Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

The beginning of Wednesday’s session was not very good for oil bulls, but the support they received from the lower line of the consolidation encouraged them to fight and resulted in a return to last week's high. What can we expect in the very near future?

Let’s analyze the charts below (charts courtesy of http://stockcharts.com).

On Monday, we wrote the following:

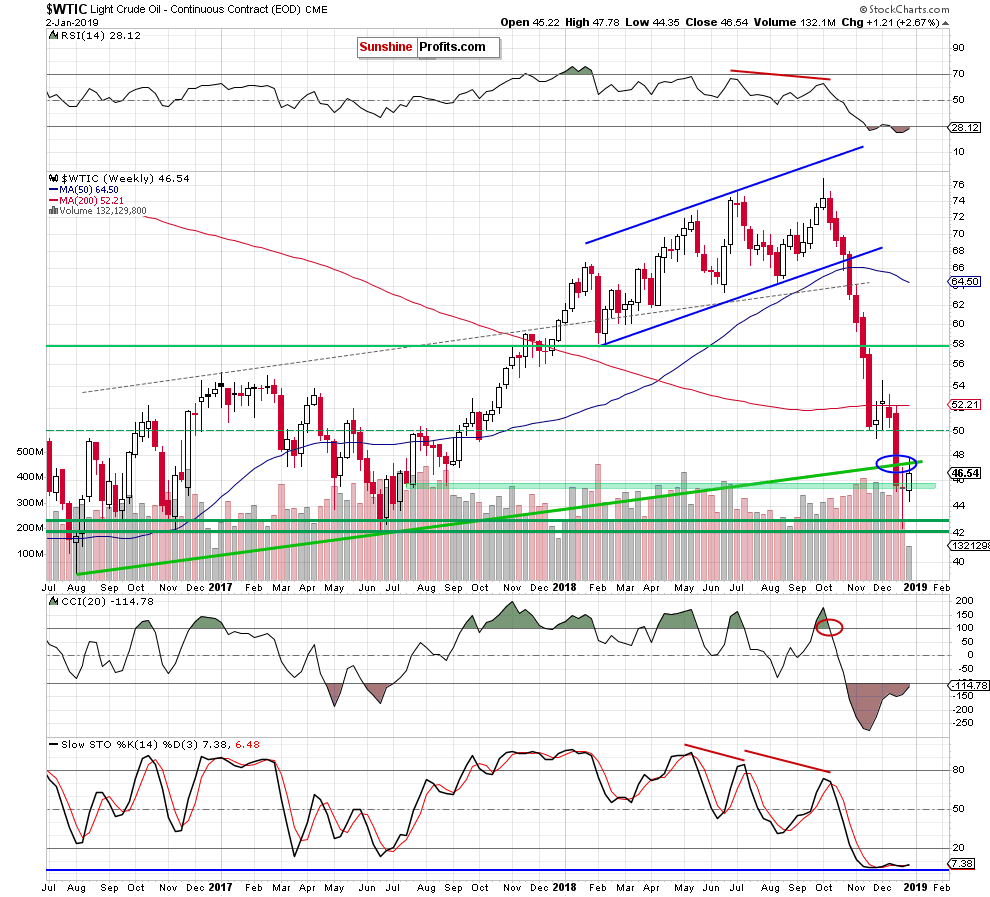

(…) when we focus on the shape of the last week’s candle, we clearly see that the market participants created a doji candle. The appearance of doji indicates the lack of decisiveness on the market - neither the bulls nor the bears show an advantage at the moment.

If the market (oil or any other) moves in a sideways trend (or increases or decreases are only in the initial phase), the doji candle is not very important. If, however, it appears on the chart after a long downward trend (as in our case) there is a high probability that we’ll see a correction or reversal in the near future (….)

From today’s point of view, we see that the situation developed in tune with the above scenario and black gold moved higher this week. Thanks to yesterday’s upswing, the price of light crude temporarily broke over the long-term green line, but then reversed and pulled back.

Despite this failure, the commodity still remains above the green support zone, which in combination with the very short-term factors suggests that another attempt to break above the green line may be just around the corner. What factors do we mean?

Before we answer this question, let's recall the quote from yesterday's Oil Trading Alert:

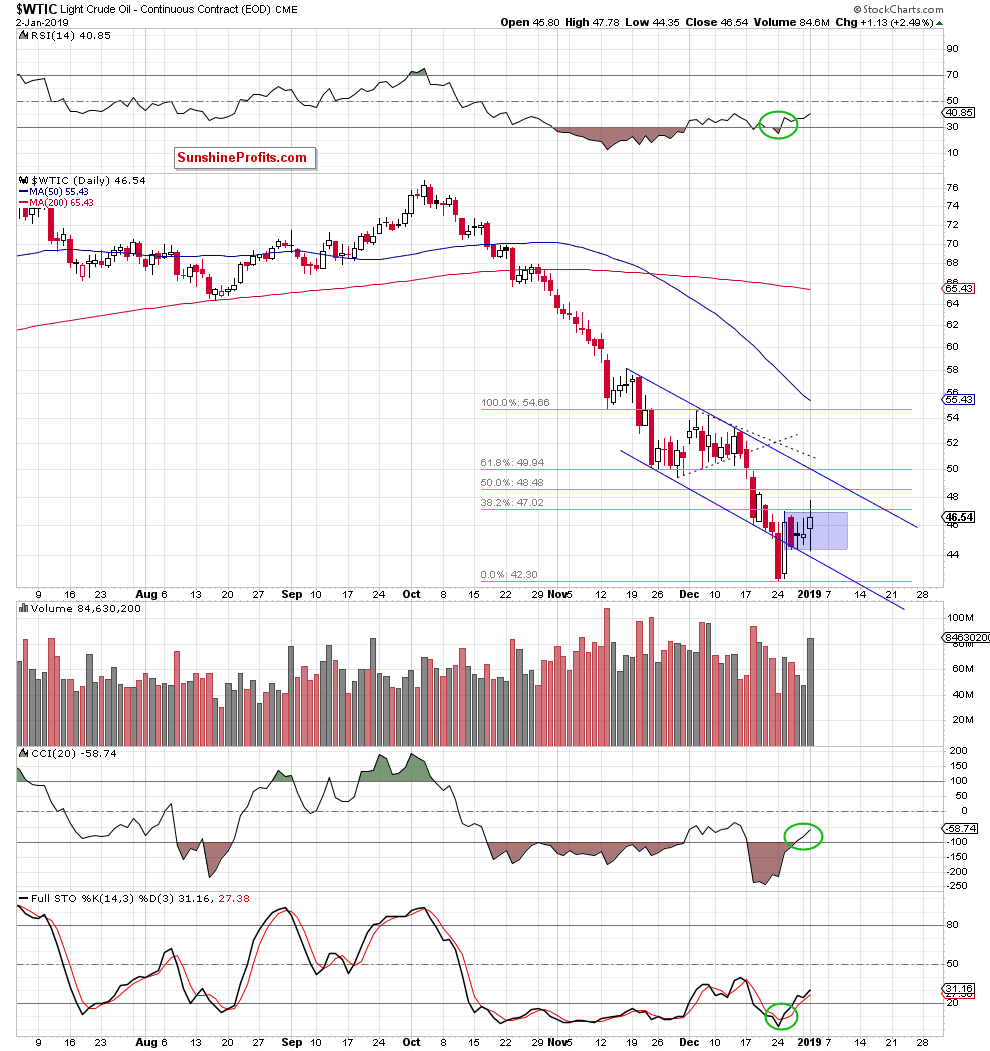

(…) bearing in mind the closing of December below the 61.8% Fibonacci retracement and the falling volume during the last "rises" we think that oil bears will test the bull's strength and determination to maintain the lower line of the blue channel and consolidation in the coming day(s). In other words, a test of the above-mentioned supports is very likely.

The result of the clash in this area will probably determine the next moves of black gold in a very short-term perspective.

What can happen if the bulls maintain these levels? In our opinion, we’ll see a rebound and a re-test of the nearest resistance area created by the Wednesday's high and the 38.2% Fibonacci retracement.

Looking at the daily chart, we see that the situation developed in tune with our assumptions and crude oil not only increased to the above-mentioned resistances, but also broke a bit above them after the price bounced off the lower border of the blue consolidation.

Unfortunately for the bulls their triumph was short-lived, because the commodity turned to the south closing the day below these resistances. In this way, light crude invalidated the breakouts (a negative development) but taking into account the buy signals generated by all daily indicators and the volume, which accompanied yesterday’s price action (it was the highest in two weeks, which confirms investors' involvement in yesterday's growth), we think that oil bulls will try to push crude oil higher once again.

If they manage to break above these levels, the way to the next retracements, the upper border of the blue trend channel and the barrier of $50 will be likely open.

Finishing today's alert, please keep in mind that if the buyers manage to close this week above all described important resistances, the way to early December peaks will likely be open and we’ll consider opening long positions.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts