Trading position (short-term; our opinion): Full (150% of the regular size of the position) short position with the stop-loss order at $74.10 and the next downside target at $68.51 is justified from the risk/reward perspective.

Wednesday’s session took the price of black gold under the major short-term support. What could be the consequences of this event in the coming days?

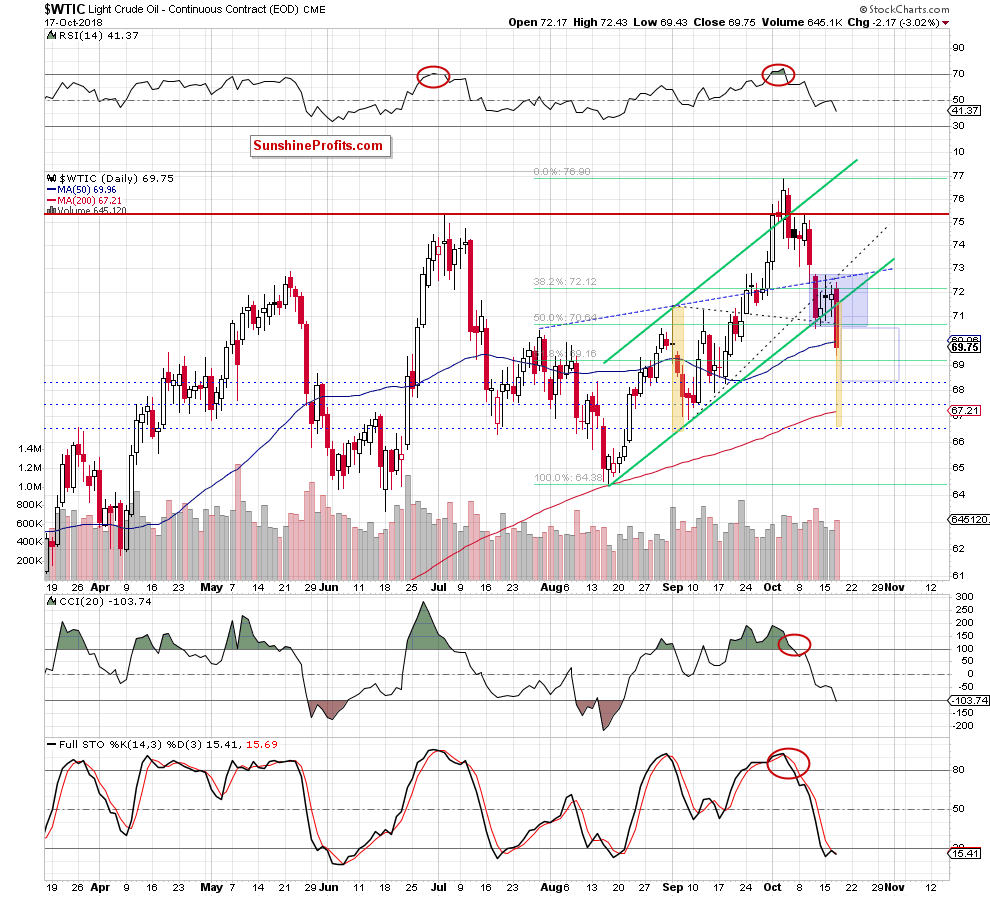

Let’s take a look at the chart below (charts courtesy of http://stockcharts.com).

In our last commentary on crude oil, we wrote the following:

(…) crude oil re-tested the nearest supports and then rebounded almost reaching the first resistance line.

Nevertheless, this time, there was no breaking above it (not to mention the test of the higher resistances), which we can read as a manifestation of oil bulls’ weakness.

Additionally, the volume that accompanied yesterday’s upswing was smaller than day earlier, which shows that the buyers' involvement in the next northward moves is getting smaller from session to session.

Such price action doesn’t bode well for higher prices of black gold in the coming days – especially when we factor in the sell signals generated by the daily indicators and pro-bearish signs about which we wrote yesterday (…)

In Wednesday’s summary we also added:

(…) another bigger decline will be more likely and reliable if the price of the commodity drops below the lower line of the blue consolidation (which will also be synonymous with a decrease below the lower border of the green rising trend channel and the 50% Fibonacci retracement).

From today’s point of view, we see that the situation developed in line with the above scenario and oil bears pushed the commodity sharply lower, making our small short position even more profitable (as a reminder, we opened it when crude oil was trading at around $75). Thanks to yesterday’s decline, the sellers opened the way to lower levels, which means that increasing our short position to 150% is justified from the risk/reward perspective.

How low could light crude go in the coming days?

In our opinion, the next downside target will be around $68.51, where the size of the downward move will correspond to the height of the blue consolidation. Nevertheless, taking into account the breakdown under the lower border of the green rising trend channel, it seems that we could see a decline to around $67.55 (to lows created around September 10, 2018) or even to around $66.55, where the size of declines will be equal to the height of the green channel.

The pro-bearish scenario is also reinforced by the lack of buy signals (which could encourage oil bulls to fight for higher prices) and the broader picture of the commodity.

Summing up, short positions are justified from the risk/reward perspective as crude oil moved sharply lower, breaking below the major short-term supports and opening the way to lower prices in the coming days.

Trading position (short-term; our opinion): Full (150% of the regular size of the position) short position with the stop-loss order at $74.10 and the next downside target at $68.51 is justified from the risk/reward perspective. As always, we’ll keep you - our subscribers - informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts