Trading position (short-term; our opinion; levels for crude oil’s continuous futures contract): Full (100% of the regular position size) speculative short positions in crude oil are justified from the risk to reward point of view stop loss $45.63 at and $30.22 as the initial target price.

With the U.S. elections over and the final results still being tallied, the markets remain volatile, including the USD Index and crude oil. No wonder the markets are trying to estimate the elections' outcome, and the odds keep changing quickly.

Consequently, in the previous Oil Trading Alerts, I wrote that the price moves currently taking place shouldn’t necessarily be taken seriously, as their nature might be temporary just as the underlying uncertainty is.

And indeed, crude oil moved lower yesterday and it’s moving lower in today’s pre-market trading, indicating that perhaps the peak-uncertainty is already behind us. This means that crude oil can get back to its previous trend – which is down.

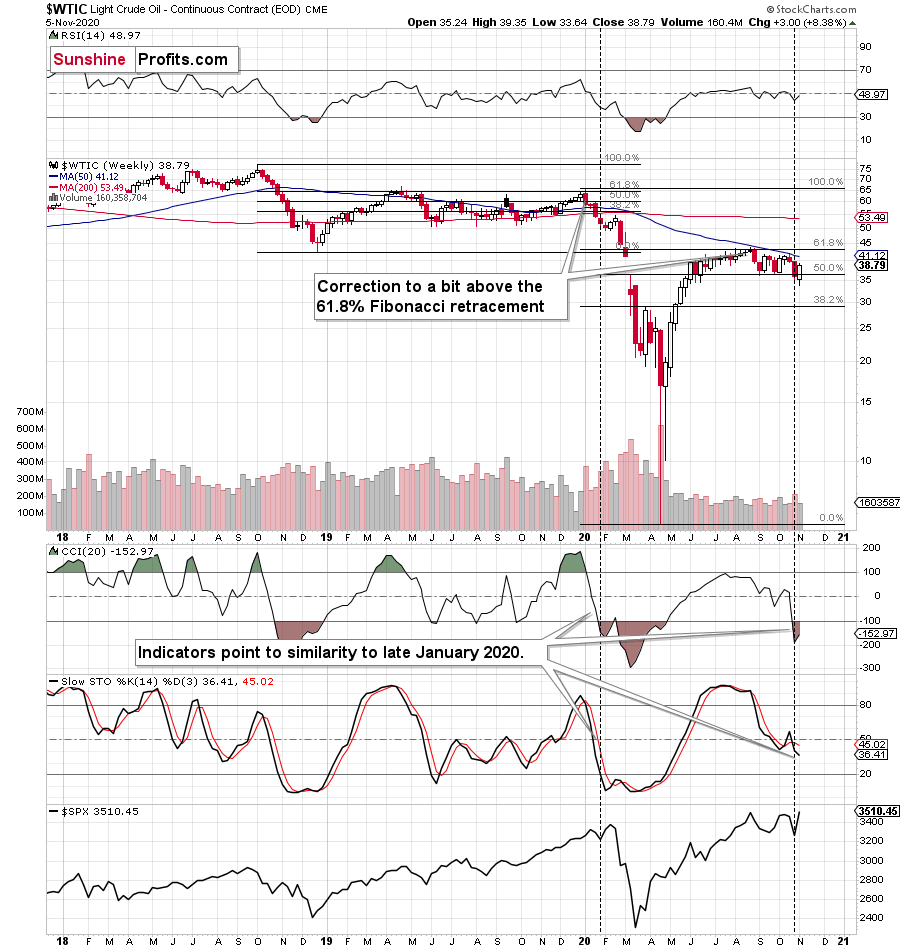

The recent rally in crude oil is just slightly above the 61.8% Fibonacci retracement based on the preceding decline, and it invalidated this small breakout. This means that – technically – this was just a correction and not a new rally. That is not necessarily a big deal, since most of what we’ve told you about the earlier decline remains up-to-date:

First of all, crude oil stopped rallying after correcting approximately 61.8% of the previous 2020 decline, which means that it was quite likely a real top instead of a fake one that will be broken shortly.

Second, the initial decline was followed by a zigzag, which is a classic corrective pattern. Since the preceding move lower was to the downside, the end of the correction insinuates another decline.

Third, the Stochastic indicator is on a sell signal.

Finally, it’s all similar to what we’ve witnessed in Q1 2020, not just the breakdown in crude oil, but the fact that it had first corrected slightly above the 61.8% of the preceding decline and that stocks were forming a double-top pattern.

Of course, we’ll be aware of the final point (stock’s double top) only after they decline further. However, the shape of the price moves (lower part of the above chart) is already similar.

Furthermore, the Covid-19 cases are soaring once again as well. Even though the fear of the unknown is not present this time, the scale of the phenomenon is much greater, and thus, the emotional reaction is also getting more serious. The charts above reflect that perfectly. Just as it was the case in January and February, crude oil is the first to show weakness, but it’s definitely not the last to do so.

Crude oil just moved slightly above its 61.8% Fibonacci retracement, and something very similar was the main factor that triggered the decline in the first part of the year. The fact that this breakout was already invalidated has profoundly bearish implications.

To summarize, for the upcoming weeks, the outlook for crude oil remains bearish.

As always, we’ll keep you, our subscribers well informed.

Trading position (short-term; our opinion; levels for crude oil’s continuous futures contract): Full (100% of the regular position size) speculative short positions in crude oil are justified from the risk to reward point of view stop loss $45.63 at and $30.22 as the initial target price.

In the future contracts that are more distant than the current contract, we think adding the premium (the difference between the July and other contracts) to both: stop-loss and initial target prices is justified.

Thank you.

Przemyslaw Radomski, CFA

Editor-in-chief