Trading position (short-term; our opinion): profitable short position with a fresh stop-loss order at $54.01 and the exit downside target at $51.20 is justified from the risk/reward perspective.

While crude oil declined profoundly yesterday, the bulls are attempting a comeback today. Wait, they just managed to open higher but the price is rolling to the downside as we speak. It can't be both ways - so, what's the most likely direction for oil after all?

Let's take a closer look at the charts below (charts courtesy of http://stockcharts.com and www.stooq.com ).

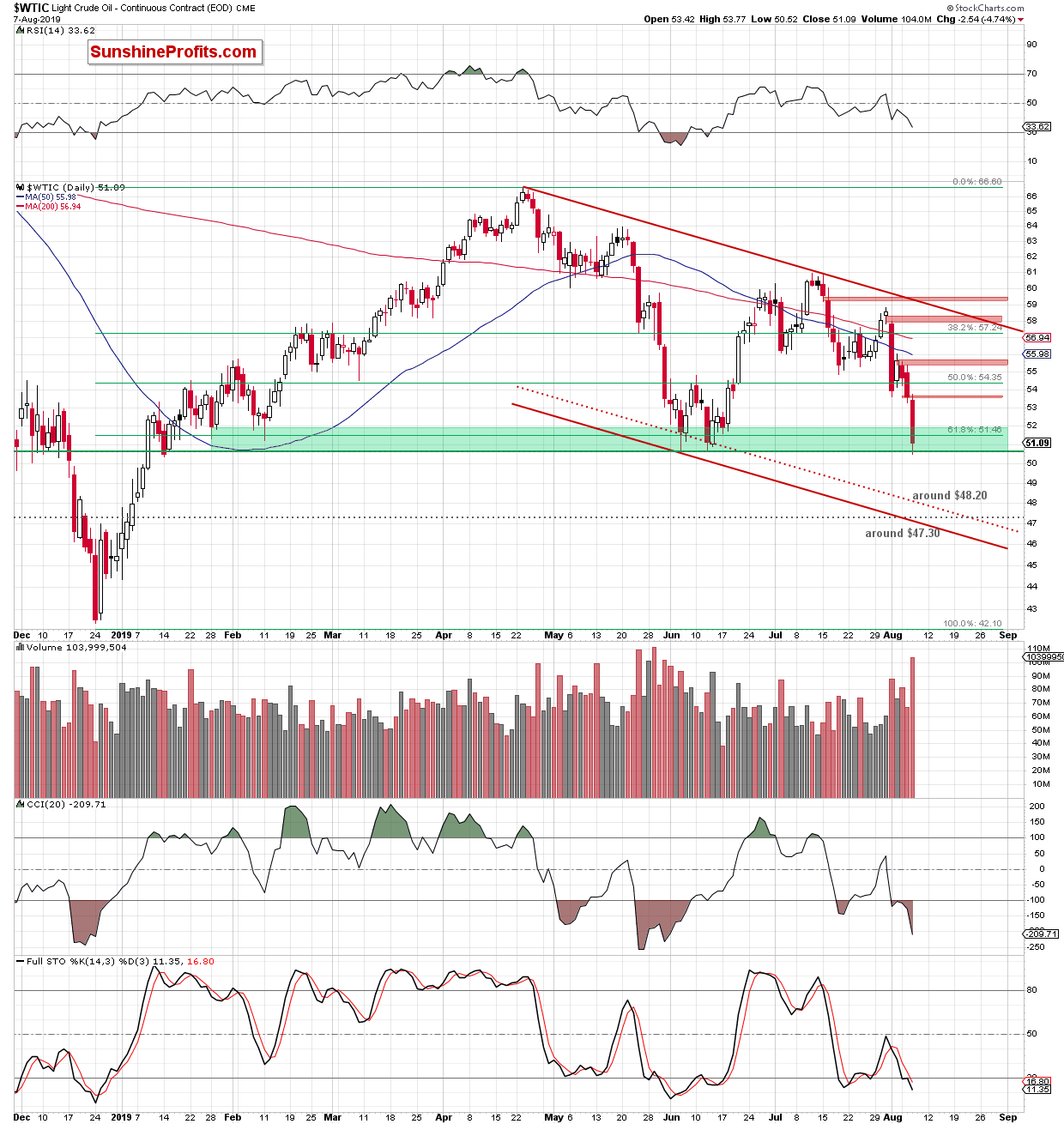

Crude oil's opening gap yesterday took the commodity sharply to the downside as the day progressed. Black gold hit a fresh August low and broke below the green support zone created by the June lows, making our short positions even more profitable.

Before the session's closing bell, light crude rebounded slightly and closed the day above the June lows. At the same time though, the commodity also closed the day below the 61.8% Fibonacci retracement, which doesn't bode well for the bulls. This is especially so when we factor in the huge volume accompanying yesterday's decline and the sell signals generated by the daily indicators.

What could happen if the bears return in force once again and take crude oil below the above-mentioned green support zone? Should we see such price action, black gold could go to not only below the psychological barrier of $50, but also drop to around $48.20 or even to around $47.30, where the lower border of the declining red trend channel currently is.

How yesterday's price action affected investors' moods before today's session open?

We wrote these words in our Tuesday's Alert:

(...) let's keep in mind that the bulls didn't manage to push the futures even to the 38.2% Fibonacci retracement. This and the volume comparison coupled with the Stochastics' sell signal suggest that another attempt to move lower may be just around the corner.

The first downside target for the bears will be around $53.50, where the June 19 low is. However, if it is broken, the sellers could test the lower border of the red declining trend channel in the coming week (currently at around $53).

Crude oil futures not only dropped to our next downside targets, but also finished the day below them.

While this is a bearish sign, the green support zone encouraged the bulls to act and the futures opened Thursday with the bullish green gap. This took the futures back to the declining red trend channel before they pulled back and slipped below it. This could be nothing more but a verification of yesterday's breakdown below the lower line of the formation.

If this is the case, lower prices of the futures will be in the cards and we could see a retest of the green support zone, the lower line of the green gap and yesterday's low. Nevertheless, as long as there is no successful breakdown below the green support zone another sizable move to the downside is not likely to be seen.

Therefore, if the futures/crude oil drops to $51.20, we will close our short position and take profits off the table (as a reminder, we opened it on August 1 when crude oil futures were trading well above $57). However, should we see a breakdown below the green zone, we'll likely reopen short position as crude oil could go below the barrier of $50 and test the lower border of the red declining trend channel marked on the first daily chart.

Summing up, the bears made themselves heard yesterday and took oil to the green support. While this has encouraged the bulls to act, their upswing attempt appears to be fizzling out. The bulls' weakness, higher volume on the downswing and the Stochastics' sell signal mean that the profitable short position remains justified.

Trading position (short-term; our opinion): Profitable short position with a fresh stop-loss order at $54.01 (we lowered it once again to protect another portion of our profits) and the exit downside target at $51.20 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist