Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Yesterday, black gold finished the day 0.28% above the Monday closure, but another warning signal appeared and oil bears can use it for their plans in the coming days.

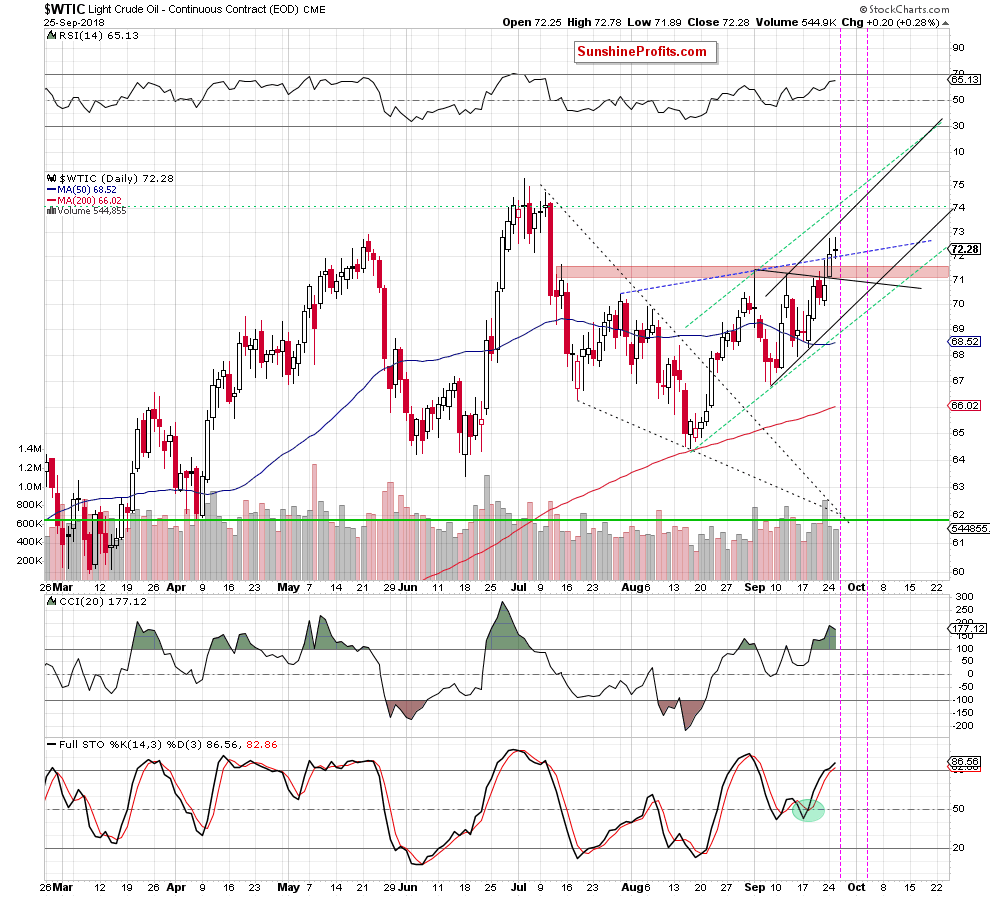

Let’s take a look at the daily chart below (charts courtesy of http://stockcharts.com).

Today’s alert will be quite short, because the overall situation in the short term hasn’t changed much as the price of crude oil remains between Monday’s intraday high and the closing price, which means that our yesterday’s comments remain up-to date.

Therefore, if you haven’t had the chance to read it, we encourage you to do so today:

Crude Oil in Uncertain Land

What about the additional pieces of the puzzle you wrote about earlier?

As you see at the daily chart, thanks to yesterday’s price action, the opening price was almost the same as the closing price (the difference was just 3 cents), which resulted in a doji candlestick. The appearance of this candle indicates the lack of decisiveness on the market. Neither the bulls nor the bears show an advantage now. If the market is moving in a sideways trend, this candle doesn’t matter much. However, if it appears on the chart after an upward move (just like in the current situation), there is a high probability that we will see a correction or a trend reversal in the very near future.

Additionally, it materialized on smaller volume once again, confirming that fewer oil bulls are involved in pushing prices of black gold to higher levels.

On top of that, we can see a bearish divergence between light crude and the Stochastic Oscillator, which in combination with the above and other negative factors about which we wrote yesterday, increasing the likelihood of reversal.

If this is the case, and we see oil bulls’ further weakness or more bearish technical factors (for example, an invalidation of the earlier breakout above the neck line of the reverse head and shoulders formation), we’ll consider opening short positions in the following day(s). As always, we will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts