Trading position (short-term; our opinion): Short position with a new stop-loss order at $56.78 and a fresh downside target at $50.70 is justified from the risk/reward perspective.

Oil has seriously pushed higher. We've written yesterday about the implications of decreasing volume of recent sessions, and announced a bigger move ahead. We've also warned against fake breakouts from the recent oil price consolidation. The $64,000 question is whether yesterday's move has been a fake one, or whether it is the real deal. Let's dive into today's analysis to both learn and adjust the trading position accordingly.

Let's take a closer look at the chart below (charts courtesy of http://stockcharts.com and www.stooq.com ).

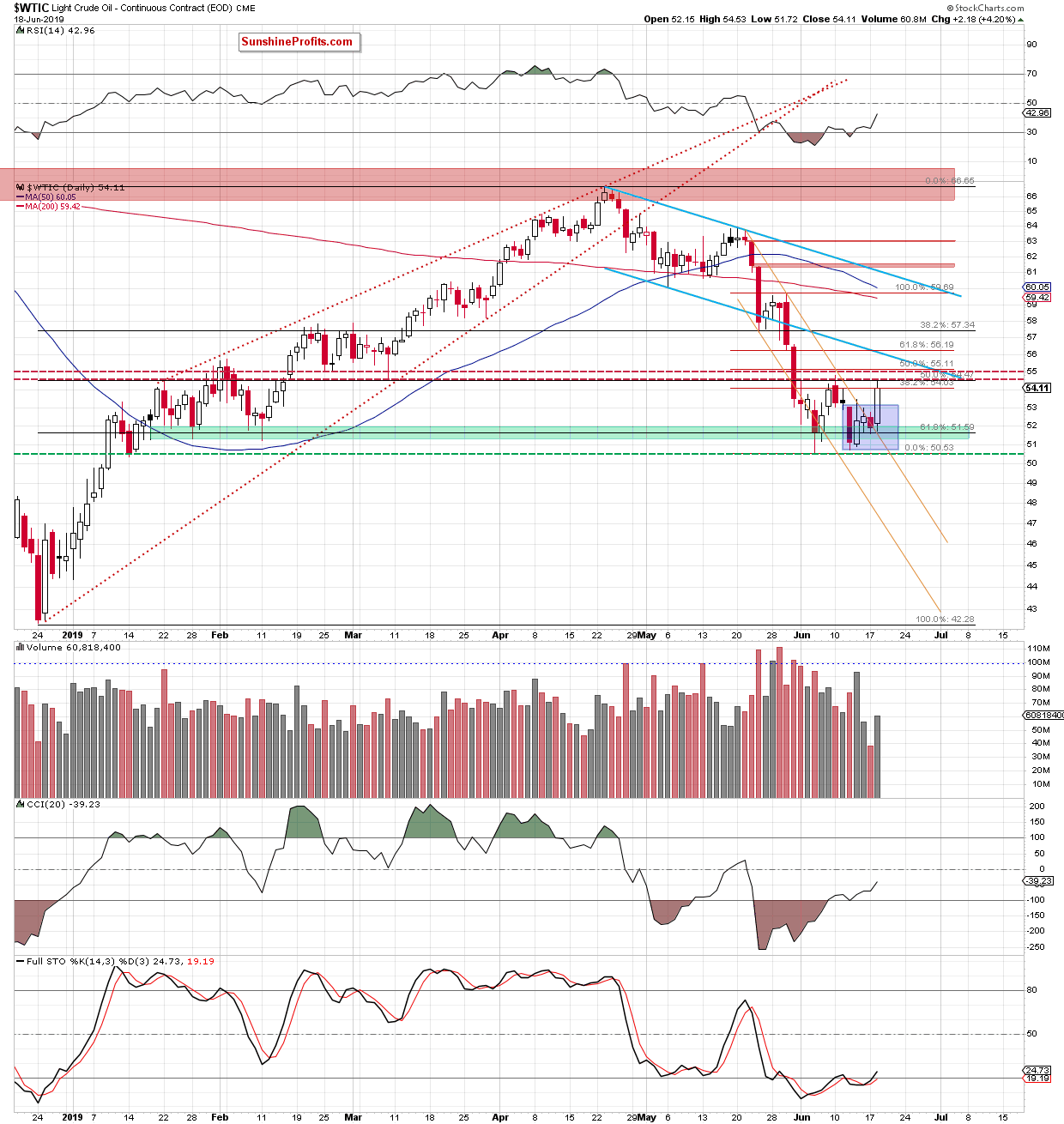

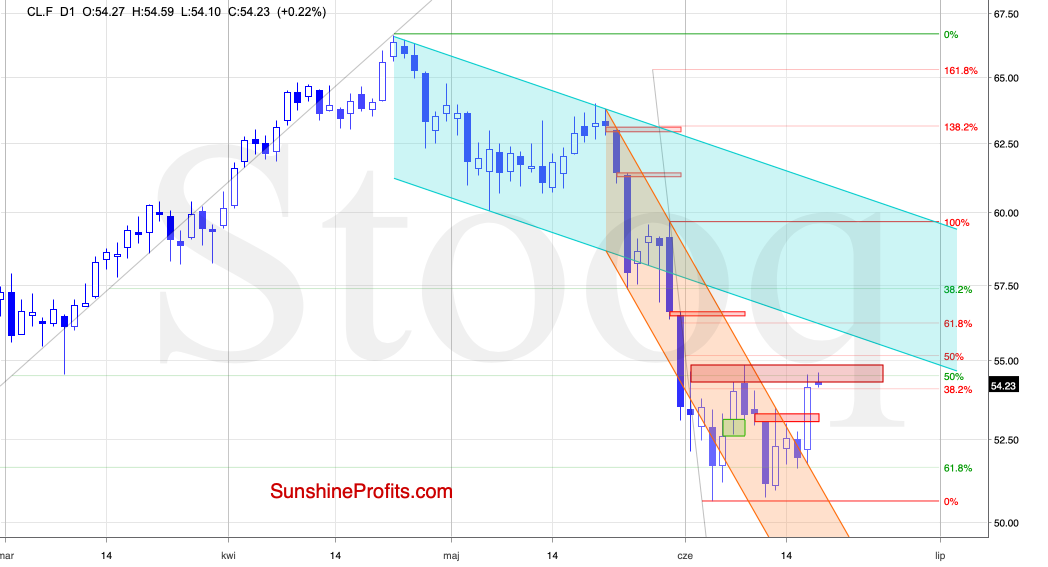

Crude oil finished yesterday's session sharply higher after it bounced off the upper border of the declining orange trend channel. The upswing means that the commodity also broke above the upper border of the blue consolidation and reached the resistance area created by the last week's peak and the early-June high.

This is where the previously-broken late-February and early-March lows are. Earlier this month, they were strong enough to stop the bulls. Should black gold once again reverse lower from here, yesterday's price action could be seen as another verification of the breakdown below these late-February and mid-March lows.

How likely is such a move lower?

While the buy signals continue to support the buyers, we should look also at the volume of yesterday's upswing. Judging by the size of yesterday's candle, we would expect to see a much higher daily trading volume. Its small relative size doesn't confirm the bulls' strength and suggests that another attempt at a move lower may be just around the corner.

Let's see today's balance of forces in the oil futures market.

Again, the bulls have tried to push higher, yet the above-mentioned red resistance has stopped them. Black gold has pulled back to trade at around $54.15 currently.

Taking all the above into account, lower oil values and a fresh June low ahead of us remain probable.

Summing up, yesterday's oil upswing is not as strongly bullish as it may appear at first sight. The relatively low volume doesn't attest to it. Black gold has reached the nearest resistance and hasn't even made a serious attempt at overcoming it earlier today either. The red gap remains open, supporting the sellers. Both the weekly chart and weekly indicators also speak in favor of lower prices ahead. The short position remains justified from the risk/reward point of view. We're however adjusting the trade parameters in light of upcoming FOMC-induced volatility. All details below.

Trading position (short-term; our opinion): Short position with a new stop-loss order at $56.78 and a fresh downside target at $50.70 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist