Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Yesterday’s session brought a fresh peak in crude oil. The buyers showed strength once again leaving their rivals far behind. However, there is one small detail that creates a scratch on this very nice increase. What do we mean?

Let’s take a closer look at the charts below (charts courtesy of http://stockcharts.com).

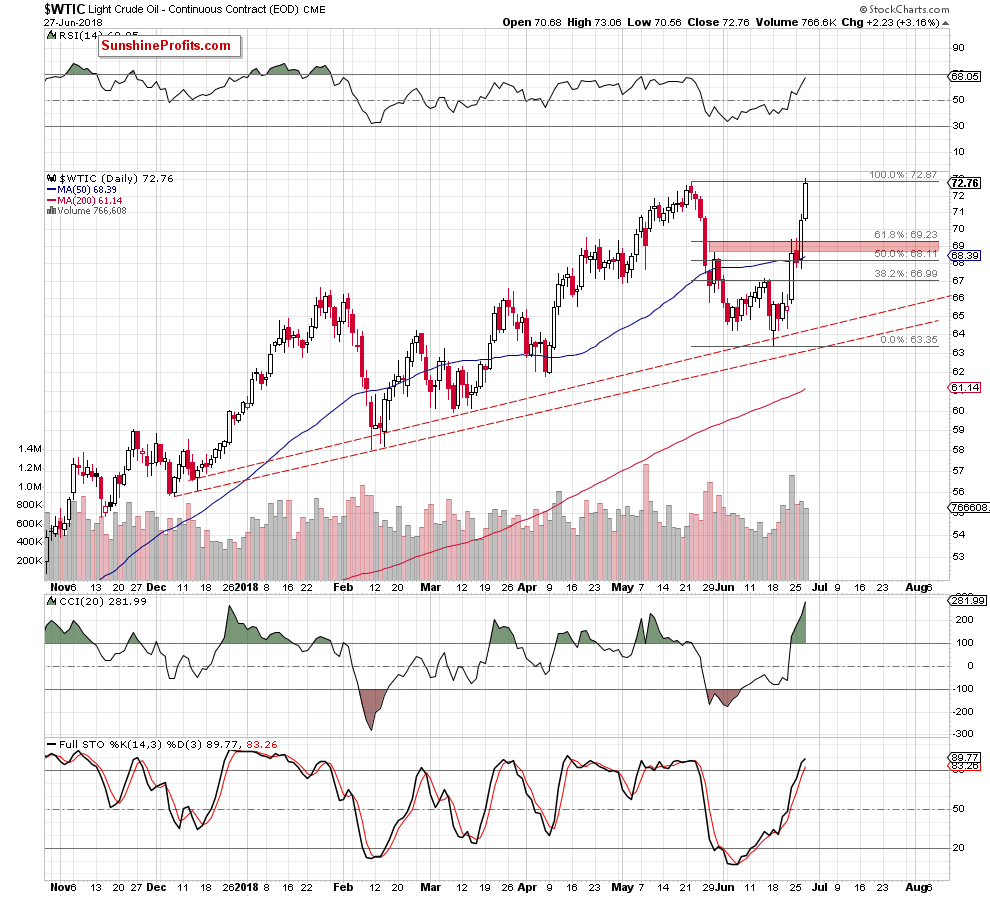

Yesterday, crude oil extended Tuesday’s gains and hit a fresh 2018 high. Nevertheless, volume, which accompanied this move was smaller than day earlier, which may suggest that the involvement of buyers has slightly decreased. If this is the case, oil bulls may have some problems to push the price higher in the following days.

Additionally, all daily indicators climbed to the highest levels since late May, which in combination with the long-term picture increases the probability that reversal may be just around the corner.

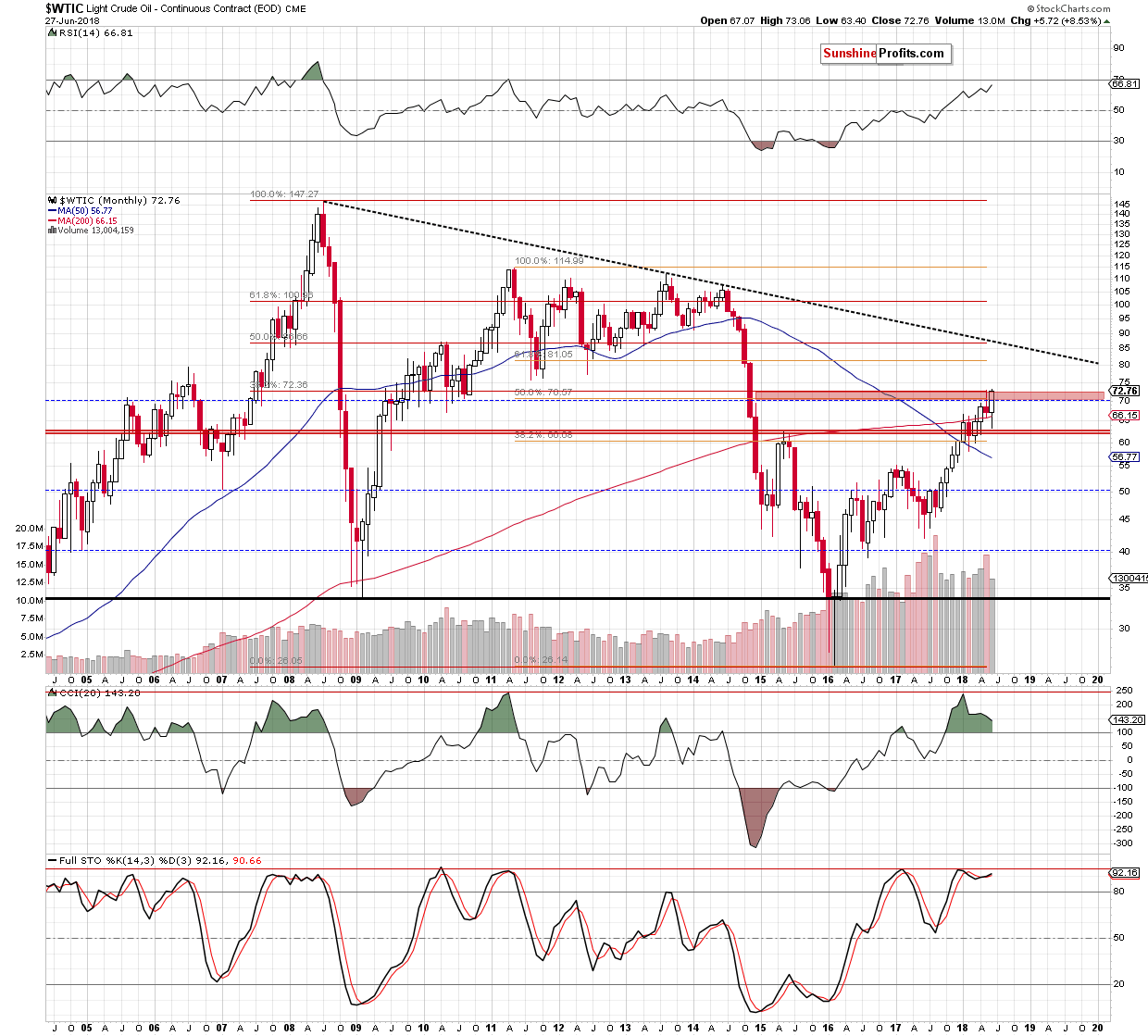

Looking at the monthly chart, we see that crude oil closed yesterday’s session slightly above the upper border of the red resistance zone (created by the 38.2% retracement based on the entire 2008-2016 downward move), but the breakout is not confirmed at the moment of writing this alert.

So, what can happen? Let’s consider both scenarios.

If oil bulls win the battle in the current area and manage to push black gold higher, it seems that they can even test the level of $80 in the following days. The main condition that must be met, however, is that they have to show the same strength as in previous days (in other words, we have to see an increase in volume during next session(s)).

And what would the negative scenario look like if the levels of previous peaks were broken (an invalidation of yesterday’s breakout)? In this case, black gold would likely come back to around $70 in the following days.

Summing up, crude oil broke above the last month’s peak, hitting a fresh 2018 high. Additionally, the commodity closed yesterday’s session slightly above, but just as one swallow doesn't make a summer so one daily closure does not decide about the confirmation of the breakout. Therefore, we’ll wait at the sidelines for move valuable clues about future moves. As always, we’ll keep you - our subscribers - informed should anything change.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts