Trading position (short-term; our opinion): Short positions (with the stop-loss order at $68.15 and the initial downside target at $56.57) are justified from the risk/reward perspective.

The first session of the new week belonged to oil bulls who were pushing the price of crude oil higher and higher after the market’s open. As a result, black gold came back above $62, but there is one small detail that spoils the positive pronunciation of yesterday's session…

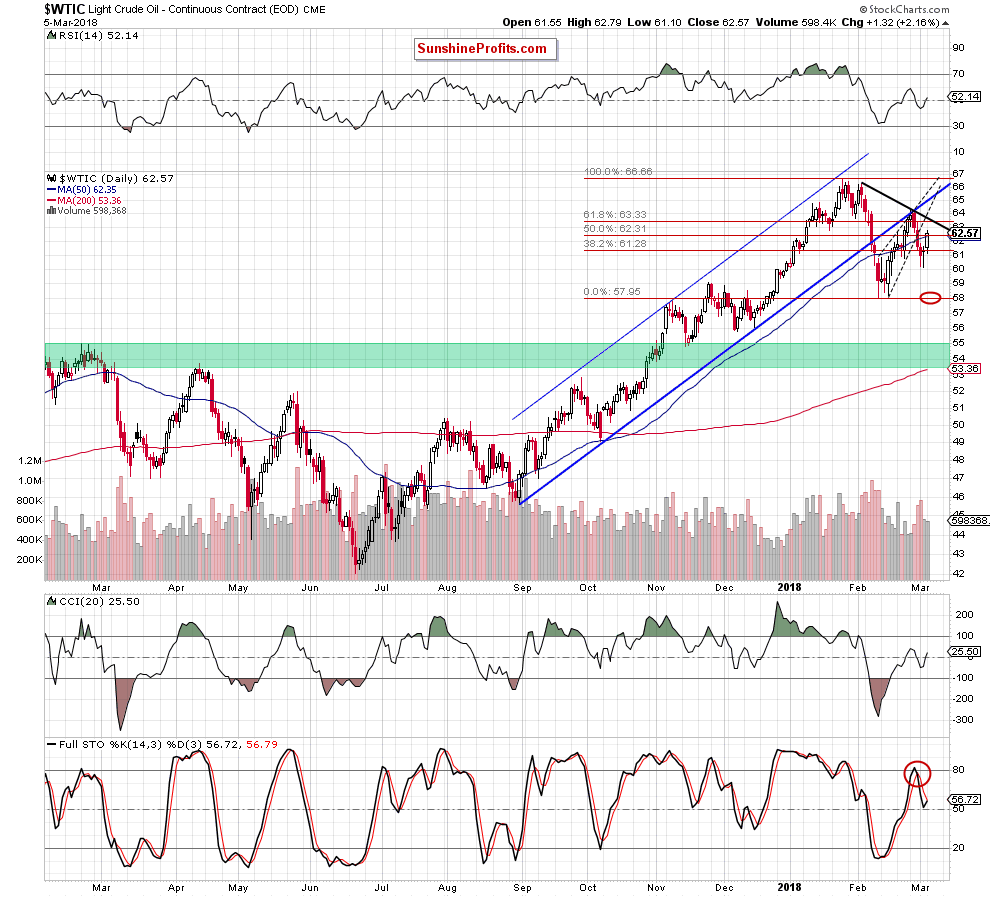

Let's examine the daily chart (charts courtesy of http://stockcharts.com).

From today’s point of view, we see that although crude oil extended gains yesterday, the commodity is still trading under the previously-broken lower border of the blue rising trend channel and the lower line of the black rising wedge (marked with dashed lines).

This means that the earlier breakdowns under these lines remain in the cards, supporting oil bears. When we take a closer look at the chart we can also notice that despite yesterday’s increase, the volume was smaller than day before, which raises our doubts about the credibility and the strength of this rebound.

Taking all the above into account and combining it with the fundamental picture of black gold (we wrote more about this issue yesterday), we think that another reversal and lower prices are just around the corner.

As always, we’ll keep you - our subscribers - informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts