Trading position (short-term; our opinion): No position is justified from the risk/reward perspective.

Oil bulls have attempted to build on their recent achievements earlier today, and neither the bears were idle. The price is however trading close to unchanged right now. Does either side have an upper hand? Let's take a look at what direction of the upcoming move is more probable.

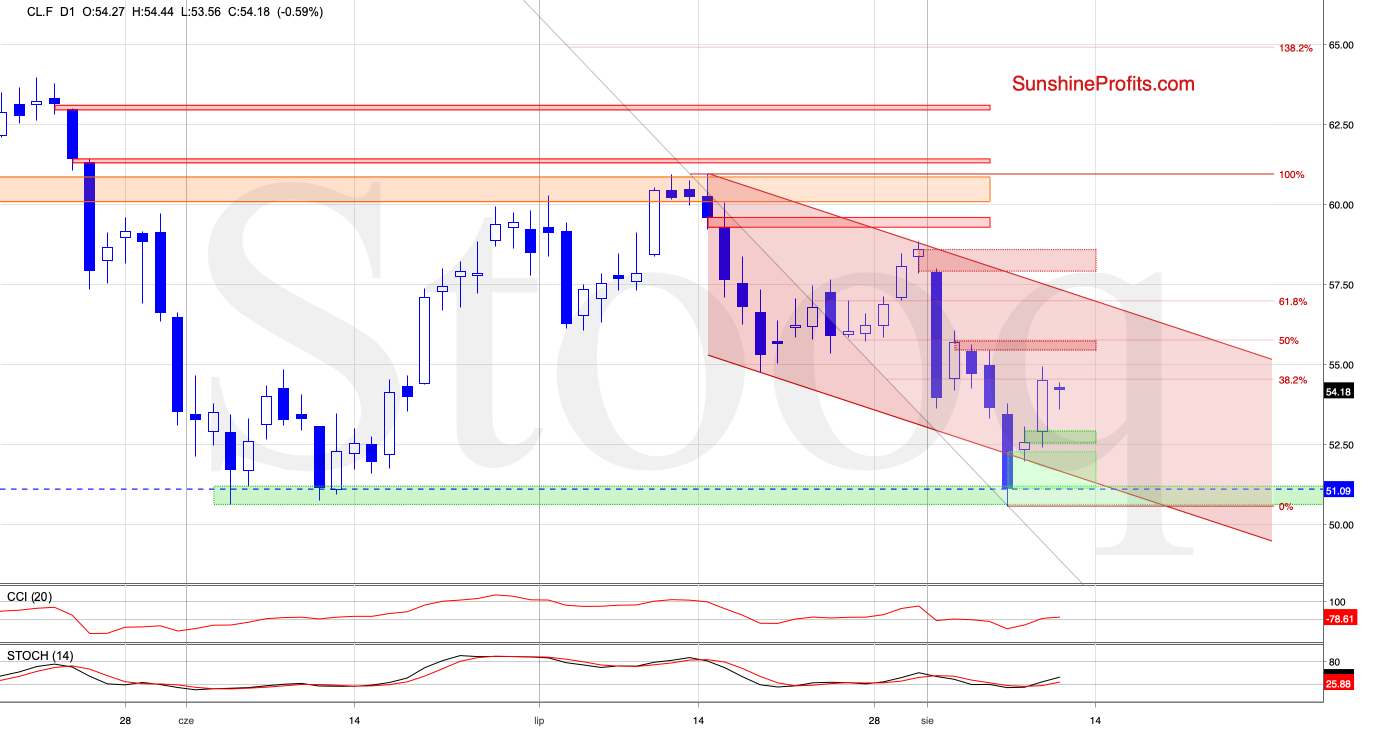

Let's take a closer look at the chart below (chart courtesy of www.stooq.com ).

Crude oil has experienced quite a sharp upswing on Friday, and that has closed our short position with a profit. This moves also means that crude oil futures have invalidated their earlier breakdown below the lower border of the blue consolidation (as shown in our Friday's Alert).

Coupled with the buy signals of the daily indicators, this suggests further price improvement. Such a bullish outcome would be more likely and reliable though only if the futures break above the 38.2% Fibonacci retracement first. Should we see that, the next upside target would be the red gap.

But this gap has stopped the bulls earlier this month - as long as it remains open, another move to the downside can't be ruled out. Should the bulls prevail however, we'll likely see a test of the upper border of the declining red trend channel. In such a case, we'll consider opening long positions.

Summing up, Friday's upswing has closed our open profitable short positions, and led to black gold invalidating its breakdown from the recent consolidation. The daily indicators suggest further improvement, and should we see oil trading above the red gap, we'll consider opening long positions.

Trading position (short-term; our opinion): No position is justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist