Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

Yesterday's invalidation of the breakdown gathered the harvest after the opening of today's session and resulted in a fresh peak. Will oil bulls finally run out of power? Or maybe they will not rest until they check in at the level of $80?

Let’s take a closer look at the charts below (charts courtesy of http://stockcharts.com).

Technical Picture of Crude Oil

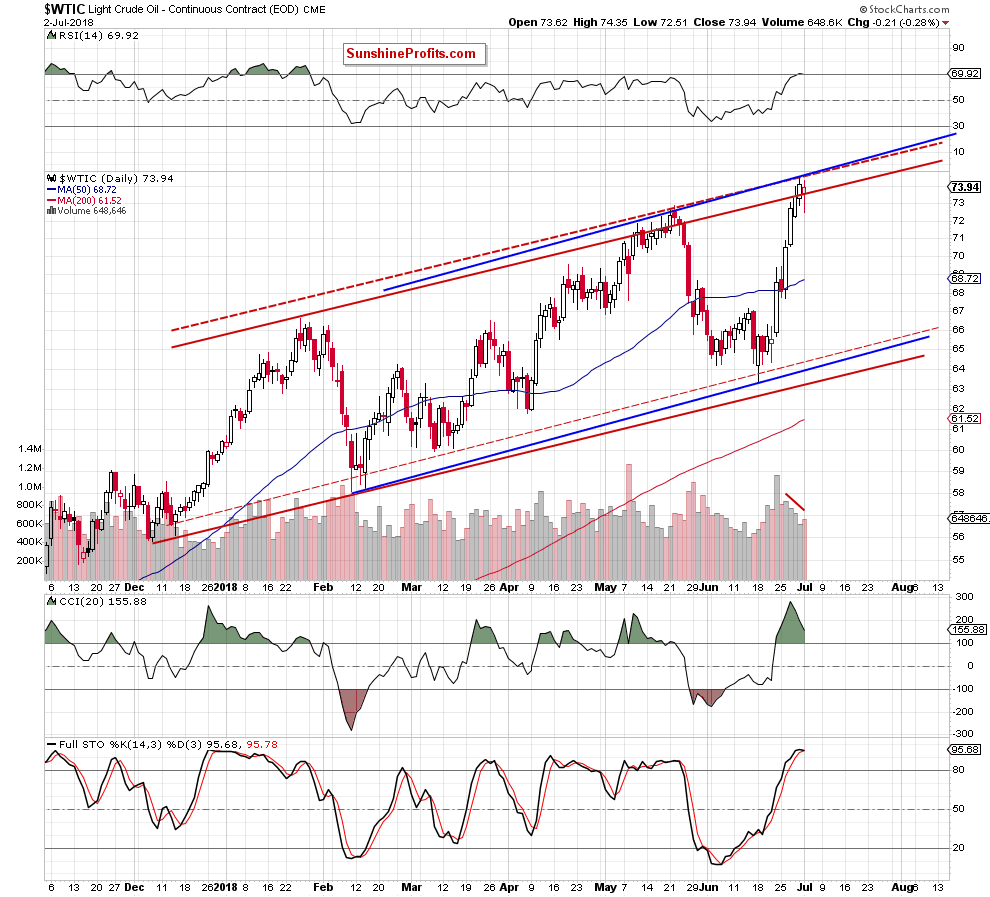

Yesterday, crude oil moved lower after the market’s open, which took black gold below the previously-broken upper border of the red rising trend channel (created by the support line based on the December 2017 and February 2018 lows and the resistance line based on the January peak).

As it turned out in the following hours, this deterioration was only temporary, and the price of the commodity came back above this support/resistance line, invalidating the earlier breakdown.

This is a positive event, which suggests that we’ll see another attempt to move higher and a test of the upper line of the blue rising trend channel (based on the February and June lows and the May high) later in the day.

Nevertheless, please keep in mind what we wrote about the broader perspective yesterday:

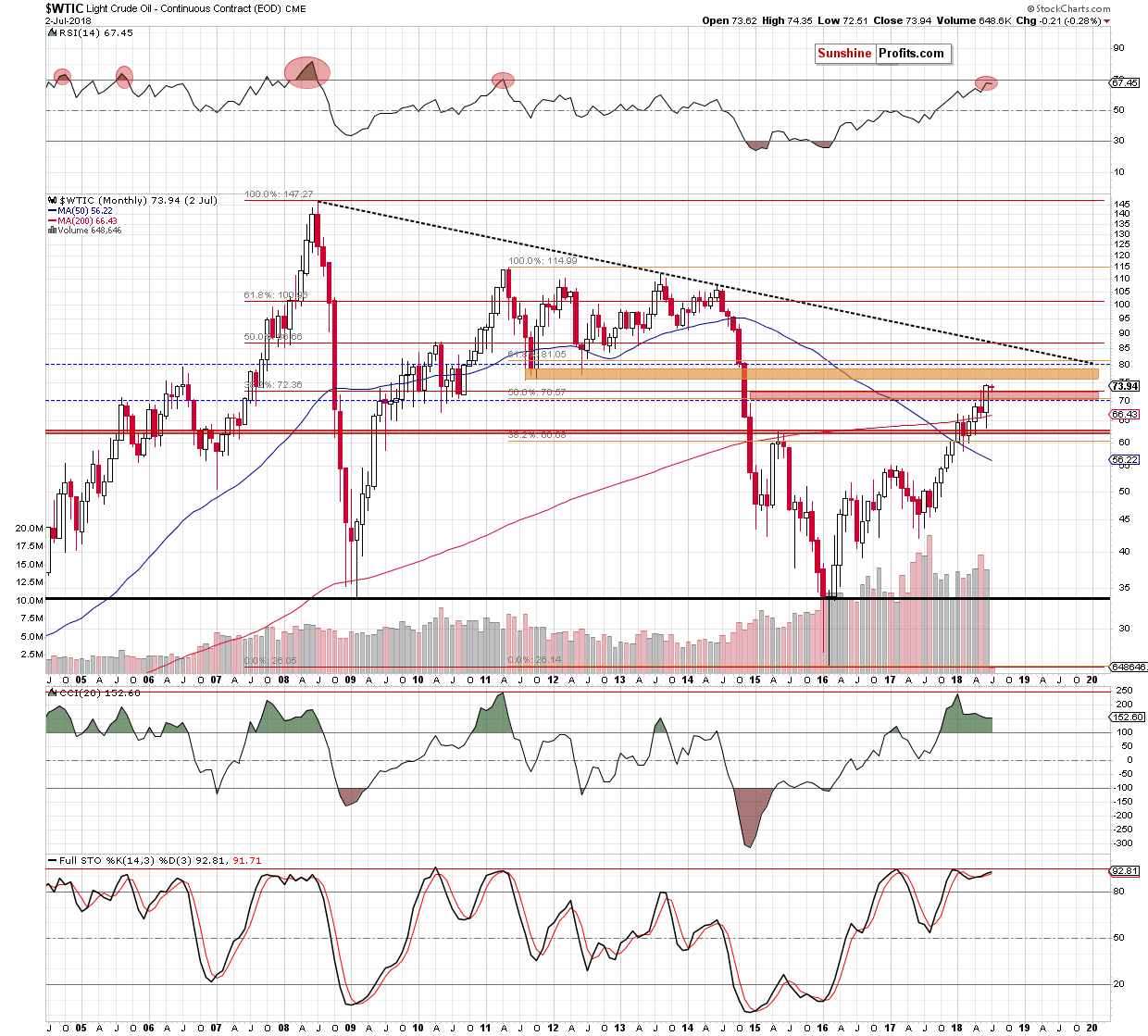

(…) even if black gold increases once again from current levels, we should keep in mind that the road to higher levels is not as wide open as it might seem at first glance. Why? Because at the level of $75.71 another resistance zone begins - this time created by the August 2011, October 2011 and June 2012 lows.

At this point, oil bulls will probably protest, saying that it is only the lower line of the resistance area and with their earlier strength they will be able to push the price of the commodity even to the barrier of $80, which is slightly above the mentioned zone.

We would probably agree with them if we could see their strength in size of volume as well. Unfortunately, in this regard the buyers have nothing to brag about, because last month's strong growth materialized on a much weaker volume than May's decline. In addition, if we compare the June and April volumes, we do not find any reasons to be delighted either.

(…) speaking about the volume… similar situation we can also observe in the short-term perspective, where the discrepancy between the rising price of light crude and the falling volume is even bigger.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts