Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Friday, crude oil wavered between small gains and losses, but finally finished the day 1.61% above Thursday closure. Did this “improvement” change anything in the overall situation of black gold?

Let’s analyze the charts below (charts courtesy of http://stockcharts.com).

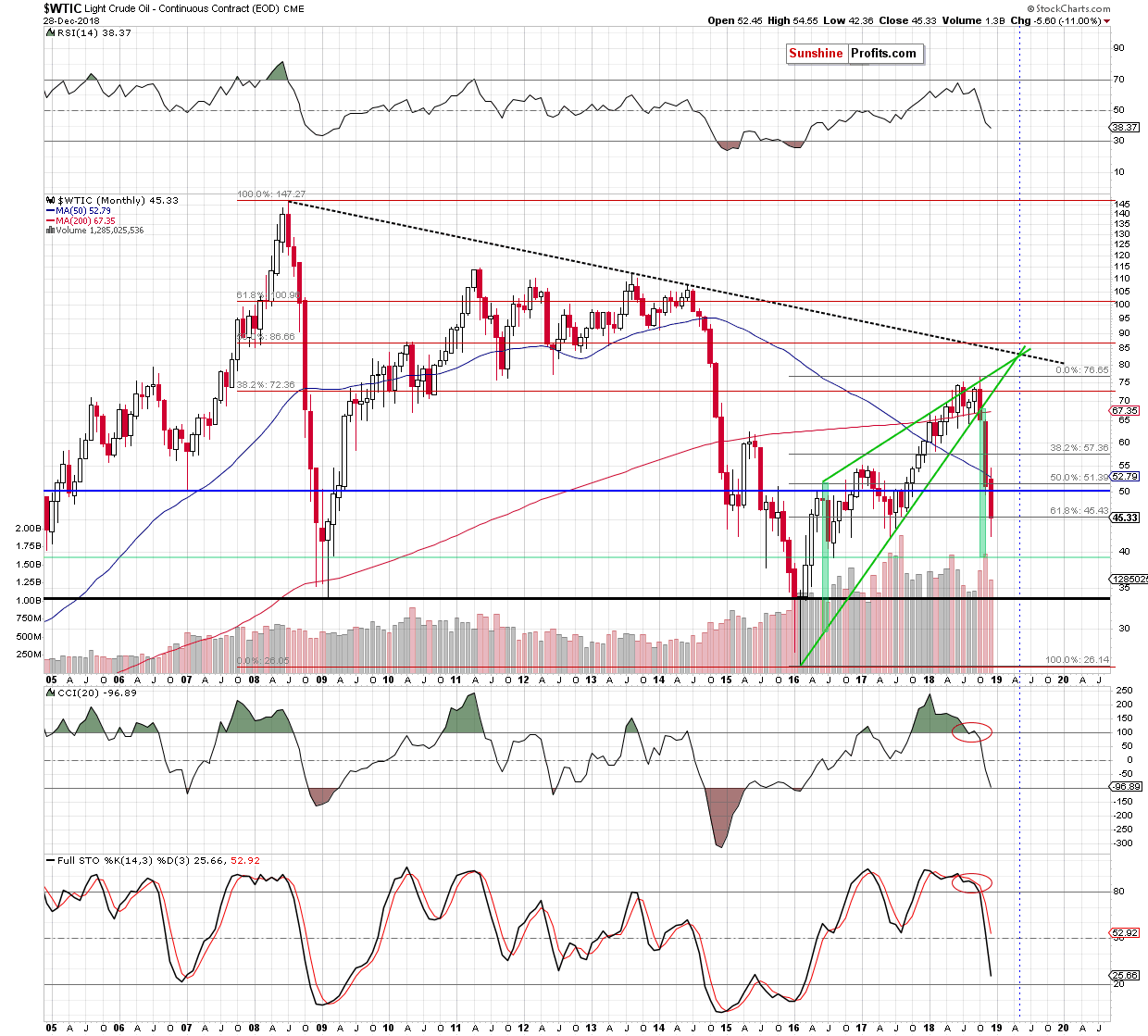

On the monthly chart, we see that crude is still trading below the 61.8% Fibonacci retracement, which doesn’t bode well for the bulls during the last session of the week. Why? Because they will have to deal with additional resistance before they can think about higher levels.

Additionally, at this point it is worth noting that if the commodity closes today’s session under this level, the sellers will receive an additional argument to act (a breakdown confirmed by a monthly closure). On the other hand, if the bulls manage to invalidate the earlier breakdown, their chances of fighting for higher prices of black gold will increase.

Having said that, let's check how the Friday’s closure affect the medium-term chart.

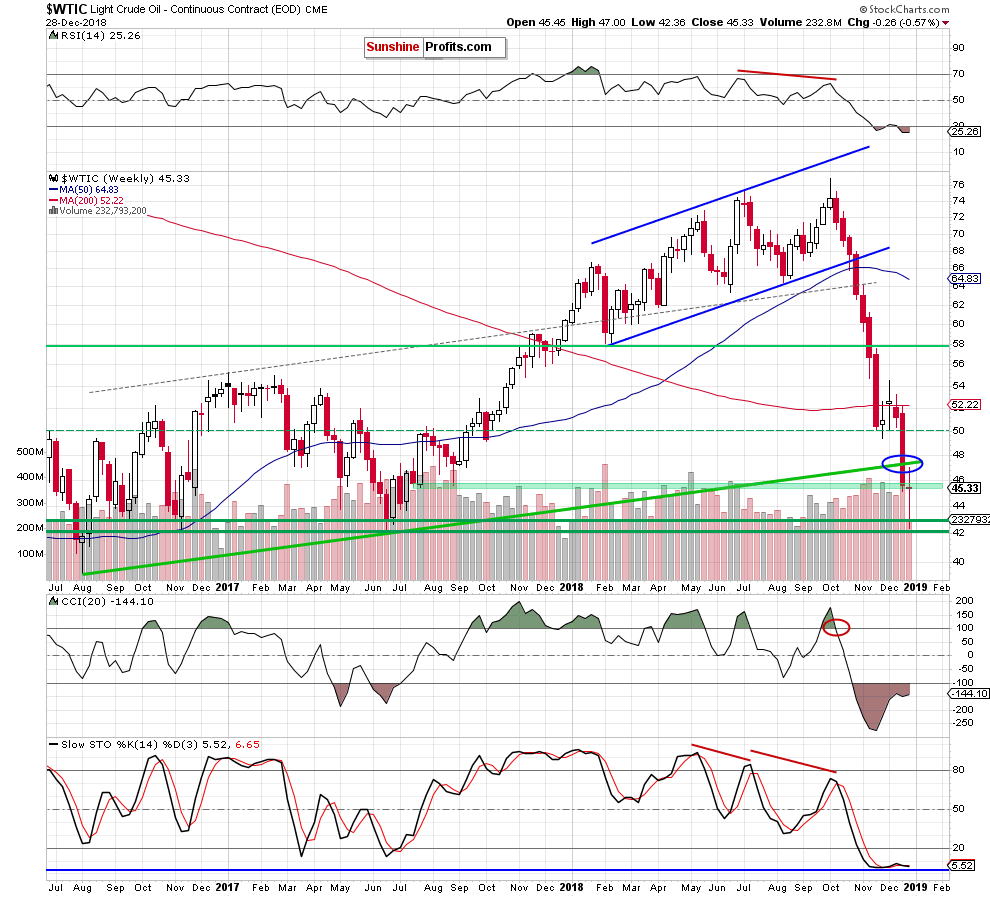

From this perspective, we see that although the commodity rebounded in the previous week, light crude closed the week under the late July 2017and late-August 2017 lows, which doesn’t bode well for the future of oil bulls – at least at the first glance.

Nevertheless, when we focus on the shape of the last week’s candle, we clearly see that the market participants created a doji candle. The appearance of doji indicates the lack of decisiveness on the market - neither the bulls nor the bears show an advantage at the moment.

If the market (oil or any other) moves in a sideways trend (or increases or decreases are only in the initial phase), the doji candle is not very important. If, however, it appears on the chart after a long downward trend (as in our case) there is a high probability that we’ll see a correction or reversal in the near future – especially if the bulls manage to invalidate the above-mentioned breakdown under the 61.8% Fibonacci retracement.

Will the daily chart give the bulls additional arguments to fight for the above-mentioned levels? Let's analyze Friday's price action and its implications.

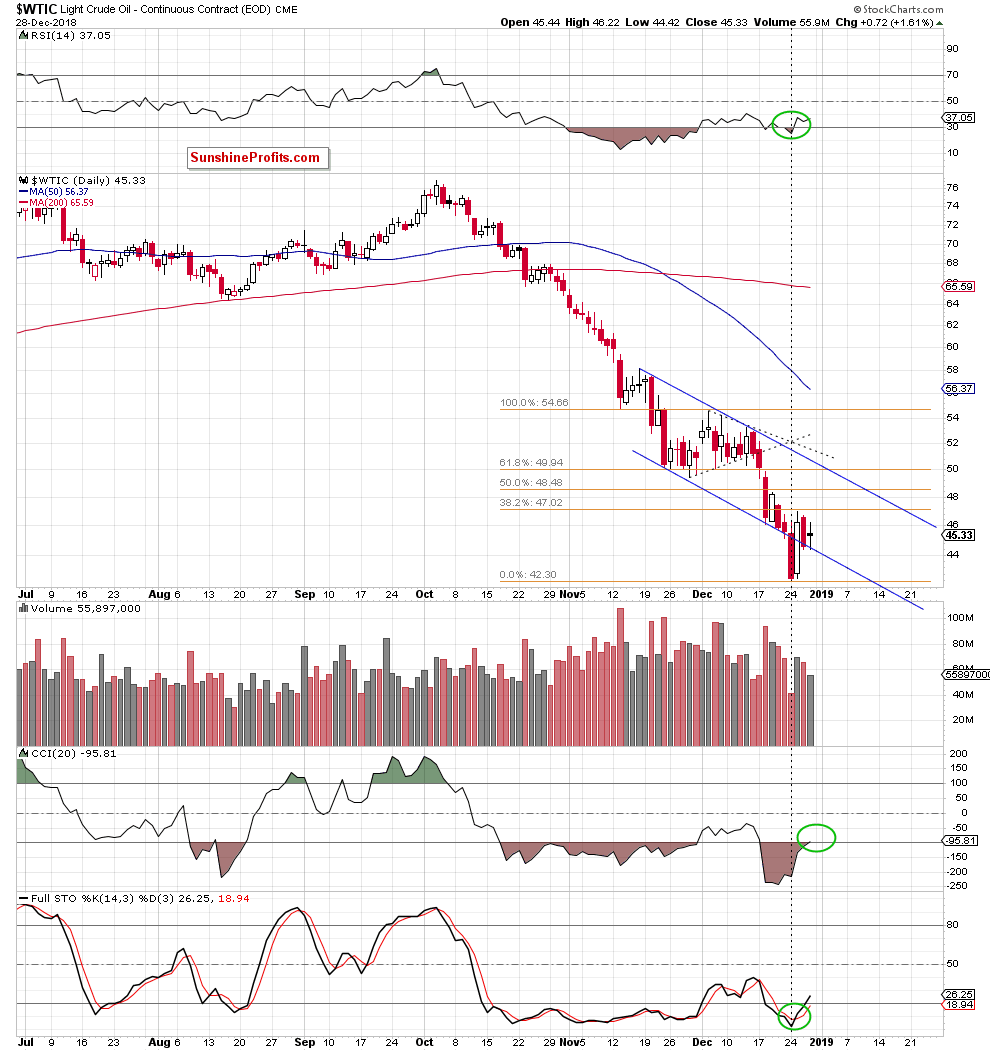

Looking at the daily chart, we see that after Thursday's pullback and the threat that could have arisen from it (a comeback under the trend channel), the buyers took the price of black gold higher and closed the day inside the blue declining trend channel.

Although this is a positive sign, we can notice another doji candle, which underscores the indecision among market participants. This interpretation is also confirmed by the volume, which clearly drops from session to session.

Nevertheless, when we take a look at the current position of the daily indicators, we see that they all generated buy signals, suggesting that another attempt to move higher may be just around the corner.

If this is the case and oil bulls fight today for a favorable closing of the month (above the above-mentioned 61.8% Fibonacci retracement), we’ll likely see at least a test of the nearest resistance area created by the Wednesday's high and the 38.2% Fibonacci retracement. If they manage to break above these levels, the way to the next retracements, the upper border of the blue trend channel and the barrier of $50 will be likely open. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Summing up, crude oil finished Friday’s session inside the blue declining trend channel, but it was not enough to close the day above the 61.8% Fibonacci retracement seen on the monthly chart. Nevertheless, in our opinion oil bulls’ attitude during today's session will be much more important, because it will show whether black gold close December above/below this important level. If they show strength, the chance of returning to around the barrier of $50 will increase significantly.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts