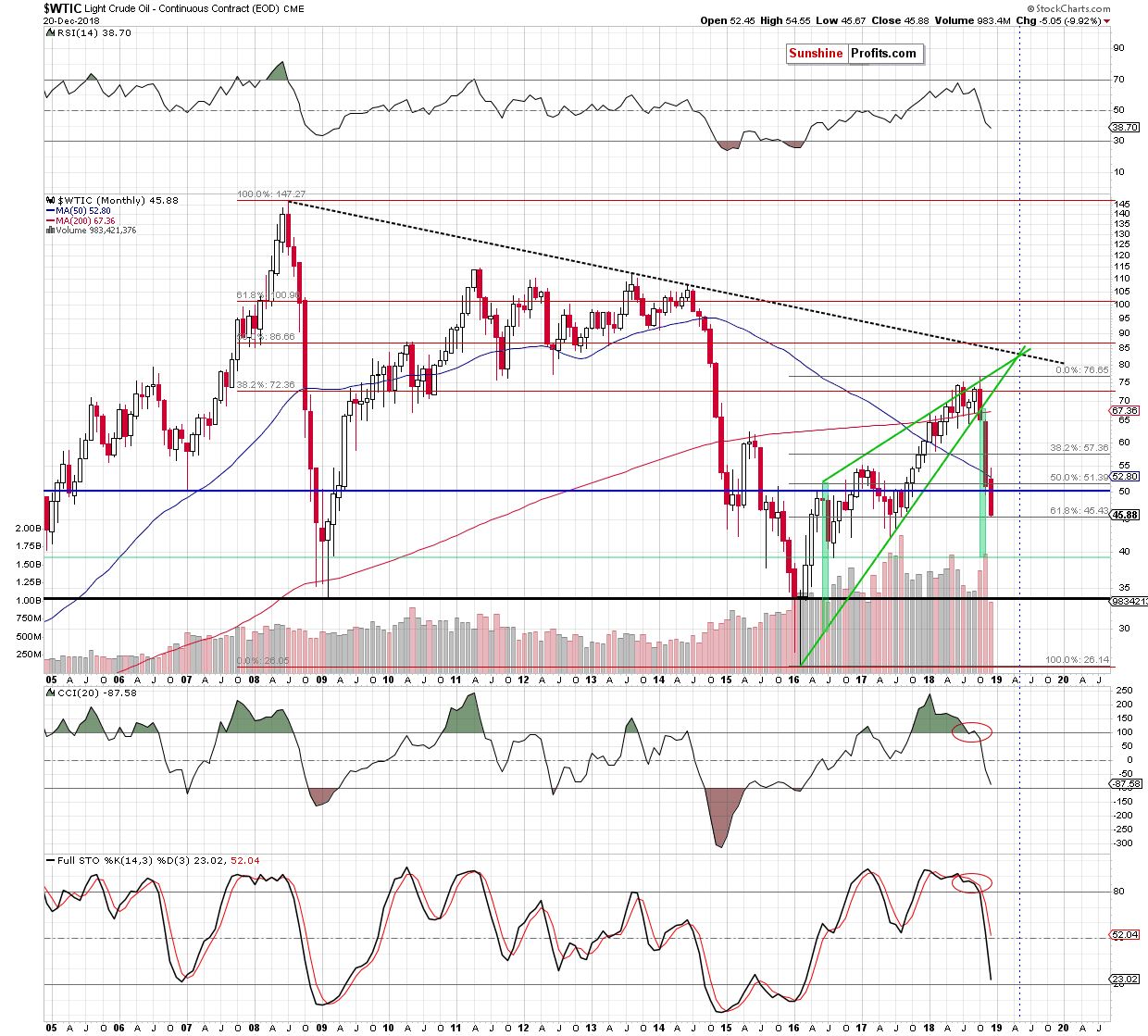

From this perspective, we see that not far from current levels (inside the above-mentioned support area) oil bears will have to face with the 61.8% Fibonacci retracement based on the entire 2016-2018 upward move.

Nevertheless, if oil bulls do not stop them there, the way to June 2017 lows (around $42.05-$43.16) will be open.

Summing up, crude oil extended loses and approached the green support zone based on the late-July and late-August lows during yesterday’s session. Nevertheless, we think that one more downswing and a test of the 61.8% Fibonacci retracement based on the entire 2016-2018 upward move is very likely before we see another attempt to stop oil bears in the coming day(s).

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts