Trading position (short-term; our opinion): Short positions (with the stop-loss order at $68.15 and the initial downside target at $56.57) are justified from the risk/reward perspective.

On Friday, the price of crude oil wavered between small gains and losses, but finally finished the day 0.43% above Thursday’s closing price. Do bulls therefore have reasons to be satisfied? Will the meeting between OPEC and U.S. shale firms in Houston help them to push the price of the commodity higher? Before we know the answers to these questions, let's check what the technical picture says about the future of black gold.

Technical Picture of Black Gold

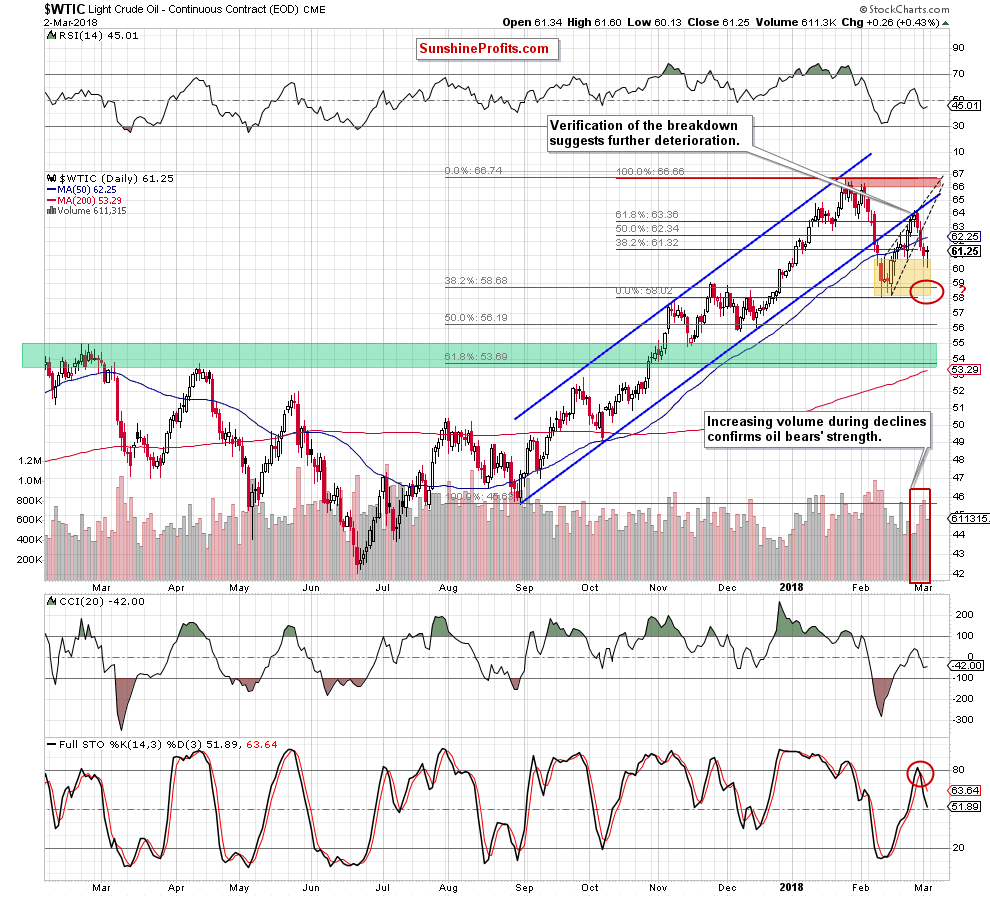

Let's examine the daily chart (charts courtesy of http://stockcharts.com).

Looking at the above chart, we see that the short-term picture of crude oil hasn’t changed much as the commodity repeated what we already saw on Thursday. Despite the rebound, which we saw later in the day, the commodity closed Friday’s session under the 38.2% Fibonacci retracement once again.

The volume, which accompanied the last session of the previous week was visibly lower than during declines, which increases the probability that oil beard didn’t say the last word and lower prices of light crude are still ahead of us.

This scenario is also reinforced by verifications of the breakdowns and invalidations of the breakouts, which we saw in the previous week (you can read more about them here). Additionally, the sell signal generated by the daily Stochastic Oscillator remains in the cards also supporting oil bears.

Fundamental Factors and Their Implications

On top of that, there are new fundamental factors, which increase the likelihood that black gold will meet our first downside target (marked with the red ellipse on the daily chart) in very near future.

What do we mean by that? Finishing today’s alert, please note that the International Energy Agency sharply upgraded its previous U.S. production growth forecasts. Earlier today, the IEA said that U.S. oil output has resumed sharp growth over the past year and is expected to rise by 2.7 million barrels per day to 12.1 million barrels per day by 2023.

Additionally, the Baker Hughes Friday’s report showed that the number of oil rigs drilling for new production in the U.S. rose to 800 for the first time since April 2015, which suggests that further increases in output are just a matter of time.

Such fundamental situation doesn’t bode well for oil bulls and higher prices of the commodity in the coming week(s) or even month(s) and together with the above-mentioned technical picture of black gold justify our short positions.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts